Doctor, Doctor, What’s The Health Of My Home’s Foundation And My Financing?

How can you tell if you have mold in your home? What options do you have to get rid of the mold? How can you tell if you have foundation problems with your house? What are some common signs that you have healthy finances and a healthy structure for your finances?

Thank you for connecting with us at Real Estate Mortgage Shoppe! Please go to www.JoGarner.com and subscribe to receive notice of the latest, most recent info concerning your real estate and financing scenarios.

Feel free to call me directly to get answers to your real estate and financing questions at (901) 482-0354 or email at jo@192.232.195.219 .

___________________________________________________________________

Good morning, Memphis! Good morning to our listeners across the 50 states. You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com . If you’re on Twitter, send your questions or comments while we are live June 4th, 2016 to #Jogarner or email me at jo@192.232.195.219 If you want to join us while we are live today, call us at (901) 535-9732 or outside the Memphis area (800) 474-9732.

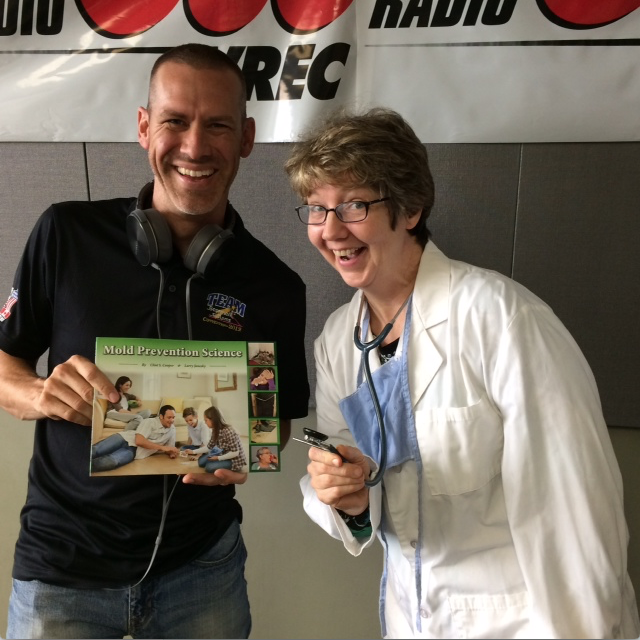

Our general topic is ““Doctor, Doctor, What’s The Health Of My Home’s Foundation And My Financing?” Clint Cooper is the owner of Redeemers Group. A Crawl Space, Basement, Foundation and Mold Prevention Contractor in TN, AR and Northern MS. Clint’s book “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers to help them communicate with their clients about mold and mold prevention. Stay tuned through the entire show and you will get some great information on 1. how to tell if you have mold in your home and 2. what to do about it if you do. 3. I will be covering the three areas of financial health and ways to structure your mortgage financing to help you enjoy a clean bill of financial health.

Clint Cooper of Redeemers Group, tell us a little about yourself and what Redeemers Group does for your customers. <Clint introduces himself and talks about what Redeemers Group does for his clients—>

(Jo) One of the things I do for my mortgage clients and referring partners is to keep them informed on movements in the mortgage market—like yesterday. Wow! The payroll report was NOT a healthy report, which caused the prices on mortgages to drop. Mortgage prices and rates are determined by a number of factors like the loan amount, loan type, loan-to-value and credit scores. The conventional 30 year fixed rate came in around 3.625% to 3.875%, in some cases with no points. The conventional 15 year rates came in around the low 3’s. The government FHA loans, Veteran Loans, 100% Rural Housing loans came in low too. The fact that the Federal Reserve decided not to raise THEIR rate, will keep rates low for most Home Equity Lines and also for some of the jumbo loans and the 100% physician loan that I have gotten for my doctor and dentist clients. If you want to discuss any of these loan products and what they could do to make your life easier and less painful financially, call me personally after this show at (901) 482-0354 (901) 482-0354 or connect with me at www.JoGarner.com OR better still, you can call now while we are live at (901) 535-9732 (800) 474-9732

<Clint makes comments and recommends that you address the health of the home before you try to get a loan on the home. Appraisers look at signs of structure problems and other needed repairs.>

