You will get some good information about probate and trust. Why do you need a will? How can you avoid the costs of probate with a living trust? Important information to know about how real estate and your mortgage are affected by the probate process.

Subscribe to get weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner .com

#JoGarner #MortgageExpert (901) 482-0354

#PrestonWilson #ProbateAttorney preston@prestonwilsonlawfirm. Com

#TimFlesner #HomeHelpers (901) 414-9696

#memphismortgage #probateandestates #nonmedicalassistance #realestate #estateplanning

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast

listeners across the 50 states! . Today is March 23rd, 2024. Call us in the studio while we are live

at 901 535-9732.You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan

Originator. You can connect with me at www.JoGarner.com. Our topic today is YOUR FAMILY’S WILL & PROBATE-HOW IT AFFECTS YOUR MORTGAGE & YOUR REAL ESTATE

INTRODUCING PRESTON WILSON, PROBATE ESTATE PLANNING BUSINESS BANKRUPTCY ASSET PROTECTION LAWYER WITH PRESTON WILSON LAW FIRM

For the first time in the Real Estate Mortgage Shoppe studio we have Preston Wilson, Probate planning, business bankruptcy, asset protection lawyer. Preston Wilson With well over 35 years of experience serving the Memphis community, you combine your vast legal knowledge with a genuine commitment to your clients’ well-being. You provide understanding, clarity, and peace of mind. I have heard some good testimonies from others who have used your services. You took very good care of one of my mortgage clients the other day too. (Preston has about a minute and a half to introduce himself and talk about the services he offers his clients)

-

(Jo) As a mortgage loan officer for over 30 years, I have seen families trying to plan for the future for their loved ones. Each family has a little different plan for making life good for their families.

(Jo) Live Life to the Fullest With Those You Love-One of my favorite stories is the one where I had a 92 lady call me up on the phone. She had been referred to me after her husband passed away. She and her husband had refinanced their home down to a 15 year loan a couple of years before he died because her husband was determined to get the house paid off sooner. After his death, my feisty client informed me that she still had a lot of living to do and wanted to enjoy the rest of her life spending time with her grandchildren and great-grandchildren at their cabin by the water. The high 15 year note was cramping her style—and after I met this lady in person I assure you—she DID have style. She went on to remind me she was 92 years old and never planned to pay the house off. “I’m not gonna’ worry about getting this house paid off before I die—I’m going to enjoy life—let the kids worry about the house after I’m gone. I want a 30 year loan with a really low payment. You don’t have a problem giving a 92 year old lady a 30 year loan, do you?” I assured her I was more than fine with giving her a 30 year loan. We both laughed. But she got her 30 year, low payment loan and off she went to have some fun at the cabin with the people she loved.

Debt-free as a Retiree-Other people are like this lady’s husband. They want more than anything to get the house paid off BEFORE they retire so they can enjoy retirement without a mortgage.

My house pays ME to live here now- Let me introduce you to Ms. Opal Osborn. Let’s start with Opal Osborn’s story. Ms. Osborn’s husband of 50 years had passed away. She did not have much money left after her husband’s death, but she owned her home worth about $275,000 free and clear.

Her son called me after listening to Real Estate Mortgage Shoppe, radio show I host, and told me his mother wanted desperately to continue living in her home but needed money to make some repairs and, after her husband passed away, she lost some of the income they had been enjoying. She was going to be forced to move unless we could find a solution.

After checking into some things, we were able to get Ms. Osborn approved for a reverse mortgage where she could get part of the money upfront to make the needed repairs on her home and then she could receive income each month from the reverse mortgage program. The reverse mortgage was a god-send for Ms. Osborn.

Buy Now, Invest in a Future for a Better Life- Some of my clients are renting and buying their first home with a payment less than what they would pay in rent or at least close . This has been happening numerous times with young families having children and wanting room to grow.

Adding income-producing properties to create growing wealth and a positive income.

Downsizing like in the story of Tiana Triskin who bought a house through a probate sale with a smaller price and a smaller house payment.

Customers selling or renting their current home and downsizing to make life a little simpler. Also people who are buying rental property with the plan that the rental income will supplement their pensions .

(JO)Preston Wilson, you are the lawyer that can share a lot of wisdom with us today on the topic of wills and probate. Please take a couple of minutes and lets launch into some of your topics (Preston has about 2-3 minutes to start launching into his topics until 9:15 AM. We can continue your topics at around 9:18 when we come back from an advertising break)

,

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. What do YOU want to accomplish with YOUR mortgage. I can make the mortgage process EASY. Call or text me at 901 482-0354 or at JoGarner.com

When we come back we will be hearing more from Preston Wilson, Probate, Wills Lawyer with Preston Wilson Law Firm. See you back in just a moment.

