“

Legacy Planning & Property: Holiday Conversations

(1st segment 12 minutes )

Have you been thinking about the best options for your loved ones who may need to downsize or move to an assisted living situation? Listen to this show for more tips, ideas and resources

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our topic today December 13th 2025 is of Legacy Planning & Property: Holiday Conversations This is our Christmas show. Thank you to attorneys Shelley Rothman and Rob Draughon of Griffin, Clift Everton and Maschmeyer Law Firm for sponsoring this episode. When you are ready to buy a home or refinance one, call Rob and Shelley for the title work and closing. 901 752-1133.

Introducing Sherry Harbur of Harbur Realty

(Jo) Back in the studio we have realtor Sherry Harbur, author of the book Senior Housing Roadmap: A Step-by-Step Guide to Choosing The Right Option For Your Family. Sherry, you have built a great reputation for helping people buy and sell their homes and guiding them on decisions to best help their loved ones. Take a few seconds tell our listeners a little about yourself and the services you offer your clients. (Sherry Harbur has about 30 seconds to intro herself and talk about the services she offers her clients)

(intro) Tim Flesner, co-owner of Mid-South Home Helpers your company offers non-medical assistance to loved ones needing help with routines for daily life and you don’t just do health care, but you do it with a heart. Take a few seconds to introduce yourself and tell our listeners about yourself and the services you offer your clients. (Tim has about 30 seconds to intro himself and talk about the services Home Helpers offers)

(intro) Mary Lou Nowak of Resource4Care.com, you have been a wonderful resource for educating the public and healthcare professionals about the people and health services available to the families that need it. Take a few seconds to introduce yourself and tell our listeners about yourself and the services you offer. (Mary Lou has about 30 seconds to introduce herself and talk about the services she offers )

(Jo) Over the 35+ years I have served my clients as their mortgage lender, they have taught me so much by sharing some of their dreams and discouragements. If I listen long enough and asked the right questions, sometimes we land some mortgage terms that has some features that gets these families what they need today with features that will also help them tomorrow. You might be pleasantly surprised at what you can do.

Reverse Mortgage The Solution To Remain In Her Home-Opal Osborn’s Story

Let’s start with Opal Osborn’s story (not her real name.) Ms. Osborn’s husband of 50 years had passed away. She did not have much money left after her husband’s death, but she owned her home worth about $175,000 free and clear.

Her son called me after listening to Real Estate Mortgage Shoppe and told me his mother wanted desperately to continue living in her home but needed money to make some repairs and, after her husband passed away, she lost some of the income they had been enjoying. She was going to be forced to move unless we could find a solution.

After checking into some things, we were able to get Ms. Osborn approved for a reverse mortgage where she could get part of the money upfront to make the needed repairs on her home and then she could receive income each month from the reverse mortgage program. The reverse mortgage was a god-send for Ms. Osborn.

What do YOU want to accomplish with YOUR mortgage? I can help you find the right mortgage and make the process EASY. Connect with me at JoGarner.com

(Jo) We have about ( ) minutes before we will be going to an advertising break. What are some of the top things to remember for people caregiving for loved ones? (The panel has until the music starts at the end of the segment. Once the music starts, the host will need that time to do a short outro)

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will be hearing more from Mary Lou Nowak of Resource4Care.com, Sherry Harbur of Harbur Realty and Tim Flesner of MidSouth Home Helpers.

2nd segment is after first break 8 minutes 50 seconds

![]()

( Waaka Waaka song in background ) COMIC QUERIES (you probably already know the answer, but we will ask anyway

(Question) The lawyer asked his family, “What’s the smartest financial document I ever completed”?

A: “My will — it’s the only one that stopped arguments instead of starting them.”

(Question): Why do lenders love clear title?

Answer: Because surprises are great for birthdays… not for property ownership.

(Question): Why are family reunions like chocolate fudge?

Answer : Because some are really sweet and some are full of nuts.

_______________________________________________________________________________________

Today on Real Estate Mortgage Shoppe, we are talking about Legacy Planning & Property: Holiday Conversations (OUR CHRISTMAS SHOW)

I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

Special Guests today on the Panel of Experts :

Sherry Harbur of Harbur Realty (901) 496-8193

Tim Flesner of MidSouth Home Helpers (901) 414-9696

Mary Lou Nowak of Resource4Care.com

TALK SHOPPE BUSINESS TIP

We thank you everyone on this panel today for your generous contributions to our local business community with your sponsorship of Talk Shoppe. Talk Shoppe offers free networking and education to our local business community and real estate community. If you join the Talk Shoppe Sponsor team, you can get a wide variety of marketing venues at a below-market price. www.TalkShoppe.com

Donna Roach of Hearthside Senior Living in Bartlett wanted to be on the panel of experts today, but is busy servicing her residents at Hearthside Senior Living in Bartlett, TN today. They always make every holiday special for their residents.