(Jo) I’m not a medical doctor or a certified financial planner, but based on my 25 years experience as a mortgage loan officer I have learned a lot from my clients and how they handle THEIR finances. Here are some common denominators of clients, some whose families I have let me be their lender over a couple of decades. I have worked together with them to structure financing terms that allow them to earn more, spend less, give more, live better. #1 It is important to have plenty of emergency fund., For salaried people having a minimum of 6 months emergency funds and the ability to put, even a small amount ,into building that fund each month. For self-employed or 100% commissioned earners, savings to cover them for 12 months in an emergency is not too small. #2 Earn more than you spend. I used to serve at my church in the financing ministry and it was AMAZING to me that people who came to us for budget counseling did not know what they spent each month. Some of them didn’t even know what they spent. I challenge you to take your most recent 3 months bank statements and credit card statements and make a list of where you spent and how much you spent. You will be SHOCKED! I decided to do that too and I WAS SHOCKED. I thought I knew what my income was and what I spent but there were things I was buying that I didn’t need and things I was paying way too much for. Unless you know the truth about what you make and what you spend, you can’t know where you to cut back, make more or make changes. 3 Decrease the COST of your financing buy paying less interest or fees. Increase what you GIVE to worthy causes. When you give, it can make you FEEL better and therefore LIVE better. When you give, it tends to come back to you at some point, pressed down, shaken together and running over.

<Clint talks about when we have small issues with our house, just like our finances, and you need to take care of these issues today and not let these issues become bigger issues.>

(Jo) Clint, I know you have plenty of stories of families you have helped stay healthy by getting rid of mold and other dangers in their homes. What keeps me motivated to get up every morning and go to work in the mortgage office is getting to make a positive difference in someone’s life because we spent a little extra time to fit them with the right mortgage. My expert assistant, Susan, and I work with real estate investors who have done multiple purchase loans and refinance loans with us from all over the country. Some of these investors start small and gradually acquire properties, making sure they make a positive cash flow on the ones they buy. You do that enough times and, before you know it, you don’t need your salaried job anymore. You have established an income almost on automatic pilot. If you are that person or want to be that person, let’s talk. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

Clint, what motivates you to get up and go to work each day? <Clint launches his topic until the 9:15 break>

____________________________________________________________________________________

2ndsegment: Our Look Back Memphis Trivia Contest is sponsored by John and Jennifer Lawhon of Lawhon Landscape (901) 754-7474 the Lawhon’s can help you plan your landscaping if you have a BIG, BIG project or a smaller project . The Lawhons are giving away a $25 gift card to the first person with the correct trivia answer. If you know the answer to the Look Back Memphis Trivia Question, call us on the air at (901) 535-9732. 800 474-9732

Trivia queston: Memphis has more of this buried treasure than any city in the United States. What is it?

ANSWERS: ARTESIAN WELL WATER, WATER, AQUIFERS

Hint 1: This buried treasure first came available to Memphians in 1887.

Hint 2: A growing number of business and political leaders say it’s time for Memphis to be more aggressive in making its case about this city’s buried treasure as part of a broader effort to lure jobs and opportunity to the Memphis.

In fact, the Memphis Regional Chamber of Commerce says 2,400 jobs and $1.3 Billion dollars in investment is directly attributable to this Memphis buried treasure over the past five years.

Hint 3: ‘Memphis is to this treasure what Saudi Arabia is to oil’.

Memphis has the world’s largest artesian well water system. Artesian well water first became available to the city in 1887.

No other city has a comparable amount of pristine water which comes completely from Artesian wells.

There are 50 trillion gallons of water in the “Memphis Sands” aquifer not to mention two aquifers below that which haven’t even been tapped.

Memphis has a unique advantage in that none of its water comes from surface lakes or rivers.

The huge groundwater supply is something no other city in the country enjoys.

That’s why manufacturers from Nucor Steel to Smith and Nephew have come to appreciate the city’s water potential.

The chamber also says there are two projects in the pipeline right now which could mean 300 more jobs and $400 million in potential investment.

The water Memphians drink right now first hit the soil when Jesus walked the earth thousands of years ago.

Experts with the city’s utility, Memphis Light Gas and Water, say they inspect the water every day to make sure it’s safe.

They also say other cities are jealous of how good we have it.

Posted 12:18 pm, May 23, 2013, by Richard Ransom, Updated at 12:25pm, May 23, 2013 WREG

_________________________________________________________________

QUESTIONS ANSWERED BY CLINT COOPER:

1.What is new at Redeemers Group?

(Clint): We are really excited and humbled to recently be a finalist for the Memphis Business Journal Small Business of the Year Award.