TALK SHOPPE BUSINESS TIP FOR REAL ESTATE PROS

2nd segment after 9:15 advertising break – (producer to start the song “Taking Care of Business” by Bachman Turner Overdrive –but bring the volume down before the lyrics start) It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the financial support of its sponsors. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) For our Talk Shoppe Business Tip today we our Talk Shoppe Tim Flesner, managing partner of Mid-South Home Helpers-offering non-medical assistance in the home. I know people who work as caregivers with Home Helpers. I have heard good things about your caregivers too. Tim Flesner, what is our Talk Shoppe Business Tip for Real Estate Professionals today? (Tim Flesner has about 1.5 minutes to share some tips )

Tim Flesner, how do we contact you? (901) 414-9696

Tim Flesner, managing partner of Mid-South Home Helpers (901) 414-9696

TOPICS COVERED BY PRESTON WILSON, LAWYER PRESTON LAW FIRMS

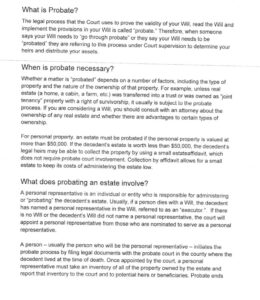

What is probate? Why do you need to probate a will?

How can you avoid the cost of probate?

The importance of a will. (Ensuring that the right people get the assets and do not get left out.)

Important points to consider in your estate planning regarding minor children.

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

The right mortgage can get you quicker to the life you want…and the life you want to leave for your loved ones.

TIANA TRISKIN-GOT OFFER ACCEPTED ON HOUSE IN PROBATE & NEGOTIATED FOR REPAIRS

![]()

Tiana Triskin owned her own business that she and her husband had spent the last few years building. They sold custom items to home builders and the recent real estate crash around 2008 had caused them to lose their nest egg of savings. Just as their business had started coming back, Tiana’s husband fell ill and passed away suddenly.

Without her husband’s help and without the extra income, Tiana felt she needed to downsize to a smaller home so that she could better manage the money situation. She still wanted a quality home in the general area where she and her husband had lived, but felt like she could not afford on her own what it would cost. She needed to find a needle in a haystack.

Tiana knew several realtors in her line of business, and through word of mouth, she discovered a home that belonged to family who had just lost a loved one. There were several siblings living away out of state and it was in their best interest to simply sell the home and split the proceeds. None of the siblings wanted to deal with replacing part of the roof that was leaking and a few other repair items.

At the advice of a realtor friend, Tiana made an offer high enough to allow the estate of the deceased family member to pay a roofing company to fix the roof right before closing on the transaction. Since the roof repair was required by the mortgage company had to be done before closing and Tiana did not have the money to pay for that, she offered a little higher price for the home so the family members could realize the same amount of profit and still pay for the roof repair. Another word for this transaction was a WIN-WIN situation.

Listing price was $200,000

Partial Roof Repair Cost $ $3,000

Tiana offered $203,000 for the house with the contract requiring the seller to pay for the $3,000 roof repair right before closing. This would keep the mortgage company happy too.

The sellers could still net what they would have netting if they sold it for the $200,000 listing price. The extra $3,000 in price covering the roof repair

LET’S TALK ABOUT OPAL OSBORNE’S PLAN USING THE REVERSE MORTGAGE

Preston: Ms. Osborne refinanced her home and put it on a reverse mortgage so that the mortgage company would pay HER each month. She talked about purchasing a term insurance policy that would pay off the reverse mortgage if she ever moved away from the property, so that her family could pay off the reverse mortgage and keep her house.

What are some ways Ms. Osborne could arrange her will or other end-of life affairs to make sure her real estate and other investments easily stay go to her family members?

What about the couple who had been renting but are new homeowners? What are some specific actions they could take to make sure that, if one spouse passed away, the other spouse and children would keep the house and other assets?

What about the real estate investor who has purchased and owns over 30 real estate properties and half of them are owned by their LLC. The LLC is managed by a living trust?

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK –Preston Wilson shares a tip on what documents you will need as a power of attorney to get the mortgage company to talk with you and share information. Preston shares another tip on what documents you will need if you need to communicate with the mortgage company of a deceased person.

Jo Garner’s mortgage tip: What can you do today, to insure that your loved ones inherit your properties and wealth? I knew a real estate investor who was trying hard to protect his wealth He put his real estate investments in the LLC and then appointed a trust to manage it. He said he did this because many states keep the names of trustees private, thereby creating a thin curtain of privacy between the public and the LLC.

901) 482-0354 Jo@JoGarner.com www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday March 20th, 2024 9AM CT “Roundup Referral Rally” for business people.

