Are you or someone you know talking about downsizing one day? Today is the day to start doing some smart things, so that one day the downsizing will be more joyful. Today on Real Estate Mortgage Shoppe, you will hear from the experts some tips to make your journey and lifestyle changes more pleasant.

Host: #JoGarner #MortgageExpert #MortgageLoanOfficer (901) 482-0354

Co-Hosts: #SherryHarbur #MidsouthRealtor HarburRealty.com 901 496-8195

#LeahAnneMorse of All Things New #midsouthmovingcompany 901 488- 9733

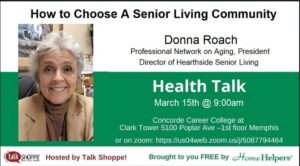

#DonnaRoach #HearthsideSeniorLiving 901 651-2503

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes www.JoGarner.com

________________________________________________________________

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our topic today is Expert Tips On Downsizing With Less Stress -Real Estate, Financing, Moving & More. Call us live today August 16, 2025 in the studio at 901 535-9732,

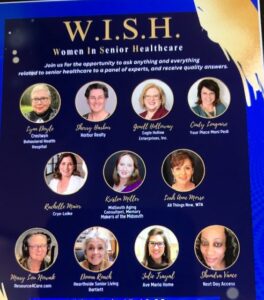

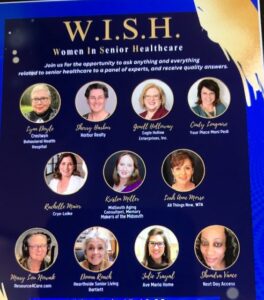

Introducing Key Members of the W.I.S.H. Team (Women in Senior Healthcare)

Sherry Harbur with Harbur Realty, Leah Anne Morse of All Things New and Donna Roach of Hearthside Senior Living. You have some additional members too. Take a moment and tell our listeners about yourselves and the WISH group.

(Sherry Harbur, Donna Roach and Leah Anne Morse have about 3 minutes to introduce yourselves, tell our listeners what you do. Tell our listeners about the WISH group and what the group does)

(Jo) I have heard so many great testimonials about each of you. I personally have witnessed the excellent service you give your client including to me and my family.

The W.I.S.H. (Women in Senior Healthcare) Group

(JO) Over the last 35 years I have been a mortgage officer, it is clear that everyone has a different story, a different challenge and the unique solution to get them to the life they want.

My older clients who are nearing retirement or in retirement, have come up with some great financing solutions to get them in a better situation.

Here are some financing tools they have used.

-

A mortgage to buy a home (Look at setting this up with a recast option if you plan to pay a large prepayment toward the balance after closing.)

-

A cash out refinance on the home you own now to have the money to pay off other debt and make your cash flow each month easier. Cash out funds could be used to modify your home to accommodate an additional family member living there.

-

Equity line of credit to do some improvements or pay to modify your living space for a changing lifestyle

-

Reverse mortgage

Here some examples of solutions my mortgage clients have used to downsize or move closer to family members.

WANT TO BUY A HOME CLOSER TO YOUR FAMILY, BUT CAN’T SELL YOUR CURRENT HOME YET?

![]()

Nelly and Nick had been living in the same house for over 20 years. They still owed a little bit on their mortgage but had over $200,000 in equity. For over a year they had been yearning to move out in the country to be closer to their family. The reason they felt they could not move is because the house needed some repairs that could not be easily completed until the furniture was moved out of the house.

Nelly and Nick wanted top dollar when they sold their old house. They also wanted to put down the $200K equity on the new home so they could enjoy a low payment. But, they could not sell the old house and that was where the $200K down payment was tied up—in the equity of the old home.

I suggested they get an equity line of credit secured as a second mortgage on their old home to use for the down payment on the new home, but they did not want to get a 2nd lien on their old home with a variable rate.

-

“If I can show you a way you could enjoy a very low monthly note as if you were putting down the $200K equity for down payment on the new home, would you buy the home out close to your family now?”

-

You can buy the new home now and move out of the old home. You can then fix up the old home and list it for top price.

-

You can put down the smallest amount of down payment to buy the house down the street from your family members. Your note on the house will be higher then you want to be at first. When you old house is fixed up and sells, you can pay the $200,000 profit as a prepayment on the new loan we just did. If the new loan was locked with a “recast” situation, the lender will apply the large $200k prepayment to principal and lower the payment calculated on the much lower loan a balance. The recast would drop Nelley and Nick’s payment on the new home from about $3,000/month to under $1,000/month. They achieved the payment they wanted on the new home, got top dollar for their old home, and now they could afford to spend time and the extra savings making memories with their family.