Tip from Donna Roach of Hearthside Senior Living

(901) 651-2503

“if you are considering moving to a senior community in 2026 start talking to your family and begin your research to determine what area of town you want to look at and what your finances are like. Consider looking at the website Resource4care to get advice from the experts in senior living.”

___________________________________________________________________________

TOPICS COVERED BY OUR PANEL OF EXPERTS

MARY LOU NOWAK OF RESOURCE4CARE.COM, TIM FLESNER CO-OWNER OF MIDSOUTH HOME HELPERS, SHERRY HARBUR OF HARBUR REALTY

Mary Lou Nowak, Resource4Care.com

The Conversations Families Avoid—And Why the Holidays Are the Best Time to Start Them

How to Talk About Aging Without Triggering Defensiveness

Tim Flesner, MidSouth Home Helpers

Noticing the signs: when loved one needs help

Taking Action: First steps in establishing care (this one overlaps a lot of the others on the panel)

Sherry Harbur, Harbur Realty

When Stuff Becomes a Burden and a Danger

Rules of thumb when it comes to planning the roadmap to your loved ones care, housing and the journey

- _______________________________________________________

3RD SEGMENT 12 minutes

- ( Brighter Tomorrows Song playing in background)

![]()

- For Did You Know today…(Bet you already know the answer, but we are going to ask you anyway…

Which famous Memphis business proved its entire business model during the Christmas season?

In December 1973, just months after launching, this company faced skepticism about whether overnight delivery of packages could actually work. To prove it, the company focused on the busiest time of year—Christmas shipping season. From Memphis International Airport, this Memphis company successfully delivered thousands of time-critical packages overnight across the country.

That holiday season didn’t just save the company—it validated the idea that speed, reliability, and logistics could change how the world does business. Today, Memphis is known globally as a logistics hub, all because a bold Christmas-season test done by Federal Express worked.

Why it matters: One successful holiday experiment turned Memphis into a city that quite literally helps the world deliver Christmas. Now YOU know that it was Federal Express that launched this daring test during the 1973 Christmas holiday season.

- Today on Real Estate Mortgage Shoppe, we are talking about Legacy Planning & Property: Holiday Conversations (OUR MERRY CHRISTMAS SHOW -AND HAPPY HANUKKAH SHOW)

- I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

- Special Guests today on the Panel of Experts :

- Sherry Harbur of Harbur Realty (901) 496-8193

- Tim Flesner of MidSouth Home Helpers (901) 414-9696

- Mary Lou Nowak of Resource4Care.com

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

As we talk about “Legacy, Planning & Property- Holiday Conversations”

Here are some common mortgages that families will use when buy a property, renovating an existing property or refinancing to restructure their finances.

- Traditional Home purchase mortgage or special home purchase program for outside-of-the-box borrowers

- Reverse Mortgage or Reverse Mortgage Equity Line

- Renovation and repair loans

- Equity Lines of Credit

- Refinances to pull cash out to pay off higher interest debt, or use the cash out for other reasons. Some refinance to lower their payments and the list continues.

Tell me YOUR story and let’s explore the mortgages that can get you quicker to the life you want. (901) 482-0354

MR JONES WITH WIFE’S MEDICAL BILLS -REFINANCED BACK TO 30 CASH OUT STORY

Let me share a past client story. Let’s call this gentleman Mr. Jones nothis real name.) Mr. Jones and his wife had a good jobs but his wife got sick and had to quit her job. The income in the household dropped but not the bills. As Ms. Jone’s health deteriorated, she ended up in the hospital and then needed around the clock care. Mr. Jones had to cut back on time he could work on his job and his own income dropped. Unfortunately, Ms. Jones never recovered and passed away.

Late one afternoon I picked up my phone and it was Mr. Jones on the other line. He told me his story. When the income dropped in their household, he said he had no choice but to start using credit cards and now was paying over 15% interest and the owed balances kept compounding higher because he could only pay the minimum payment. He also told me they had amassed mountains of medical debt.

