“Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction”

“Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction”

“Did you know that one smart bid today can build a legacy tomorrow?” How do you need to prepare for your financing BEFORE you go to the real estate auction? What is holding you back? Are you holding off buying a home because you don’t have the down payment?

Do you need a renovation and repair loan or a temporary bridge loan? Are you wanting to sell

your home but you are reluctant to give up the low mortgage rate you got several years ago?

Maybe you’re real estate investor, looking to buy homes to rent out for an income or sell later

for a profit? Click to hear this show for nuggets that can enrich you.

Host: #JoGarner #MortgageExpert #MortgageLoanOfficer (901) 482-0354

Co-Host: #LanceWalker #auctioneer (901) 922-5609 www.WalkerAuctions. Com

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes www.JoGarner.com

#buyingatauction #midsouthauctioneer #memphismortgage #memphisrefinance #bridgeloans

#realtor #realestateinvestor

__________________________________________________________________

1st segment 9 minutes LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our topic today is October 21st, 2025. “Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction.” Thank you to real estate attorneys Shelley Rothman and Rob Draughon of Griffin, Clift, Everton and Maschmeyer Law Firm. For your home purchase or refinance, call Shelley or Rob for title closing services at 901 752-1133.

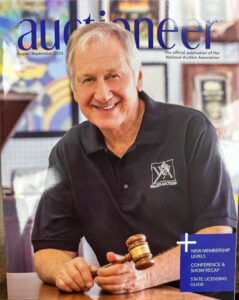

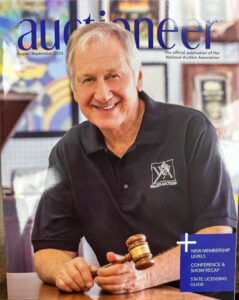

Introducing Lance Walker, Auctioneer of Walker Auctions

(Jo) Its been a while since we have had Lance Walker, Fast-Talker, Auctioneer from Walker Auctions in the studio. Lance, you founded Walker Auctions LLC 45 years ago and you and your wife specialize in conducting real estate, personal property and benefit auctions throughout the United States. You write a monthly article for The Best Times publication. You and your wife, Terri, host a radio show and podcast. Terri was voted number one auctioneer in the country. You served as President of the National Auction Association. Tell us a little bit about yourself and the services you offer your clients. (Lance has about 1.5 minutes to intro himself and talk about the services he offers through Walker Auctions….)

(Jo) “Did you know that one smart bid today can build a legacy tomorrow?” How do you need to prepare for your financing BEFORE you go to the real estate auction?

- Know your personal comfort level on a monthly mortgage payment and how much you can pay down and still leave adequate emergency funds in the rainy day account.

- Explore the best mortgage program option with your lender. Get a preapproval letter to strengthen you as a buyer

- Know what home is going to meet your needs as your primary residence or as a rental property. If possible, inspect the property before the auction .

Wooden gavel resting on sound block with gold sold sign in front of blurred background featuring large house, suggesting real estate auction and successful sale

Common Financing Programs Used to Buy Auctioned Real Estate

- Traditional mortgages from Fannie Mae, Freddie Mac, FHA, Veterans Loans, USDA Rural Housing loans. Permanent, outside-the-box loans, that allow less restrictions. These take about 30 days or so to close, so you will need to be preapproved and have the ability to pay for the auction house within 30 days of the closing.

- Temporary loans from private lenders or hard money lenders to have fast cash to pay for the property and do repairs if needed. These temporary loans are good for about 6 months, even though some lenders will let you use the money at a high price for one year. The purpose here is to use it to buy and fix up the property so that you can refinance to a more permanent loan.

- Tip to the wise- If you are using a temporary loan, make sure you structure it as one loan to cover the purchase and any repairs you will need to do. Some of the better permanent loans want to make sure you have owned the home for 6 months to a year before they will give you cash back over and above what is owed on the first mortgage. If you have one mortgage that includes the purchase and repairs, you are only refinancing to a permanent mortgage and paying off that one mortgage, and no requirement to own the home for several months.

EPISODE #1 – Joe from Digginfordeals.com

The voice on the other end of the phone sounded angry. He needed to know what his house was worth, and he didn’t want to play games. He said it wasn’t in great shape, but what he really meant was he wasn’t in great shape. Turns out, Joe had been diagnosed with an inoperable brain tumor. He’d worked all his life, really wanted a family, but things hadn’t turned out perfectly. The house was paid off, but it needed maintenance, and the taxes kept going up.