Call me today and let’s explore some best financing scenarios for YOUR next lifestyle change. Tell me your story and how you want to live, your comfort level on a mortgage payment, down payment. I can help you find the right mortgage so you can have some bragging rights at closing. My team and I will help make the mortgage process EASY for you. Connect with me for your home purchase mortgage or refinance at www.JoGarner.com

(Jo) Stay tuned. We will be hearing more for our guests Sherry Harbur of Harbur Realty, Donna Roach of Hearthside Senior Living and Leah Anne Morse of All Things New when we come back.

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will our downsizing experts will be sharing some valuable tips that can help you or someone you know.

2nd segment 9:18 am – 9:30 am

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

LET’S TALK SHOP—TALK SHOPPE’S BUSINESS TIP FOR REAL ESTATE PROS:

Click to vote for the Sponsors of Talk Shoppe and this Real Estate Mortgage Shoppe radio show

Health and Beauty Section

Home Health Category

MIDSOUTH HOME HELPERS Market Community’s Choice Awards Voting

Entertainment and Leisure “

Radio Personality

Jo Garner, iHeart WREC Market Community’s Choice Awards Voting

Finance People

Financial Planner

Ben Hunter, Independent Planning Group https://commercialappeal.gannettcontests.com/2025-Memphis-Most-Communitys-Choice-Awards/gallery/502008161

Mortgage Lending Company

Supreme Lending Company Jo Garner Market Community’s Choice Awards Voting

Services:

Basement/Foundation Repair

Redeemers Group Market Community’s Choice Awards Voting

Heating/Air Company

Refrigeration Unlimited -Mark McLaurine Market Community’s Choice Awards Voting

Law Firm

Griffin, Clift Everton and Maschmeyer Rob Draughon and Shelley Rothman

Market Community’s Choice Awards Voting

Moving Company

All Things New-Leah Anne Morse Market Community’s Choice Awards Voting

Printing Company

Cartridge World -Taylor Morse Market Community’s Choice Awards Voting

Roofing Company

Masters Roofing- Ed Hill Market Community’s Choice Awards Voting

Real Estate Company

Harbur Realty Sherry Harbur Market Community’s Choice Awards Voting

Security Company

Black Flag Security Mark Cardona Market Community’s Choice Awards Voting

Services People:

Real Estate Agent

Pat Goldstein, Crye-Leike Market Community’s Choice Awards Voting

Retirement Communities 55+

Hearthside Senior Living Donna Roach Market Community’s Choice Awards Voting

TOPICS COVERED BY THE W.I.S.H. EXPERTS

Sherry Harbur Donna Roach Leah Anne Morse

Harbur Realty Hearthside Senior Living All Things New Moving

Donna

-

What to think about when looking at a senior community

There are different levels of senior communities so make sure you are choosing the correct one.

Independent living

Assisted living

Memory care

-

All senior communities are self-pay so consider your finances

What income do you have or expect to have

VA assistance

Retirement funds and/or social security

Savings

Money from selling home or property

Family willing to contribute

-

Legal documents that need to be in place –

-

Power of attorney – if getting this for parents get it done early so everyone will be making clear decisions

-

There are two kinds of POA – financial and medical

-

Bank documents – Payable on Death, pitfalls of having family member on checking/savings account

Sherry

-

When is the BEST time to sell a home

-

Should improvements be made or sell as is – will improvements make that much difference compared to cost of improvements

-

Consider how long it might take to sell a home – this could have a financial impact if move is made before sale

Leah Anne

-

Downsizing is a difficult decision – consult with a professional who can help.

-

Packing and moving – a professional will make take care of all of the details which eliminates stress

-

Talk to family impacted by the move – a professional can help with these conversations.

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

- Sid Stenner Takes Clever Steps to Safeguard His Income and Savings With the Right Mortgage Loan

![]()

Sid Stenner has been living alone for the last several years and doing just fine on his fixed retirement income and the money he makes in his small home-based business. A few years ago Sid needed money for his business and he took out a bank loan secured on his home.

This loan was quick and easy when he got it, but now the fixed rate term is ready to switch to a variable interest rate. He used some variable interest rate credit cards and still had unpaid balances lingering. it seemed like a good time to somehow convert the risky variable rate debt to a safer fixed rate. But how?

We looked at several options. Mr. Stenner decided to refinance his home and replace his risky variable rate mortgage with an affordable, fixed rate mortgage. He decided to roll into this refinance loan the variable credit card balances too. When inflation and higher Federal Reserve rates come knocking, Mr. Stenner’s rate will stay low and the variable rate from credit cards will be gone too. Those cards were paid off with the loan from the refinance.