2.*Wet season we’ve had and what it will mean for foundations as it dries out

Plenty of discussion here…talking about how spring brought a lot of water issues with people’s homes: basements and crawl spaces. As we move in to summer, the drying out effect of the soil will be severe, and we anticipate people will really start to notice symptoms of foundation settlement appearing: cracked walls, sticking doors, etc.

Mold is always an indicator of a different problem (IE, dirt crawl space or leaking basement)

Q: If someone has mold in their house, why would they have it in one place but not another?

Q: What does having mold in your house have to do with having a dirt crawl space or a basement?

4.. Techniques for combating mold

Q: Are there products that homeowners can go purchase to help them combat mold?

Q: Other than waterproofing that prevents mold, what other services does Redeemers Group provide?

8. Love Well 5k & Festival- (Clint): On July 23rd, the Redeemers Group Love Well Initiative will be putting on the Love Well 5k & Festival to benefit the Old Path Homeless Shelter for Women and Children.

What are you looking for?

1. Race participants- individuals or teams. We encourage teams to sign up- whether it’s a company or just a group of friends. You can create a team, and each team member can fundraise directly for the Homeless Shelter and have fun and build comradery while doing so.

*Perhaps the Talk Shoppe regulars should form teams with their companies and see who comes out on top! We will have team prizes for the best team costume, most $ fundraised, and largest team.

2. We are looking for vendors: people or companies that would like to come set up to sell or display for business or handmade items…

Where do people learn more?

1. www.lovewell5k.com will give you everything you need to know in terms of how to register, how to form a team, how to become a vendor, or how to join the discussion on social media.

8. New CE class for realtors added to current lineup: Dry Basement Science

Clint: I now teach 4 different classes at Memphis Area Association of Realtors for CE credits. A new class: Dry Basement Science was added to that lineup.

The current lineup of classes can always be found both on our website redeemersgroup.com and maar.org.

Next up is Foundation Repair Science on 6/20.

Our new Dry Basement Science class will be offered for the 1st time on 7/21.

QUESTIONS ANSWERED BY JO GARNER:

1. What can someone determine if their mortgage financing a good fit for them or not?

Jo answers: As a loan officer I asked my clients what is their maximum comfort level on a house payment? What is their max comfort level on a down payment for buying a home? Where do they see themselves over the next 5 years or so? I want to make sure, based on their answers that the payment will be manageable enough to allow them to earn more than they spend and be able to invest and save each month.

If my client tells me they really want to pay the house off in 15 years or less, but the payment is too high and not manageable on a 15 year amortization, then we look for other ways to free up money that they can use to seriously pay off early a 20 or 30 year loan. For instance, once some of my younger clients get their student loans paid off, they can take the extra money and pay extra principal payments to get rid of the mortgage loan sooner and still be able to buy groceries, put gas in the tank and have a life.

Some clients call me and ask me if I can lower their house notes a few hundred dollars per month. With the mortgage rates being as low as they are now, it usually isn’t hard to do this for the customer. If they want to lower the mortgage note because they are drowning in double-digit interest rate credit card debts racked up due to a hardship that is now in th past with no reason to continue to rack up the debt, sometimes the answer is a cash out refinance to pay off the double digit interest rate credit card debt, reducing the cost of the debt, making it easier for the homeowner to use the money saved by lowering the cost of the debt to pay extra on the mortgage and get it paid off sooner. The important factor is that the customer is not still out there charging up more credit card debt. They have to be serious about getting rid of their debt –even getting the mortgage paid off earlier.

First time homebuyers are usually needing a low down payment or zero down starting out with low fixed rate payments that won’t break their budget.

People who have a property to sell so they can use the equity from the sale to pay down on the new house may need to use a temporary bridge loan if their current home doesn’t close before they are ready to close on the new home. The payment structures must still be affordable though. Otherwise, it would be better to sit on the other house until it sells.

If YOU are exploring the perfect antidote on your mortgage terms for what YOU want to accomplish, call me while we are live on the air at (901) 535-9732 OR (800) 474-9732 Or call me PERSONALLY after the show at (901) 482-0354. (901) 482-0354. But you have to talk to me personally to work with me personally. I want to be your lender for life, so make that call.

2. Since we’re talking about doctors and the health of your home’s foundation and financing, talk about your 100% physician loan.

