“Homewise Real Estate & Mortgage Inside Tips from the Pros”

Make your wise move with your real estate and financing plans using inside tips from the pros. Some of the best deals are made in real estate during the holiday season. Mortgage rates at a 12-month low creates opportunities for a refinance you can brag about.

Airing Saturday November 8th, 2025 9AM CT AM 600 WREC, 92.1 FM & on your iHeart app.

Host: #JoGarner #MortgageExpert #LoanOfficer (901) 482-0354

Co-Host: #PatGoldstein #midsouthrealtor West TN & North Mississsippi (901) 606-2000

Special Feature: #ChuckBohannon, booking agent brings #SantaClaus 901 619-6436

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes www.JoGarner.com

___________________________________________________________________

1st segment 9 minutes LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our topic today is November 4th, 2025. ““Homewise Real Estate & Mortgage Inside Tips from the Pros.” Thank you to real estate attorneys Shelley Rothman and Rob Draughon of Griffin, Clift, Everton and Maschmeyer Law Firm. For your home purchase or refinance, call Shelley or Rob for title closing services at 901 752-1133.

Introducing Pat Goldstein, Realtor with Crye-Leike in West TN and North Mississippi

(Jo) Pat Goldstein, realtor with Crye-Leike in West Tennessee and North Mississippi, your customers and referring partners call you “The Gold Standard in Real Estate.” You take good care of your home buyers and home sellers AND you just won the Memphis Most Community Award in the Realtor category. Kudos! For those listeners who don’t already know you, take a minute or so and tell us a little about yourself and the services you offer your clients. (Pat has about a minute and a half to share about herself and the services she offers her clients )

(Jo) When I think about inside tips and getting something right the first time, I think about the principle—MODEL WHAT WORKS. Anthony Robbins wrote the book Unlimited Power that gives examples of people who wanted to be the best at something like a sport, a skill or maybe at buying real estate. If you can model their thought process and their process of execution, you can be the best too. Find someone who is living your dream, doing very well something that you would like to do with excellence. Take them to lunch. Buy them lunch often and ask them how they have achieved their success doing that something that you want to do well. Model how they think about what they do, what they believe and the steps they take to execute this skill MODEL WHAT WORKS AND SEE IT START WORKING FOR YOU.

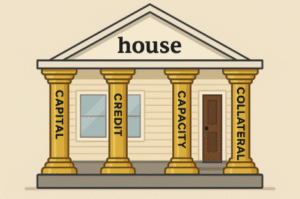

Let’s talk about how to succeed getting your mortgage approved for a home purchase or refinance. We need to go back to the basic 4 C’s of lending. The most important CAPITAL, CREDIT, CAPACITY AND COLLATERAL.

The highest priority on the mortgage underwriting software is CAPITAL— making sure you have enough funds to close. Remember to always keep your emergency fund intact too. That means don’t run out and pay off all your credit cards before you meet with your lender. You may discover that, even it your debt ratios are a little on the high side, you are still ok because you have money in the bank. Money in the bank is more important than having all your credit cards paid off.

Second highest on the priority list is CREDIT. The higher your credit scores, the lower your loan costs. Higher credit scores give you better selections for mortgage programs too. In the book “Choosing the Best Mortgage-The Quickest Way to the Life You Want,” I wrote a whole chapter on how to improve your credit scores. You can pick up this book on Amazon and Barnes & Noble.

Third is CAPACITY. This is having enough verifiable income to pay the mortgage. The process of verifying income is pretty straightforward with paystubs and W2s for salaried and hourly employees. For self-employed borrowers, if they take a lot of legal deductions on their tax returns, we may have to use a different loan program that tracks income from the last 12 months bank statements or a profit and loss statement instead of tax returns. For people financing rental properties, the low documentation DSCR loan is the most popular real estate investment mortgage. The only income documents used on the DSCR program is the lease on the subject property. The lender wants to make sure the lease income is about the same or more than the mortgage payment.

COLLATERAL is the property you are buying or refinancing. For mortgages where appraisals are required, it is important that the property be in good condition. The title needs to be clean, with no outstanding liens or judgments. If the property needs repairs, we have special renovation and repair loan programs. There are some special loan programs for real estate investors to buy and fix up and keep or flip the property later.

Stay with us. I have some stories to share later in the show.

(Jo) Before we go to break, Pat Goldstein, Realtor with Crye-Leike. Please start sharing some of your top tips for people who want to buy real estate. (Pat has 1- 2 minutes or until the 9:15 am break )

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will hearing more from Pat Goldstein, Realtor in West TN and North Mississippi. Also, Chuck Bohannon, booking agent for Santa Claus in the MidSouth has brought the jolly old elf himself into our studio. So…stay tuned…

______________________________________________________________________

2nd segment 9:18 am – 9:30 am 12 min

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

![]()

( Waaka Waaka song in background ) COMIC QUERIES (you probably already know the answer, but we will ask anyway (: Q. Riddle: Doors open wide, in hopes that you’ll step inside. What am I?