Mr. Stenner said, “I’m going to work another five years, if the good Lord lets me. While I have both my retirement income and my business income, I’m going to pay extra each month to get my mortgage paid down as low as possible. Then when I retire, I might refinance to a lower payment or get a reverse mortgage.” Mr. Stenner was thinking ahead and preparing a good life for himself now and later.

What do YOU want to accomplish with your mortgage? Let’s explore the possibilities. Connect with me at www.JoGarner.com

IS THE REVERSE MORTGAGE RIGHT FOR YOU?

-

How does the reverse mortgage program work for senior citizens?

-

Before you talk with a reverse mortgage loan officer, government guidelines require that you first consult with a HUD approved Reverse Mortgage Counselor. You can find a reverse mortgage counselor by calling 1-800-569-4287 or going to www.HUD.GOV and searching under “reverse mortgage counseling.” It is advisable to also consult with your certified financial planner or other certified financial consultant.

-

Depending on how long you plan on living in your home and the amount of equity you have in your home, the next step is to determine which type Reverse Mortgage is right for you. Here are a few of your options:

-

When you need the largest possible initial or future credit line, like a lump sum of cash or a credit line that could offer you the cash in the future if you need it.

-

You could set up the plan for getting the largest possible monthly payment for as long as you live in the house.

-

You could arrange to get as much cash as possible, at closing or after 12 months.

-

Reverse mortgages can be used to purchase a house with the smallest possible cash outlay.

-

Reverse mortgages can be used to pay for help in the home or for long term care policies.

-

The reverse mortgage program is not for everyone. Generally speaking, if you are over the age of 62 and have a home with a large amount of equity in it and no other options to take care of your cash and income needs, the Reverse Mortgage may be for you.

If you can reallocate your assets and investments to get the cash or income you need without having to get a Reverse Mortgage, that might be better. Reverse mortgages can eat away a significant amount of the equity in your home because of the high cost to do them.

If you have family that you would like to inherit your home, you may not want to encumber the home with a Reverse Mortgage. There are some alternative solutions that could allow you or your family member to get a Reverse Mortgage and still provide a way for the family members to pay it off when needed.

My Second Mortgage Payment Has Gotten Higher Than I Can Pay

![]()

A lady called me who was struggling with having enough cash to pay her bills per month due to a temporary family crisis. She asked me, “My 2nd mortgage equity line payment just went up quite a bit and now it will be tough to be able to afford to pay my bills each month. What can I do about my home equity line loan?”

Normally, she would not even consider refinancing her fixed rate FIRST mortgage because she only owed around $40,000 on her first mortgage with less than 5 years left to pay it off. Her 2nd mortgage was a variable rate home equity line with a balance of about $50K. Her bank had just told her that her payment on that loan was converting to a full principal and interest payment increasing the minimum payment by an extra $200 per month. She told me she knew that later the monthly payments on her mortgage would be no problem, but the increase on the 2nd note for the moment was threatening her ability to pay for basic family needs at least until her family could get through their current crisis. The thought that the 2nd loan was also a variable rate loan with no safety caps on rate increases made her feel financially vulnerable too.

Everyone’s story is different. In today’s market a solution for the lady who called me would be to refinance her first and second mortgage fixed rate mortgage amortized over 30 years with no prepayment penalty. Even if her rate was lower on the small first mortgage, she would be paying off the higher, variable rate on the second mortgage. By refinancing everything back to a 30 year mortgage, she could save a few hundred dollars per month to handle her family crisis. Once the family had overcome the crisis, she would be disciplined to apply the cash savings each month to paying the mortgage off early. Solutions vary from person to person. But here’s the good news, you don’t need to give into fear or worry. The path can be made clear to overcome the obstacles and enjoy the life you want.

Let’s you and I talk about YOUR plans to save on your mortgage costs or your plans to build your real estate portfolio. But you have to talk with me personally so I can work with you. You can connect with me at www.JoGarner.com or call me directly at (901) 482-0354. MAKE YOUR PLAN, LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY!

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, LET’S DO IT TODAY. I can make the mortgage process easy. Connect with me at www.JoGarner.com You can email me at Jo@JoGarner.com or call me at (901) 482-0354

REAL ESTATE TIP OF THE WEEK

Sherry Harbur has about 45 seconds to share a quick tip ( The best time to plan for your future is now. You don’t have to move today, but plan with your loved ones what you prefer. Planning today makes tomorrow much easier.)

Donna Roach has about 45 seconds to share a quick tip. ( When you are thinking about moving on your downsizing journey. If you are thinking about moving into an assisting living facility, think about the services you need or might need later. How close do you want to be to family and services that are important to you.)