3. Refinances and rehab-renovation loans –How can these programs work to bring healthier financing to the customer.

– HARP special refinance terms and government streamline loan programs can help reduce payments and interest costs to homeowners –even rental property owners– who don’t want to pay to worry about an appraisal and are looking for less costs.

– The renovation and repairs mortgage programs allow homebuyers to finance buying a home, and finance the fixups and hopefully end up with quite of bit of equity in the property when they are done. I work with the FHA 203K rehab loan program and the conventional program too.

_________________________________________________________________

REAL ESTATE TIP OF THE WEEK: (Clint has about 1.5 min to share a real estate related, time-saving and/or money-saving tip- How can a homeowner tell if there is mold in their home? What can be done to get rid of it?)

___________________________________________________________________ANNOUNCEMENTS:

1. Talk Shoppe offers free education and networking to anyone interested in real estate or business. This Wednesday June 1st, 2016 Talk Shoppe will be presenting “Help, I’m A Caregiver!—How Caregiving Impacts You & Your Employees” presented my Mary Lou Nowak, owner of Home Helpers (non-medical assistance in the home.) Talk Shoppe is free for the next 2 months thanks to our supporters like John Keller, Investment Advisor with Edward Jones (901) 569-5009 and Beverly Borwick, www.beverlyborwickdesigns.com and advertisers like Kevin Yee of Save Energy Solutions. He can clean out your home’s duct system and clear the air for allergy relief. (901) 492-1649 www.sesinfo.biz. For more information about Talk Shoppe, go to www.TalkShoppe.com

· 2. To hear today’s podcast of the Real Estate Mortgage Shoppe and others, go to www.JoGarner.com

-3. “MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.”

4. Special for adding some fun to Real Estate Mortgage Shoppe with costumes for many of our themes. You ROCK!!!! Check them out at www.lincolncostumes.com Lincoln’s Costume Shop 29 Florence St Memphis, TN 38104 901 726-6084

QUOTE CORNER:

Erma Bombeck-“Never go to a doctor whose office plants have died.”

Groucho Marx-“A hospital bed is a parked taxi with the meter running.”

REJOINERS:

Mary Lou Nowak, Home Helpers of Germantown (901) 414-9696

John Lawhon, Lawhon Landscaping (901) 754-7474

Sonia Balcer, Physicist-Rocket Scientist, Montrose, CA

____________________________________________________________________________________________________________________________________________________

___________________________________________________________________________________

Transitional Music: “Calling Doctor Casey” by John D Loudermilk; “Like A Surgeon” parody of “Like A Virgin” by Weird Al Yankovic; “Doctor, Doctor” by Robert Palmer; “Memphis” by Johnny Rivers

____________________________________________________________________________________

ABOUT CLINT COOPER, owner of REDEEMERS GROUP

www.RedeemersGroup.com

– Clint was born and raised outside of Nashville, TN and is a graduate of MTSU.

– He served in Iraq with the Marine Corps Infantry before returning home to Tennessee to live and work in Memphis.

– In Nov 2007 he started Redeemers Group.

During his time with Redeemers Group, Clint has published several articles on his areas of expertise. Most recently his first book entitled “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers to help them communicate with their clients about mold and mold prevention. He teaches CE classes for Memphis Areas Association of Realtors several times per year.

He has also earned the following certifications and licenses:

Basement Systems Waterproofing Certification

Basement Systems Crawl Space Repair Certification

Foundation Supportworks Diagnostics School Certification

National Association of Mold Remediators and Inspectors License

Blue Institute- LEED Training Certification, Member ID#:

Green Building Council, Certification

TN State Board for Realtors CE Authorized Instructor

Clint lives in Germantown, TN with his wife and two children.

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@192.232.195.219 twitter @jogarner

Jo’s job description: “As a mortgage loan officer, my job is to give my client the benefits they want from their financing terms—listening to my client and determine what’s of the most value to THEM– What is their comfort level on a house payment, how much are they comfortable paying down, what type of financing do they need to get the house they want to buy or refinance. Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income. Whatever their personal priorities are, my job is to put together a mortgage with comfortable terms that will help them achieve their goals.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business since 1987. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 20 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com She was also the editor of Power Shoppe, a free weekly e-zine designed for real estate professionals and others indirectly connected to the real estate industry and currently publishes on her blog www.JoGarner.com .

For real estate financing solutions, plug into Real Estate Mortgage Shoppe. You can find mortgage rates, FHA Streamline refinance with no out-of-pocket costs, and more.