How strong are you financially? Is your source of income stable? If something personally earthshaking should occur, do you have enough savings to cover your expenses for three months or even a year? Just like the foundation under your home, it is important to keep your budget and your bank account on solid ground. I will be sharing some examples of methods some of my mortgage clients used to fortify where they were so they could build into where they wanted to be. It’s all about your foundation…

What do YOU want to accomplish with YOUR mortgage? For your home purchase or refinance, make your plan. Let’s work your plan. If the deal works for you today, let’s do it today. Connect with me at www.JoGarner.com

To Your success,

Jo Garner, Mortgage Loan Officer NMLS #757308 (901) 482-0354 Jo@JoGarner.com

LET’S START FROM THE GROUND UP

Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com. Thank you to real estate attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer for sponsoring our Real Estate Mortgage Shoppe today. For your home purchase or refinance, call Rob Draughon and Shelley Rothman at (901) 752-1133. Our general topic is BUILDING YOUR FINANCIAL FOUNDATION & KEEPING YOUR HOME FOUNDATION STRONG. Subscribe to get our weekly blogposts with podcasts at www.JoGarner.com. Call us while we are live today August 21st, 2021 at 901 535 9732.

INTRODUCING CLINT COOPER OF REDEEMERS GROUP

(Jo) Our co-host today Clint Cooper has been in the foundation repair business since 2007 and has published several articles on his areas of expertise. He wrote the book “Mold Prevention Science” which is used by the entire Basement Systems and Foundation Supportworks’ network of dealers for educating their clients about mold and mold prevention. Clint, your company Redeemers Group has been recognized as one of the top 5000 by Inc Magazine and I saw one time where you won Executive Of The Year out of 17,000 Mid-South businesses. Take a minute or so and tell us a little more about yourself and what you do for your clients. Clint introduces himself and what he does for his customers-foundation work about 1 min or so

REAL ESTATE MARKET 2021 GOOD AND BAD

(Jo) Our market is as of today August 21, 2021 is gifting homeowners with the highest home values they have ever seen. It is offering borrowers the lowest fixed rate mortgage rates ever known. Some realtors are banking the biggest paychecks because homes with more than a dozen offers to buy are selling in a matter of days or even hours. Put together a simple budget, systematic saving so your financial foundation becomes strong enough to step into the better life you have always wanted.

If you own your home, your net worth is probably looking better and better, with the values on homes appreciating at over 15% year over year. (Median home prices have risen at a higher percentage, but affordability is not calculated on median home price. Affordability is determined by comparing household income with the appreciation rate.) Lawrence Yun, the chief economist with the National Association of Realtors, predicts that home prices will continue to rise over the next year or more but not at the lightning speed we have been experiencing.

Renters are having a tough time. Rents in many parts of the country have increased over 10% year over year and are predicted to continue rising. Rising rents are compelling renters to gear up to trek into the homebuying market. Good news for those entering the homebuying market—more homes will be coming on the market this fall and next year. The bad news is pricing is still going up, making it a little more challenging to find a home with a payment that matches the budget. However, once you own your home and lock in a mortgage with a low, fixed-rate, you get to enjoy a principal and interest payment that never increases.

If you want to build a good life living in a home that you own, here are some ways to get started building a solid financial foundation:

-

Get a job with a stable income, even if it is part-time. If you are self-employed, you will need to show at least a two year income history on your tax returns. Mortgage underwriters average the last two years of NET income. (Some paper expenses can be added back to your income for qualifying purposes.)

-

Set up a realistic budget. Take two or three hours to review your credit card statements and bank statements. Then, find ways to eliminate as many expenses as possible, replacing them with a different product or service that gives you the same benefit at a much lesser cost. Once you know what you spend each month compared to your income, you will confidently know how much you can afford on a house payment.

-

Build up your savings. Arrange with your payroll department to have a set amount of your paycheck automatically sent to a savings account and let it grow.

-

Improve your credit. Review your credit at www.annualcreditreport.com and correct any errors. Make your payments on time. If you want to see your credit scores improve, keep your balances on credit cards showing LESS than 30% usage on each card.