Answer: Open House

From Riddlepedia.com

Today on Real Estate Mortgage Shoppe, we are talking about

“Homewise Real Estate & Mortgage Inside Tips from the Pros”

”

I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

Pat Goldstein, Realtor with Crye-Leike Realtors in West TN and North Mississippi (901) 606-2000

Here’s our Talk Shoppe Business Tip coming up with

LET’S TALK SHOP—TALK SHOPPE’S BUSINESS TIP FOR REAL ESTATE PROS:

It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the generous financial support of its sponsors and advertisers. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) This week our very generous sponsor was brought here by Chuck Bohannon, booking agent for Santa Claus in the MidSouth –It’s Santa Claus himself. Book early to get Santa to attend YOUR Christmas business or networking event, your family Christmas, church or senior health care facility. Santa Claus, what is our Talk Shoppe tip today?

Santa’s tip: Make your lists and check them twice. You do that for your Christmas gift lists. If you are thinking about buying a home, take Pat’s advice to make a list of what you want, what you can bargain and what you don’t want in the house. Making a list helps insure that you will get what you are seeking. (Make sure that you put on your list that your house has a convenient place to put the milk and cookies out for Santa Claus every Christmas Eve)

How do we contact Chuck Bohannon to book Santa for our Christmas festivities? (901) 619-6436

TOPICS COVERED BY PAT GOLDSTEIN, REALTOR WITH CRYE-LEIKE REALTORS

- Make a list of the things you have to have in the house . Now make a list of things you would like to have in the house. Then make a list of things you do not want in the house.

- Make the lists separately with each person (including the children) who will be living in the house.

- Get preapproved for your financing before you start looking to buy homes

- Eliiminate as many contingencies on the contract as possible. If there are too many conditions, like selling a current home first, you may lose out to someone else making a stronger offer to purchase the home.

3rd SEGMENT 9:35 AM-9:45AM) 13 min

- ( Brighter Tomorrows Song playing in background)

- For Did You Know today…

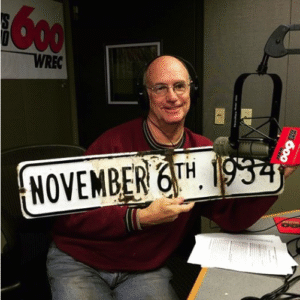

- On November 6, 1934, the city of Memphis voted overwhelmingly to affiliate with the Tennessee Valley Authority (TVA) for public power, rather than rely on private utilities. A downtown alley was later renamed November 6 Street to commemorate that vote. We have a picture of our Shelby County Historian Jimmy Ogle in the Real Estate Mortgage Shoppe studio holding one of the old white street signs that had been replaced. He told us that the street name November 6, 1934 is the only street in the entire nationa that is named with the month, day and year. Check out the picture on the blog post of this show if Jimmy Ogle in the studio holding up the street sign. Catch it later on JoGarner.com

- Today on Real Estate Mortgage Shoppe, we are talking about

- “Homewise Real Estate & Mortgage Inside Tips from the Pros”

- I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

- Pat Goldstein, Realtor with Crye-Leike Realtors in West TN and North Mississippi (901) 606-2000

- Chuck Bohannon, booking agent for Santa Claus brought Santa Claus. How do we contact Chuck Bohannon to book you for our Christmas festivities?

- (901) 619-6436

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

Earlier in the show we were covering some mortgage tips on the four C’s –CAPITAL, CREDIT, CAPACITY AND COLLATERAL

Remember that Capital –your funds to close and money left over in your emergency fund is the most important of the C’s. If you’re short on funds to close, we can find treasure in some of these places

Digging for treasure when you need funds to close.

First let’s dispel one big gorilla-sized myth- The minimum required down payment to purchase a home where you will live is NOT 20% down. You can actually buy your home with 3.5% or even zero down. Call me at (901) 482-0354 or connect at www.JoGarner.com and let’s look at some of YOUR mortgage financing options.

Three areas to search are the borrower’s forgotten assets, gifts from family or employers and move-in costs paid by third parties. Sinking a shovel into these three areas has turned up pay dirt.