He and his wife had paid down their mortgage over the years and only owed about 25% of the value. The mortgage payment was really high though, because they had refinanced it a few years ago to a short 15 year term, hoping to have the mortgage paid off before they retired. The mortgage payment in Mr. Jones’ situation, was choking the life out of him.

We looked at several scenarios and Mr. Jones decided on this one:

He refinanced his mortgage back to a 30 year term with a lower fixed rate to get the payment as low as possible. He rolled the biggest part of the credit card debt, especially the cards with the exorbitantly high interest rates. By consolidating his high debt payments all into his new 30 year mortgage by refinancing, he lowered his monthly payment hundreds of dollars per month.

Mr. Jones then set up a small monthly payment plan with the medical collection companies. He used some of the monthly savings from refinancing his mortgage to wipe out even more debt. Now he was seeing light at the end of his tunnel.

By setting up a plan to systematically pay off his debt, he figured that in less than 5 years when the biggest part of his debt was paid off, he could start paying all of the money that he was saving and start prepaying his principle on his mortgage so he could still pay off his mortgage early.

My client, Mr. Jones, was enjoying some hero status with other family members because of the steps he took to overcome what seemed to be insurmountable odds. Not only did he quickly get his debt back under control but he was still going to get to pay his mortgage off early.

Lydia Lovelace’s story—Do You Love where you live and need to make changes but want to stay?

Does the layout of your home work well for you and your family? Are you in close proximity to people and places that make living in your current location convenient? Do you have a good relationship with your neighbors?

Lydia Lovelace (not her real name) called me with this dilemma-should I stay or should I go? Instead of downsizing after retiring, she invited her daughter and son-in-law to go in together to buy a larger home with a mother-in-law wing and sell Lydia’s home.

The problem was that her daughter’s family really liked the old home place, its land and the pond and woods out back and the layout of the house. Ms. Lovelace had a licensed contractor come out and look at the feasibility and costs of separate living unit to the existing homeplace so that Lydia could have her private space.

The family looked at other homes and got estimates on what it would costs with money down and payments per month on other homes with the right layout and proximity to work and shopping and doctor’s offices. They compared these numbers to what it would costs to remodel and add the extra living space onto Lydia’s existing home. The decision ended up being to make the modifications to the home and for everyone to live in remodeled existing home instead of moving.

They compared doing a cash out refinance on the home to get the funds to remodel or getting an interest-only home equity line of credit to cover the costs of remodeling. Since the daughter’s family and Lydia’s would be taking over the mortgage payments, the decision on how to finance the remodeling of the home would be a group decision.

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, LET’S DO IT TODAY. I can make the mortgage process easy. Connect with me at www.JoGarner.com You can email me at Jo@JoGarner.com or call me at (901) 482-0354

4th Segment 8 minutes and 50 seconds

(THE SONG UpBeat Inspirations PLAYING IN BACKGROUND ) INSIGHTS & INSPIRATION

On Christmas Eve, a busy mother looked around and felt she’d fallen short. The house wasn’t perfect, the cookies were a little burnt, and not everything on her list was finished.

She apologized to her family, saying she wished she’d done more. Her young son looked up, smiled, and said, “It still feels like Christmas.”

Years later, she realized that moment mattered more than any decoration or gift. The mess was forgotten. The warmth remained.

That Christmas taught her what truly lasts—presence over perfection.

Moral: The heart of Christmas isn’t found in perfect plans, but in being fully present with the people you love.

Whether it is family or friends or just someone who needs a friend, how can YOU be present to love and care for others this Christmas and holiday season?

Today on Real Estate Mortgage Shoppe, we are talking about Legacy Planning & Property: Holiday Conversations (OUR CHRISTMAS AND HOLIDAY SEASON SHOW)

I’m your host, Jo Garner, Mortgage Loan Originator . For your home purchase or a mortgage refinance you can brag about,. I want to hear your story. We can find the right mortgage product and make the mortgage process EASY. Connect with me at JoGarner.com

Special Guests today on the Panel of Experts :

Sherry Harbur of Harbur Realty (901) 496-8193

Tim Flesner of MidSouth Home Helpers (901) 414-9696

Mary Lou Nowak of Resource4Care.com

REAL ESTATE TIP OF THE WEEK

Someone on the panel shares a 1.5 minute tip for the Real Estate Tip

(it doesn’t have to be directly related to real estate )

Jo Garner’s tip : Have a conversation with your mortgage loan officer. I would like to sign up for the job. Let’s review some of your plans or explore some financing options that will help you achieve some of the plans you and your family talked about putting in place this holiday.