Talk Shoppe events are free thanks to sponsors like Ben Hunter and Manny Corless of Independent Planning Group. Ben Hunter and Manny Corless believe in doing whatever they can to help and encourage the business people in the Talk Shoppe community. Thank you Ben Hunter and Manny Corless of Independent Planning Group

3. Thank you to Talk Shoppe sponsor Kelly Inman of Next Day Access. Kelly can help you modify your home with wheelchair ramps, grab bars, stairlifts and more. She can make the home accessible and safer for your family members who need help with mobility. Connect with Kelly Inman of Next Day Access at 901 258-2626.

4. Subscribe at www.JoGarner.com and you can get our weekly blog posts with podcasts conveniently in your inbox.

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER Pinterest—“ Where there is a will, there will be 500 relatives”

____________________________________________________________________________________

REJOINDERS:

-

Lynn and Troy McDonald of Erin McDonald Insurance Agency 901 849-7101

-

Genell Holloway, Eagle Hollow Enterprises (901) 270-1127

-

Suzan David of www.webandstorymedic.com Web designs

Transition Music “Circle of Life” Elton John; “If You Get There Before I Do” by Collin Raye;; “Forever Young” by Rod Stewart; “Taking Care of Business” by Bachman Turner Overdrive for the Talk Shoppe business tip.

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

Let me provide you with peace of mind as you face life’s uncertainties. Come see for yourself why I continue to be the go-to lawyer for estate planning, probate, business law and bankruptcy clients in Memphis, TN and the Mid-South since 1978.

ABOUT PRESTON WILSON, ATTORNEY WITH

Wampler, Carroll, Wilson & Sanderson, P.C.

(901) 523-1844

Proudly Born and Raised in Memphis, TN

Experience matters, especially when it comes to practicing law. I’m a true Memphian, born and raised within the community that I now continue to serve, practicing law since 1978. My passion for providing my clients with a great experience is as deep as my roots.

Why Go With Preston?

His passion for people makes a big difference…

With well over 35 years of experience serving the Memphis community, Preston combines his vast legal knowledge with a genuine commitment to your well-being. He’s not here just to offer advice; he’s here to provide understanding, clarity, and peace of mind. Preston is a trusted partner on your journey through life’s legal intricacies.

Whether you’re planning your estate, navigating probate, considering bankruptcy, or seeking counsel on business matters, Preston’s expertise is your compass.

What truly sets Preston apart is his down-to-earth approach and deep roots in Memphis. He’s not just your attorney; he’s your neighbor, your friend, and a pillar of the community. With Preston by your side, you’re not just a case; you’re a person with unique needs and dreams, deserving of personalized attention and unwavering support.

RESUME

P. PRESTON WILSON, JR. Wampler, Carroll, Wilson and Sanderson, PC

208 Adams Avenue

Memphis, Tennessee 38103

901/523-1844

***********************************************************************

EXPERIENCE: Practicing attorney in Memphis, Tennessee, for 45 years.

Practice has primarily been business oriented, focused on commercial law and litigation; bankruptcy; probate, estates and estate planning; and business organizations and asset protection.

Chapter 7 Bankruptcy Panel Trustee from1991to 2007; extensive experience in all aspects of bankruptcy and commercial law, representing both creditors and debtors.

Additional experience includes criminal law matters in state and federal courts, appeals in state and federal courts, and military law.

PROFESSIONAL: Wampler, Carroll, Wilson & Sanderson 2019-present

McNabb, Bragorgos, Burgess & Sorin 2015-2019

Gotten, Wilson, Savory & Beard 1995-2015

Evans & Petree 1982-1995

Merrill, Gilliland, Wilson & Russell 1979-1982

Solo Practitioner 1978-1979

U.S. Army JAG Corps 1974-1977

MEMBERSHIPS: Memphis Bar Association

Board of Directors, three terms

Small Firms Section, Chair two terms

Bankruptcy Section

Business Law Section

Estate Planning and Probate Section

Tennessee Bar Association

Business Law Section

Estate Planning and Probate Section

Mississippi Bar Association

Business Law Section

Estate Planning and Probate Section

National Network of Estate Planning Attorneys

Mid-South Estate Planning Forum, President, two terms

Memphis Estate Planning Council

ORGANIZATIONS: Grace-St. Luke’s Episcopal Church, Vestry three terms; Boy Scout Troop 34, Troop Committee Chairman three years; Visiting Nurses Association, Board of Directors eight years, president three years.

************************************************************************

EDUCATION: J.D. University of Mississippi, 1974

B.A. Vanderbilt University, 1971

ADMISSIONS TO Tennessee Supreme Court

PRACTICE: Mississippi Supreme Court

5th U.S. Circuit Court of Appeals

6th U.S. Circuit Court of Appeals

11th U.S. Circuit Court of Appeals

U.S. District Court, Western District of Tennessee

U.S. District Court, Northern District of Mississippi

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes and Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”