(Jo) Clint Cooper of Redeemers Group, you are the master when it comes to keeping the foundation on our homes solid. Let’s talk a minute about the base of the house where we live. (Clint Cooper continues his topics when we come back from break)

(Very important tip) Make sure your gutters are clean and that they are directing water at least 10 feet from your home’s foundation. Clean your gutters and add the extenders to make sure the water is directed a long way from the house.

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. What do YOU want to accomplish with your mortgage? Make your plan. Let’s work your plan if the deal works for you today, let’s do it today. When we come back you will be hearing more from Clint Cooper of Redeemers Group.

2nd segment after 9:15 break: It’s time for the Look Back Memphis Trivia Contest. The Look Back Memphis Trivia Contest is brought to you by notable Memphis historian, Jimmy Ogle. Jimmy offers free historic walking tours in downtown Memphis in the spring and fall. To find out more, ask Jimmy at www.JimmyOgle.com . Our Look Back Memphis Trivia Contest is sponsored by John and Jennifer Lawhon of Lawhon Landscape (901) 754-7474 the Lawhon’s can help you plan your landscaping if you have a BIG, BIG project or a smaller project . The Lawhons are giving away a $25 gift card to the first person with the correct trivia answer. If you know the answer to our trivia question, call us at 901 535 WREC 901 535-9732.

Garner # 35 12/03/14

Normal Station Neighborhood

Question: My neighborhood name comes from the original names of the University of Memphis. Who am I?

Hint: My northern boundary is the first railroad to connect the Atlantic Ocean with the Mississippi River.

Hint: The largest Veterans Hospital in WW2 is on my southern boundary.

Hint: One of my street names did not get changed due to the construction of the hospital.

Final Hint: The Larry O. Finch basketball center is located in my neighborhood.

Answer: Normal Station Neighborhood

Named for a teacher’s college and railroad depot, the Normal Station neighborhood is bounded by Goodlett, Park, Highland, and Southern. The Chickasaws originally had a hunting camp on Black Bayou that runs through the area. William F. Eckles bought much of the land in 1835, but all that remains of that time into the 21st Century are the Eckles family cemetery on Carnes Avenue and a former carriage house built in 1846.

Two major influences on the neighbor-hood have been the Normal Depot, serving as a rail and streetcar stop until 1949, and the University of Memphis. The City annexed the neighborhood in 1929. Most houses, representing typical Southern styles, were built between the mid-1920s and early 1950s, and many eastern section homes were built in the 1940s for employees of the nearby Kennedy General Hospital for veterans. Normal Station neighborhood was placed on the National Register of Historic Places in 2005. A historical marker for Normal Station Neighborhood will be unveiled today (Saturday, December 6) at 11:00 a.m. on Spottswood (between Goodman and Normal streets) by the Shelby County Historical Commission.

___________________________________________________________

TOPICS COVERED BY CLINT COOPER, REDEEMERS GROUP

-

What is your number tip to avoid foundation problems?

Install and clean your gutters, making sure the downspouts take water at least 10 feet from your home.

2.: We have had some bad weather.. What effects do you see from that?

Clint: Discusses how the ground swells and foundations begin to settle. Symptoms of structural issues begin to appear.

-

How long people wait to address structural issues

Jo: You mentioned to me that people tend to wait a really long time to address structural issues. Why do you think that is?

Dan: Jo, thinking you have a structural issue with your home can be really unnerving if

not scary. Some recent research says that, when people call us, only 36% of

them have had the problem for a year or less. Another 36% have had the issue for 6-10 years, and the other 28% for more than 10 years. So, when people start noticing cracks in drywall or the brick on the exterior, they patch it for the time being and wait and see

-

What are some signs that we can look for that indicate a possible foundation problem?

-

Windows and doors that stop opening and closing easily, hanging up and getting stuck.

-

Cracks in the exterior bricks.

-

Cracks in sheetrock or floor covering.

Number 2 top tip: Don’t wait to get your foundation problem fixed. Just like when you have a cavity, the quicker you get it corrected, the less money you have to spend when the problem has deteriotated.