Leah Anne Morse has about 45 seconds to share a quick tip. (If you are over 60 years old, think about where you want to be in the next 10 years. Start acting on that plan a little bit at a time. Invite your adult children to help clean out your stored stuff. If some of it is their stuff, ask them what they want to keep. If they don’t want the stuff, then throw it away or give it away. If you can make downsizing a priority before it becomes a priority, your experience will be much more joyful.

Jo Garner’s tip :

What do YOU want to accomplish with YOUR mortgage? I have the knowledge and experience. Let’s look at traditional mortgage products, alternative mortgage products and even combinations of products. I can help you get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Independent Planning Group’s conference room 110 at Clark Tower 5100 Poplar Ave 1st floor Memphis, TN

(Thank you Ben Hunter 901 660-2912 outstanding Financial Professional at Independent Planning Group for being Talk Shoppe’s location sponsor)

Talk Shoppe on Wednesday August 27th, 2025 “The Mastermind Principle-based on the book “Think and Grow Rich” by Napoleon Hill.

Talk Shoppe says thank you to the generous sponsors who support business owners and sales people in our community. Thank you to Taylor Morse of Cartridge World, helping his clients get the best fit with a cost-effective printer and recycled cartridges which can save them 30% or more on printing costs. He was nominated in the top five for printing services on the Memphis Most Community Awards contest going on now. Connect with Taylor Morse at 901 853-3230

Thank you to Talk Shoppe sponsor Ed Hill of Masters Roofing. Maste.rs Roofing has a long list of happy customer testimonials. Even the shingle companies warranty their jobs. He was nominated in the top five for printing services on the Memphis Most Community Awards contest going on now. For your new roof or roof repair, call Ed Hill at 901 273-6594

MAKE YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE DOES NOT ENDORSE 100% OF THE CONTENT ON THIS EPISODE. REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY, AND NOT AN OFFER TO LEND. EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND MOST ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS. JO GARNER IS A LICENSED MORTGAGE LOAN ORIGINATOR. (EQUAL HOUSING OPPORTUNITY)

QUOTE CORNER:

QUOTE CORNER: “Don’t let aging get you down…Its too hard to get back up.”

“You know you are getting old when everything hurts and what doesn’t hurt doesn’t work.”

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

CREDITS AND ACKNOWLEDGEMENTS

REJOINDERS:

-

Genell Holloway of Eagle Hollow Enterprises (Health Benefits Consultant)

-

Clint Cooper Redeemers Group Basement and Foundation repair www.RedeemersGroup.com

-

Shelley Rothman and Rob Draughon real estate attorneys with Griffin Clift Everton and Maschmeyer 901 752-1133

Transitional Music: “The Best Is Yet to Come” by Michael Buble’; “The Remember Song” Tom Rush; “Forever Young” by Rod Stewart;

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

On Amazon and Barnes and Noble

THE W.I.S.H. (Women in Senior Healthcare)

_____________________________________________________________________________________

SHERRY HARBUR, REALTOR WITH HARBUR REALTY

Sherry Harbur, Broker and Owner of Harbur Realty. 1984 started my real estate journey in New Mexico and it has been a pleasure assisting buyers and sellers in the Memphis/Midsouth market since 2000! I’ve worked through up and down markets and we get creative to make things happen for our clients best interest, no matter what the market decides to do!

Today, we still work hard for our first-time home buyer, relocation buyers and sellers, and helping our buyers and sellers right size for their current housing needs. We’ve appreciated working with multiple generations in the same family! We also love helping investors build their portfolios while making sure they truly understand our Memphis market before investing here.

We are very passionate about representation for our 55+ community. We have witnessed some serious senior abuse in their housing sales and it is heartbreaking to know their one asset that they could live on was sold at steeply discounted prices. We are adamant about taking education to our communities to help protect this class, so this last year we wrote a book called “Senior Housing Roadmap”. We want to get this into as many hands as possible for our senior community or their families. We deliver the books for free or can send them a digital link if they want to read it on their phone or iPad.

We then offer free workshops and provide a free workbook for them to work with — we call it a “Roadmap”, because it helps avoid a WRECK in their real estate planning. This is for anyone that owns a home and do not have a PLAN for what to do going forward. It allows them to know what their “Scenic Route” ahead would look like if all goes as planned, but it also gives direction for their family in the event things turn and they have to “Fast Track” into different housing. It’s always nice when we know what our loved ones desire and we can work towards that goal even if they are not able to communicate that to us at some point.

Sherry Harbur, Realtor

Harbur Realty

(901) 496-8193

___________________________________________________________________________

ABOUT LEAH ANNE MORSE OF ALL THINGS NEW

(901) 488-9733

ORGANIZING YOUR HOME AND OFFICE

ORGANIZING YOUR MOVE

MOVING YOU FROM HERE TO THERE

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com X @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating

*Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”