Joe used a real estate auction to sell his home. He had to property listed to sell at auction and got several thousand dollars over what he thought he could get and the home sold as is without Joe having to do the repairs. The home sold in 30 days and Joe was thrilled. The money was a Godsend to assist with his medical care. Or, he thought he might just buy a motor home and travel. Either way, the sale was fully transparent with no monkey business – a win-win for both the buyer and seller.

Call me and let’s explore some ways you may be able to save thousands of dollars with a home purchase mortgage or a refinance, combining higher-interest rate debt into one mortgage. I want to hear your story. Call me or text me at 901 482-0354 www.JoGarner.com We can find the right mortgage and make the mortgage process easy.

(Jo) Before we go to break, Lance Walker of Walker Auctions, we have a couple of minutes before we go to break. Let’s jump into some of your auction topics until break. (Lance shares some of his content and returns after ad break to continue.) Lance has about 2 minutes before end of first break

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will hearing more from Lance Walker, of Walker Auctions. And we will be hearing from…

______________________________________________________________________

2nd segment 9:18 am – 9:30 am 12 min

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

![]()

( Waaka Waaka song in background ) COMIC QUERIES (you probably already know the answer, but we will ask anyway (: Q. Riddle: I talk so fast that nobody can understand me, but everyone knows exactly what I’m selling. I often lose my marbles, but I always get my bids. What am I?

… An auctioneer.

Today on Real Estate Mortgage Shoppe, we are talking about

“Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction”

I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

Lance Walker, Auctioneer Walker Auctions www.walkerauctions.com

_____________________________________

TOPICS COVERED BY LANCE WALKER, AUCTIONEER OF WALKER AUCTIONS

What is an auction?- sale of goods by competitive bidding conducted by a licensed auction professional

What is a good auction scenario? settling an estate, need to sell quickly, need to sell in As Is condition

Why do people choose to sell at action? they need items gone quickly and in an organized fashion, when it is hard to determine value,

selling a collection, like selling by competitive bidding which creates several offers, auctions attract a more qualified buyer,

Explain auction terms- absolute, buyers premium, As Is, Where IS, auction pickup,

What are the advantages of online bidding auctions.- discreet, stretches over several days, bidders can be anonymous, competitive bidding enforces value. it limits people coming through your home.

Give us a preview of the auction documentary Terri is about to finish.

Ways Auctioneers and Real Estate practitioners can work together

I write a column in The Best Times each week

Served as President of the National Auction Association

3rd SEGMENT 9:35 AM-9:45AM) 13 min

- ( Brighter Tomorrows Song playing in background)

![]()

- For Did You Know today…

- Who am I? This famous Motel was successfully purchased at a public foreclosure auction on December 13, 1982.

- During this motel’s heyday, it was not uncommon to see well-known entertainers, athletes and politicians at the motel. Louis Armstrong, Cab Calloway, Nat King Cole, Sarah Vaughn, Aretha Franklin and Otis Redding were just a few of its famous guests. The motel boasted an excellent café and renowned customer service.

- When the property was auctioned in 1982,

- The buyers bought the motel for $144,000, using a last-minute $50,000 loan guarantee to secure the purchase.

- The buyers where-The Martin Luther King Memphis Memorial Foundation (As you know now, this motel was later renamed the Lorraine Civil Rights Museum )

- Today on Real Estate Mortgage Shoppe, we are talking about

- “Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction”

- I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

- Lance Walker, Auctioneer Walker Auctions www.walkerauctions.com

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

Are you thinking about buying a home? What is holding you back? The stable real estate market and much lower mortgage rates may be a unique pocket of opportunity where you can score. Are you holding off buying a home because you don’t have the down payment? There are several down payment assistance loans for first-time homebuyers. There are some assistance programs and 100% programs for you if you are NOT a first-time home buyer too.

Do you need a renovation and repair loan or a temporary bridge loan? Are you wanting to sell

your home but you are reluctant to give up the low mortgage rate you got several years ago?

Maybe you are a real estate investor, looking to buy homes to rent out for an income or sell later

for a profit?

Steps to Prepare Financing Before the Auction

What steps does someone need to take to ensure that they’ll be preapproved for a loan to

buy real estate at auction? It normally takes about 8 to 10 minutes on the phone or online to

Freddie Mac. To strengthen the preapproval letter considerably, we recommend sending over

do a quick preapproval letter using the automated underwriting software through Fannie Mae

a copy of your income verification documents, and copies of statements showing your assets.