GIFTS FROM FAMILY, LOANS SECURED ON OTHER ASSETS, (like cars, certificates of deposit, 401ks, margin loans on investments, a cash out refinance on a different real estate property, SALE OF AN ASSET LIKE JEWELRY, A VEHICLE, SALE OF A HOUSE. STATE AND OTHER GOVERNMENT DOWN PAYMENT ASSISTANCE PROGRAMS AND 100% LOANS—AND MORE…

SAM AND SALLY -WILL CREDIT ISSUES DELAY THEM GETTING THEIR OWN HOME?

Sam and Sally Smith are newly married and expecting their first child. Saddled up with student loan debt had kept them strapped for cash and existing in a small apartment, not large enough for their expanding family. Sam regretted his carefree days in college charging up the credit cards he accepted in the mail. It was so easy to use them –even for necessary items, but a few missed payments and a collection account tanked his scores.

When Sam tried to was denied credit to purchase a car he needed to get to work, reality came like a slap in the face. It was time to make a plan and stick to a plan to get his credit back working for him and not against him.

Sally’s story was a little different. She had stayed away from credit altogether and did not have a credit score at all. Her income was too low to qualify for a house on her own, so the plan was to build her credit and make Sam’s credit better.

Due to Sam’s bad credit, in order to get a car, he had to buy what he described as a “rust bucket on a roller skate.” He said he paid way over the blue book value for the car and had a loan that had an interest rate in the double digits. The payment he described as “Ouch!”

When Sam and Sally went to apply for a mortgage to try to get out of the cramped apartment and into a house, the news was not what they wanted to hear. Even if he could improve his credit score up to a 640 from his current 565 score, he would be paying about a half point higher on the interest rate. Over a period of time, the financing would cost him almost $10,000 more than what he would pay if his scores were higher. But he had a plan to move the dial up on his credit scores in just a few months. Sally’s plan would get her a decent credit score in only 30 days.

Sammy set up a payment plan with some of the past due balances that had been haunting him on his credit cards. He made a deal with the credit card companies not to report negatively on him as long as he was making regular payments to pay off the past due balances.

He went online and signed up for a well-known secured credit card. He put up $300 of his own money and kept a balance of no more than $25/month for 3 months which put an extra 50 points on his credit score.

Sally’s parents added her to one of their seasoned, low usage credit cards which just about instantly popped her credit score up to around 680 from zero.

Sam and Sally worked with the credit bureaus and their creditors to correct errors. They kept the usage on their credit card under 10% of the credit limit and paid on time. They did the work and were rewarded on the day they got to purchase their beautiful home.

CAPACITY is having enough verifiable income . I you are a salaried or hourly employee, the methods of calculating payments are done using paystubs and W2s. Some programs use tax returns.

Outside-the-box mortgages are growing, especially for self-employed borrowers. You don’t need a tax return. Lenders use these alternative documentation loans, outside-the-box mortgage programs to calculate income coming in on the last 12 months bank statements or a CPA’s profit and loss statement. Here is an example of a self-employed couple who used the bank statement loan to qualify their CAPACITY—enough income to pay the mortgage.

SERGIO & SELENA-SELF-EMPLOYED HOME BUYERS GETTING FROM A “NO” TO A “YES” WITH A PORTFOLIO MORTGAGE

Sergio and Selena owned a profitable convenient store and had been saving for a home in the suburbs-outside the noisy, crowded city. After searching for months, they found the house with just the right layout, outside the city but still convenient to everything they needed.

What a negative shock when the mortgage company turned them down for their mortgage request due to “not enough income.” Suddenly it looked like the home they wanted so badly was going to get away from them.

Their realtor referred them to me. I could see why the other mortgage company turned them down for lack of income. They had a really good tax accountant who legally wrote of a lot of expenses, making their NET income look very slim.

“But we make PLENTY of income,” Sergio emphatically told me. I believed them.

I asked Sergio and Selena to scan over all pages of the last 12 months bank statements from their business. From the bank statements we took a percentage of all of the business deposits. Now the income-to-debt ratios were looking good.

One more hurdle though. On the first pass, the underwriter turned Sergio and Selena down because it appeared the income from deposits had declined about 50% in the last 6 months.

That night I went back over the bank statements, noticing that the income to the owners had NOT declined—just the overall income. Sergio and Selena explained that they had changed some of their suppliers and types of products sold which reduced cost of goods sold, so they did not have to bring in as much income to keep the same level of profit.

The underwriting team relooked at this angle, agreed and approved their loan.

It was celebration time for Sergio and Selena at their home purchasing closing

Are you self-employed or know someone who has self-employment income who wants to buy a home or refinance? Let’s explore the in-house portfolio products. The interest rates on these programs are surprisingly affordable.

_____________________________________________________________

4th Segment 9: 48am to 9:56 am 7 min

(THE SONG COUNTRY ROADS by Sergie Pavkin PLAYING IN BACKGROUND ) INSIGHTS & INSPIRATION

The Farmer’s Lantern

An old farmer once gave his son a lantern before sending him into town at night.