5. Topic Mentions:

Any other topics Clint wants to cover …

TOPICS COVERED BY JO GARNER, MORTGAGE LOAN OFFICER:

TOPICS COVERED BY JO GARNER:

-

How do you know the maximum house payment that will work for your budget?

-

I’ve had the privilege of talking with some of the best personal finance gurus, who suggest limiting your monthly house note to 25% or a maximum 33% of your gross income. Adding in other debts, taxes, insurance, and association fees, total debt should not exceed 38% to 43% of your gross income. Consult your licensed financial advisors when you put your financial foundation together.

-

Keep Emergency Funds as fuel to power through the unexpected. The best brains in personal finance strongly suggest you keep an emergency fund. The general consensus is to keep a minimum three to six months of living expenses if you have a stable job with regular pay; or, one full year of living expenses for the self-employed.

-

What is a quick and easy way to come up with a budget?

Get to the truth about your income and expenses.

The head of the finance team at our church was affectionately called Baaba Lou. We called him that because he and his wife served in a school in Zambia for a number of years, and the children called him Baaba, meaning “father”.

Lou was brilliant at budget counseling because he and his wife had already lived it. They obtained excellent wealth just by practicing what he preached. It was a joy and privilege working under Lou Celli, serving those families who found themselves spending more than they earned either because of loss of work, medical expenses, or legal bills. Here are some easy steps Lou suggested to get on track with your budget.

Step 1: Set a timer for one or two hours and hit play on your favorite tunes. Commit to spending every minute of this time going methodically through each bank and credit card statement.

If you dread the task of budgeting, at least you know the pain will be over in two hours and you can enjoy listening to your favorite songs while you complete the task.

If going through all of the last 12 months causes a mental and emotional block, go for the last six or no less than three months of transactions. Don’t forget the car tags and other bills you pay once or twice a year.

Step 2: Assign a category for each expense. As you record the dollar amount, label it with an appropriate category such as monthly utilities, food, gasoline, internet/cable, mortgage, car payment, entertainment, business expenses, and so on. Also include bills you pay less frequently like car tags, property taxes, homeowner’s insurance, and so on.

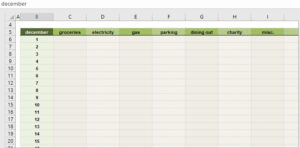

TIP: There are many templates you can download and use for free to get you started, such as this one from moneyunder30.com/free-budget-spreadsheet.

Step 3: Tally all expenses. Now is also a good time to examine each item. Where can you cut back?

Step 4: Determine your true income from pay stubs and bank deposits. Be sure and record your net income. To calculate net, look at your latest paystubs and itemize the deductions such as taxes, FICA, insurance, etc. Subtract all deductions from the gross amount to calculate what finally makes it to your back account, i.e., net income.

Step 5: Ask for discounts. Call companies and see if you can get a discount on their products or services.

One client succeeded at negotiating a much lower interest rate on his credit cards. He socked away quite a bit of savings just from this one step! You have not because you ask not. Why not ask?

Step 6: Replace higher cost items with comparable lower costs items.

When shopping and dining, don’t be afraid to ask questions to find the bargains.

Lou had a list of places where families could get great bargains. One on his list was my favorite grocery store. I found out from Lou that at 6 am they offered 75% off meat getting close to the sell-by date. A 75% reduction in meat costs could change your life … leaving 75% more “change” in your pocket.

Lou also taught me to find budget items that could be replaced with something similar but less costly. For example, if you love having pizza delivered to the house once a week for you and the kids, try buying some great frozen pizzas from the grocery store. Throw them in the oven while you are busy around the house or, even better, while you’re resting. Pizza is ready in 15 to 20 minutes and you paid a lot less for heating them in your oven than having them delivered from someone else’s.

Step 7: Now you know the maximum house payment you can comfortably afford.

The Rushings

![]()

Starting out, the Rushings were trying to pay off debt without much in the bank. They paid about 3.5% of the home price for a down payment. To give them some breathing room on their house payment, Rubin and his wife chose a 30-year fixed-rate mortgage. The low 30-year payment allowed them to build up some savings while paying down more debt.