Even if you choose to wait until later to move forward with your property or finance restructure, at least you know, based on today’s rates, what monthly payments, down payments and benefits will give you. Call or text me to talk about mortgage terms 901 482-0354 or JoGarner.com

What do YOU want to accomplish with YOUR mortgage? I have the knowledge and experience. Let’s look at traditional mortgage products, alternative mortgage products and even combinations of products. I can help you get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe offers free networking and education to people working in the business, real estate and health care industries. . Talk Shoppe meets every Wednesday 9A-10A CT at Independent Planning Group’s conference room 110 at Clark Tower 5100 Poplar Ave 1st floor Memphis, TN

(Thank you Ben Hunter 901 660-2912 outstanding Financial Professional at Independent Planning Group for being Talk Shoppe’s location sponsor)

The next two Wednesdays December 24th and 31st 2025, Talk Shoppe will not meet to give you time to spend with your family, friends and other loved ones.

JACK’S CHALLENGE

Many years ago World War II veteran and retired licensed counselor stood at the podium in our Talk Shoppe meetings during the holiday season. His name was Jack Redding. Jack would give us a challenge each year, and now I am going to share Jack’s challenge with You.

Think right now of someone in your circle of friends who is going to be alone this Christmas. Think of someone in your circle of associates or even family members who are going through a hard time this year. Invite them for coffee. Buy their coffee and spend time with them. Be the friend that person needs today. You may never know this side of heaven the positive impact your caring act will have on that person, others, and even yourself. Now YOU have this challenge from the late Jack Redding.

Thank you to Talk Shoppe sponsor, Lawren Bogard of Shelby Gardens Memory Care in Cordova, TN. Lawren Bogard and Shelby Gardens Memory Care says, “Welcome to the family! You enjoy flexibility in pricing and seasoned professionally trained personnel. Contact Lawren Bogard at 901 713-1681

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE DOES NOT ENDORSE 100% OF THE CONTENT ON THIS EPISODE. REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY, AND NOT AN OFFER TO LEND. EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND MOST ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS. JO GARNER IS A LICENSED MORTGAGE LOAN ORIGINATOR. (EQUAL HOUSING OPPORTUNITY)

- QUOTE CORNER: Wikihow “My parents moved around a lot when I was growing up… but I always found them.”

ACKNOWLEDGMENTS AND CREDITS

REJOINDERS:

- Leah Anne Morse of All Things New (Moving Company) 901 488-9133

- Jackie Woodside, Marlboro, Massachusetts, author of “Calming the Chaos”

- Lynn and Troy McDonald of Erin McDonald Insurance Agency 901 849-7101

Transitional Music: First Segment “WAAKA WAAKA” (PD) for Comic Queries; “Brighter Tomorrows” by Stocktunes for Did You Know segment; “Upbeat Inspiration” by Ikoliksaj for Insights and Inspiration segment.

INTRO AND OUTRO THEME MUSIC “Country Roads” by Sergie Pavkin

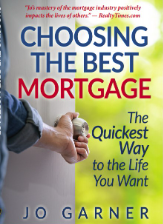

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

On Amazon and Barnes and Noble

ABOUT TIM FLESNER OF MIDSOUTH HOME HELPERS

(Home Care with a Heart )

Tim combines personal empathy with professional expertise to provide quality caregiving through Home Helpers. With over 20 years of experience in logistics, training, and leadership development, he has built strong systems for process improvement, staff development, and continuous growth.

For the past seven years, Tim has also served as a business consultant and coach, helping others discover their passions and equipping them to succeed. His personal experience as a long-term caregiver for his mother gives him a deep understanding of the emotional and practical challenges families face.

Today, Tim applies his operational expertise and passion for empowering others to create efficient processes and training systems that equip caregivers to deliver compassionate, exceptional care to every client.

901 979-0355

Mary Lou Nowak of Resource4Care.com

Empowering seniors and their caregivers with vital health and wellness information. Explore expert insights and interviews with specialists to help you navigate health and wellness journey confidently.

Sherry Harbur of Harbur Realty HarburRealty.com

Harbur Realty is a boutique brokerage licensed in Tennessee and Mississippi. Harbur Realty is a leading authority on the Greater Memphis Area and the surrounding communities. Our love for the communities we live and work are why we do what we do!

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com X @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating *Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on the Mighty 990 AM, 107.9 KWAM & streaming on the app https://mighty990.com/app with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”