We would have already seen your credit at that point. The appraisal can be a wild card

Sometimes the mortgage underwriting software doesn’t require an appraisal. We

don’t know if it will or not, until we put the address of the property and the final price into the

system.

New outside-the-box mortgage programs have opened up opportunities with low-documentation and alternative ways to verify income for self-employed borrowers with good credit. These special loan programs help real estate investors finance properties that are business loans, helping real estate investors buy with less documentation. Using these loans, the investor can buy properties in the name of their business.

KEYON, USES A TWO-STEP FINANCING PROCESS TO BUY A MONEY MAKING RENTAL PROPERTY

· Key tip: “Even if you can’t close with a traditional loan before auction day, you can refinance right after you win.” Keyon’s story of buying with quick temporary mortgage and later refinancing with me on a more permanent loan once the home was repaired.

Keyon figured out a long time ago, the way to make money was to own income-producing real estate—and a lot of it. He used hard money, private mortgage lenders—temporary mortgages to go buy a house in unrepaired condition at a discount price from the seller. Keyon already had his permanent, outside the box mortgage preapproved through me. This particular outside-the-box loan he had through the mortgage company where I work, was the DSCR loan for investors that allowed him streamlined documentation and he could put the title in the name of his Limited Liability Corporation for added protection. Keyon closed quickly, buying the house in unrepaired condition and used the temporary private mortgage until he had completed renovations at the house he bought. Then he refinanced with me with the DSCR program or investors and paid off the more expensive temporary loan.

Blancey Bryant-Knows What She Wants and Uses a Little-Known Tool to Get it

Blancey Bryant was looking forward moving outside the city so she could get back to her farming roots during the hours she wasn’t working. She lived with her youngest son in the home she had raised her family. He was finishing at the nearby college and planned to move out of state for a career opportunity. She didn’t want to sell her home until he was on his own and able to support himself. But…the world doesn’t give us opportunities on our own timetable.

Blancey’s realtor knew the kind of country place Blancey was dreaming of owning. As it turns out, her realtor found the perfect bit of land and country home with the functioning greenhouse that Blancey had been searching for. There could not be a more perfect location, and the price wasn’t bad either. Blancey felt pushed and pulled in opposite directions. She wanted to buy the new place, because who knows if another home like that would ever come along. But, she couldn’t sell the house out from under her son.

She could have gotten an equity line of credit for the $200K equity she had in her home and use it to pay down on the new home so her note on the new home would not be too high. But the equity line was a variable rate and Blancey did not like the uncertainty of that. She didn’t want to do a cash out on the old home for a fixed rate mortgage because there were closing costs.

How was Blancey going to buy the new home in the country and still keep her old home for her son to live in and not borrow against the old home? The answer was for use to use a little-known tool on her new loan by making it a mortgage with a recast option on it.

Blancey was still working so she could afford the payment on the old home and the higher payment on the new home. But when her son moved out of the old home, she would sell it and take the $200K profit and make a large prepayment to pay down the balance on the new home loan. Instead of having to refinance and pay closing costs, Blancey would exercise her recast option and the mortgage company would lower her payment to reflect the lower paid down balance. Her mortgage rate would not change. But her payment would drop from $3,000 per month to about $1,000 per month.

OTHER FINANCING TOOLS TO BUY QUICKLY AT AUCTION

Equity lines and other lines of credit to pay cash for a property at auction

The two-step financing arrangement like Keyon did

Buy with cash heavy real estate investor partners

Using a cash out refinance on one real estate property to have the cash available to pay cash at auction.

Use of business lines of credit -especially when buying income-producing property.

____________________________________________________________

4th Segment 9: 48am to 9:56 am 7 min

(THE SONG COUNTRY ROADS by Sergie Pavkin PLAYING IN BACKGROUND ) INSIGHTS & INSPIRATION

#1: Preparation Meets Opportunity

Have you ever noticed that “lucky” people are usually just prepared people who were ready when the moment came?

At a real estate auction, the excitement builds fast—but those who’ve done their homework and lined up financing beforehand are the ones who walk away with the winning bid and the winning deal.

Remember, in real estate and in life: luck happens when preparation meets opportunity.

Today on Real Estate Mortgage Shoppe, we are talking about

“Bid Smart, Borrow Smart: How to Buy & Finance Real Estate Through An Auction”

I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

Lance Walker, Auctioneer Walker Auctions www.walkerauctions.com

REAL ESTATE TIP OF THE WEEK

Lance Walker has about 1 min or so to offer a tip from his industry.