Fast forward five years.…

My phone rang.

“A voice from the past,” he said joyfully, clearly happy about something. Rubin Rushing went on to share with me their story.

After buying their first home, Rubin and Rosie enrolled in the Dave Ramsey “get out of debt” program. They’d learned some clever methods of living a fun-filled life with their young children on a limited budget. When they got raises at work, they continued paying off debt and investing more and more money into an emergency fund.

Rubin described their plan to refinance their 30-year mortgage to a 15-year mortgage for a lower rate and to eliminate ten years (120 payments). Here’s how they won their bragging rights:

The Rushings initially had a mortgage for about $172,000 on a 4.625% 30-year mortgage with an $884.32 principal and interest (P&I) payment, plus taxes and insurance, and FHA monthly mortgage insurance of about $119/month—a total of about $1,368/month.

-

They refinanced their mortgage to a 15-year term …

-

This lowered their rate a whole point. Their P&I payment increased by $246/month but …

-

They eliminated the FHA mortgage insurance and lowered the interest over the whole loan amount for the entire term of the mortgage.

If the Rushings had not refinanced, they would have paid $884 P&I for the remaining 25 years for a total of $265,200 plus monthly FHA mortgage insurance. Since they refinanced, total P&I payments over the new 15-year term would come to $203,400 for a whopping savings of ~$61,680 plus the reduction in FHA monthly mortgage insurance costs. BRAGGING RIGHTS!

Raymond Ridley’s Story–Work Smarter Not Harder

![]()

Owning your own home can bring joy and satisfaction in so many ways having nothing to do with money. A home is your castle. It is the neighborhood where your children grow up, where family memories are made and are retold for years during family gatherings. These things are priceless …

… but the financial benefits can be great, too.

Raymond Ridley, a licensed real estate broker and full-time investor, has successfully owned, rehabbed, and sold over 500 homes and apartment units. Raymond started out as a hard-working, money-making realtor, but having to shovel half of his earnings over to Uncle Sam for taxes wasn’t his cup of tea.

Working harder was not the answer. He had to figure out how to work smarter.

Raymond told a bunch of fellow realtors and investors, “I have probably made more money in real estate than anyone in this room, and I have probably lost more money in real estate than anyone in this room. When someone earns an hourly wage, he has to be on the job every day to earn his pay. When he builds wealth by buying real estate, the tenants pay him rents—even when he is on vacation.”

Raymond presented six reasons to enjoy investing in real estate:

-

Cash flow on a rental property is equal to the monthly income minus the mortgage payment including taxes and insurance. (So: Income – PITI = Cash Flow).

If you plan to keep the rental house a long time, the 30-year fixed-rate mortgage is a great tool. With a 30-year mortgage, you enjoy a principal and interest payment that stays the same for the life of the loan. This means that every rent increase affords you a pay raise. While the rent goes up, your payments stay the same, which gives you a bigger and better margin.

-

Appreciation is the rate that the house value increases every year. Raymond pointed out that there is a direct correlation between positive cash flow and appreciation. Cash flow is usually less per month in areas with higher appreciation rates. For example, real estate investors who buy homes in areas that are going up in value faster compared to other areas usually pay a higher price with a smaller profit each month on rent income.

Investors can usually pay less for homes in areas that are not appreciating in value. Rents tend to increase at a faster pace than home prices, which typically brings increased positive monthly cash flow to the investor.

-

Real estate can provide a wonderful tax shelter enabling an investor to make a six-figure income and pay zero taxes*. Raymond confessed that sheltering almost all of his income was where he learned to work smarter and not harder.

To shelter $50,000 per year in income, an investor would need approximately $1,000,000 in real estate. Raymond prefers having ten houses valued at about $100,000 over 30 houses valued at $30,000. With ten houses, he has only ten tenants and ten potential dramas, which sounds a lot better than 30 tenants with a potential 30 problems.

-

Thanks to amortization, with each mortgage payment the principal balance is paid down at a faster pace. The investor builds equity on the house as the mortgage is paid off. Later, the investor may choose to borrow against this equity to purchase another property.