The son grumbled, “I don’t need this old light — I know the road.”

Halfway there, he stumbled into a ditch, tore his boot, and had to limp the rest of the way.

When he returned home, the farmer simply said,

“The road doesn’t change, son — but the way you see it does.”

From that day on, the young man never traveled without his lantern.

💡 Moral:

Wisdom is the lantern that lights your path.

The road of life may stay the same, but seeing it with wisdom helps you walk it better, safer, and with more peace.

Today on Real Estate Mortgage Shoppe, we are talking about

- “Homewise Real Estate & Mortgage Inside Tips from the Pros”

- I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

- Pat Goldstein, Realtor with Crye-Leike Realtors in West TN and North Mississippi (901) 606-2000

- Chuck Bohannon, booking agent for Santa Claus brought Santa Claus. How do we contact Chuck Bohannon to book you for our Christmas festivities?

- (901) 619-6436

REAL ESTATE TIP OF THE WEEK

Santa Claus has 1 minute to share a tip

Pat Goldstein has one minute to share a tip

Get your supporting financing information to the mortgage company early so that your preapproval letter can be strong. This will give you and the seller confidence, making your offer more compelling than another person making an offer on the same house.

Pat congratulates Jo Garner on being one of the winners of the Memphis Most Community Award for best radio show and best mortgage lender. Jo thanks Real Estate Mortgage Shoppe listeners for voting for the show and for voting for Her and Supreme Lending that made these awards possible.

- Jo Garner’s tip Refinancing is back in vogue. With mortgage rates at a 12-month low, this is an opportunity for many borrowers to refinance to a shorter term mortgage. Rates are low enough now for borrowers to score on refinancing their old mortgage and rolling into the new mortgage money to pay off high interest rate credit cards and other high-cost debt.

What do YOU want to accomplish with YOUR mortgage? I have the knowledge and experience. Let’s look at traditional mortgage products, alternative mortgage products and even combinations of products. I can help you get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Independent Planning Group’s conference room 110 at Clark Tower 5100 Poplar Ave 1st floor Memphis, TN

(Thank you Ben Hunter 901 660-2912 outstanding Financial Professional at Independent Planning Group for being Talk Shoppe’s location sponsor)

Talk Shoppe on Wednesday November 12th, 2025 join us “A Hands-on CPR Practice Experience”

This is a Health Talk powered by Mary Lou Nowak’s Resource4Care.com; Sponsored by Genell Holloway and Tim Flesner, owners of Mid-South Home Helpers, providing non-medical assistance to help loved ones who need help with daily routines of living (901) 414-9696; Hosted by TalkShoppe.com

Talk Shoppe thanks Talk Shoppe’s sponsor Genell Holloway of Eagle Hollow Enterprises for your generous support of our business owners. Open enrollment time is here for signing up for health benefit packages, medicare and other benefit packages for yourself and your employees. Call Genell Holloway today at 901 270-1127.

Talk Shoppe thanks to Peggy Lau, Retired US Navy Line Commander and representative for Viago travel company. Do you want to make great memories with your loved ones taking first class vacations? Want to know how? Call Peggy Lau 901 289-0747

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, IT TODAY.

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE DOES NOT ENDORSE 100% OF THE CONTENT ON THIS EPISODE. REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY, AND NOT AN OFFER TO LEND. EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND MOST ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS. JO GARNER IS A LICENSED MORTGAGE LOAN ORIGINATOR. (EQUAL HOUSING OPPORTUNITY)

QUOTE CORNER:

QUOTE CORNER: If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes, buy a third.” ― John Paulson, American billionaire hedge fund manager

www.bing.com “Real estate is the best investment next to donuts. At least you can eat the donuts.”

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

CREDITS AND ACKNOWLEDGEMENTS

Songs: “Waaka Waaka” Freepd.com for the Comic Queries; “Brighter Tomorrows” From Stocktunes no copyright ; “Country Roads” Sergie Pavkin public domain music through Pixabay

REJOINDERS:

- Ed Hill of Masters Roofing 901 273-6594 Masters Roofing | Bartlett, TN | Roofing Contractor

- Clint Cooper of Redeemers Group Foundation Repair www.RedeemersGroup.com

- Taylor Morse of Cartridge World of Collierville, TN 901 853-3230

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

On Amazon and Barnes and Noble

ABOUT PAT GOLDSTEIN, REALTOR WITH CRYE-LEIKE REALTORS

In West TN and North Mississippi 901 606-2000

https://patgoldstein.crye-leike.com/

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com X @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating

*Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”