- Jo Garner’s tip Refinancing is back in vogue. With mortgage rates at a 12-month low, this is an opportunity for many borrowers to refinance to a shorter term mortgage. Rates are low enough now for borrowers to score on refinancing their old mortgage and rolling into the new mortgage money to pay off high interest rate credit cards and other high-cost debt.

What do YOU want to accomplish with YOUR mortgage? I have the knowledge and experience. Let’s look at traditional mortgage products, alternative mortgage products and even combinations of products. I can help you get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Independent Planning Group’s conference room 110 at Clark Tower 5100 Poplar Ave 1st floor Memphis, TN

(Thank you Ben Hunter 901 660-2912 outstanding Financial Professional at Independent Planning Group for being Talk Shoppe’s location sponsor)

Talk Shoppe on Wednesday November 5th, 2025 join us “Staged to Sell: Transforming Listings for Faster, Higher Offers.” Janel Taueg

Talk Shoppe thanks Talk Shoppe’s sponsor Genell Holloway of Eagle Hollow Enterprises for your generous support of our business owners. Open enrollment time is here for signing up for health benefit packages, medicare and other benefit packages for yourself and your employees. Call Genell Holloway today at 901 270-1127.

Talk Shoppe thanks Stephanie Jones of Evernest Property Management in the Memphis area. Stephanie and Evernest Property Management can take the headaches out of owning real estate rental properties. Contact Stephanie Jones at (901) 660-2812

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, IT TODAY.

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE DOES NOT ENDORSE 100% OF THE CONTENT ON THIS EPISODE. REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES, AND NOT AN OFFER TO LEND. EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND MOST ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS. JO GARNER IS A LICENSED MORTGAGE LOAN ORIGINATOR. (EQUAL HOUSING OPPORTUNITY)

QUOTE CORNER:

QUOTE CORNER: Up For Auction—A parachute, used once, never opened…. Uh oh

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

CREDITS AND ACKNOWLEDGEMENTS

Songs: “Waaka Waaka” Freepd.com for the Comic Queries; “Brighter Tomorrows” From Stocktunes no copyright ; “Country Roads” Sergie Pavkin public domain music through Pixabay

REJOINDERS:

- Pat Goldstein, Realtor with Crye-Leike Realtors in West TN & North Mississippi (901) 606-2000

- Silvana Piadade, Realtor with EXP Realty in TN and North Mississippi (901) 647-6661

- Brett Bernard, Realtor with Stamps Company-The Investment Division (901) 692-7401

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

On Amazon and Barnes and Noble

Walker Auctions LLC 2749 Park Ave. Memphis, TN 38114 901:922-5609

Lance@WalkerAuctions.com www.WalkerAuctions.com

Lance Walker founded Walker Auctions LLC 45 years ago and specializes in conducting real estate, personal property and benefit auctions throughout the United States. Walker has been involved in over 3000 auctions throughout his career.

In the Memphis area he heads the Walker Auctions real estate division working with sellers and fellow Realtors in selling houses, land and commercial property that would best sell using the live or online auction format. He and his auctioneer wife Terri have pioneered the sale of real estate and personal property using an online auction format in the Memphis area through the MarkNet Alliance online auction bidding portal.

The active auctioneer recently served as President of the National Auction Association. He was named to the Tennessee and Missouri Auctioneer’s Hall of Fame. He also has M.S. and B.S. degrees in Education, is a graduate of the Certified Auctioneers Institute at the U. of Indiana Bloomington and the Certified Estate Specialist program through the National Auctioneers Association. Walker was elected to the NAA Board of Directors and has served as President of the Missouri Auctioneers Association and Vice President of the Tennessee Auctioneers Association. Walker was once featured on a TV episode of Hoarders and the “You Bet Your Life” TV program. He hosts and produces an hour radio program and podcast on KWAM 990 called “Time to Sell “and writes a monthly article for The Best Times publication with the same title. Walker has served as anchor on the annual NAA IAC Live broadcast which was founded by his wife Auctioneer Terri Walker several years ago.

He also has the reputation of being a leading benefit auctioneer and is very active in conducting numerous benefit auctions each year throughout the United States. These charities raise millions of dollars annually through the production of successful fundraising events where Lance is involved as auctioneer and advisor. Walker co-wrote the Benefit Auction Specialist curriculum for benefit auctioneers and taught the course to hundreds of auctioneers through the National Auction Association. He recently presented an auction seminar via a webinar to 1500 Chinese auctioneers. He is working with his wife on a documentary about auctioneering that should be released next spring.

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com X @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating

*Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”