-

The fifth advantage of owning real estate is leverage. Real estate is one of the few investments that allows the investor to borrow almost the entire value of the investment without a large lump sum of cash.

-

Last but not least: investing in real estate opens opportunity for family relationship bonding while working together in the investment business.

REAL ESTATE TIP OF THE WEEK (Clint Cooper has about 1 to 1.5 minutes to share a real estate related money-saving or time-saving tip Clint shares brand new technology available that can correct some home foundations by drilling a dime-sized hole without having to tear up the structure. ):

ANNOUNCEMENTS:

Talk Shoppe offers free networking & education to anyone interested in real estate or in business. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor of the Clark Tower. Talk Shoppe will be presenting “The Mastermind Principle based on the book Think and Grow Rich by Napoleon Hill. You can also join us at Talk Shoppe on zoom by going to www.TalkShoppe.com (Shoppe) and click the Events tab for the zoom address.

Talk Shoppe events are free thanks to supporters like Tim Gilliland of www.BackupRX.com Protect your personal and business data with multi-level backups. Talk with Tim Gilliland at www.Backup.RX.

Thank you to Peggy Law of Club Seacret for making Talk Shoppe’s free education and networking available to our community. Want to build some great adventures and fond memories with your loved ones? You can enjoy first-class travel at a fraction of retail costs. Connect with Peggy Lau of Club Seacret to plan your next vacations. (901) 289-0747

2. Take a few minutes this weekend to imagine a better life for yourself and your family. What does a better life look like for you? What steps can you start taking today to get across the map from where you are to where you want to be? If real estate or financing plays into your plan, call me and let’s mastermind the best route using your home financing. Call me directly after the show at (901) 482-0354 .

4. Thank you to real estate attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer for sponsoring our Real Estate Mortgage Shoppe today. For your home purchase or refinance, call Rob Draughon and Shelley Rothman at (901) 752-1133.

5. Subscribe at www.JoGarner.com and you can get our weekly blog posts with podcasts conveniently in your inbox.

6. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

Jim Rohn- “Whatever good things we build end up building us.”

____________________________________________________________________________________

REJOINDERS:

Suzan David www.webandstorymedic.com Helping you build customer loyalty to your brand online.

Don Lawler www.storytellersmemphis.com Telling your business’ story online with photos and video

Tom King expert real estate appraiser in Shelby Co Tipton Co and Fayette Co TN 9901 487-6989

Solid Ground by Sidney Barnes; Feeling Stronger Everyday by Chicago”; “I Feel The Earth Move Under My Feet” by Carole King “Memphis” by Johnny Rivers

Jo Rook, real estate investor and Director of Healing Ministry at Church of the Harvest in Olive Branch, MS

( Jo Rook does 30 sec interview with Jo Garner on finding money to close – From Jo Garner’s new book “Choosing The Best Mortgage-The Quickest Way to the Life You Want”

____________________________________________________________________________________

ABOUT CLINT COOPER, owner of REDEEMERS GROUP

-

Clint was born and raised outside of Nashville, TN and is a graduate of MTSU.

-

He served in Iraq with the Marine Corps Infantry before returning home to Tennessee to live and work in Memphis.

-

In Nov 2007 he started Redeemers Group.

During his time with Redeemers Group, Clint has published several articles on his areas of expertise. Most recently his first book entitled “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers to help them communicate with their clients about mold and mold prevention. He teaches CE classes for Memphis Areas Association of Realtors several times per year.

He has also earned the following certifications and licenses:

-

Basement Systems Waterproofing Certification

-

Basement Systems Crawl Space Repair Certification

-

Foundation Supportworks Diagnostics School Certification

-

National Association of Mold Remediators and Inspectors License

-

Blue Institute- LEED Training Certification, Member ID#:

-

Green Building Council, Certification

-

TN State Board for Realtors CE Authorized Instructor

Clint lives in Germantown, TN with his wife and two children.

___________________________________________________________________

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308 (currently working with Sierra Pacific Mortgage, Inc)

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com