Guest host: Jo Rook, Real Estate Investor and Director of Healing Ministry at Church of the Harvest in Olive Branch, MS www.JoRook.com

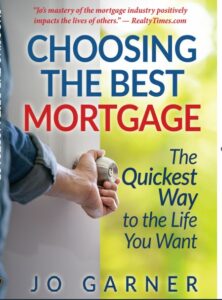

PURCHASE YOUR OWN COPY OF THIS BOOK AT www.JoGarner.com

LET’S GET STARTED TO THE LIFE YOU WANT…

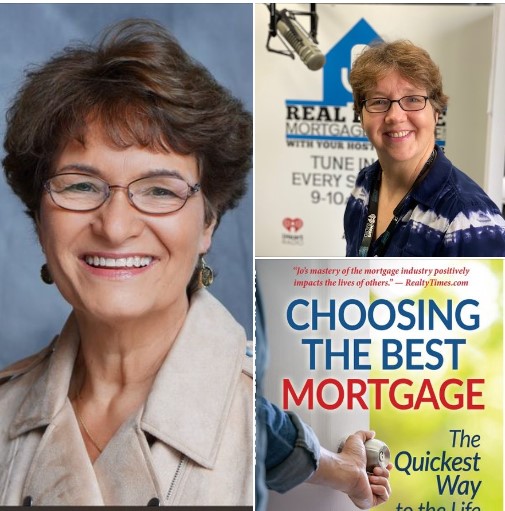

Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com. Our general topic is WHEN THE STAKES ARE HIGH, PUT THE BEST REAL ESTATE PROS ON YOUR TEAM. Subscribe to get our weekly blogposts with podcasts at www.JoGarner.com

Producer Dan O’Brien announces show:

(Dan) [You’re on Real Estate Mortgage Shoppe. Guest hosting the show today is Jo Rook, real estate investor, and Director of Healing at Church of the Harvest in Olive Branch, MS. Jo Rook will be interviewing regular host, Jo Garner, about her new book Choosing the Best Mortgage-The Quickest Way to the Life You Want. ]

Guest Host Jo Rook starts interview with Jo Garner

why don’t we talk about the purpose of the book of the book is to present to readers valuable principles of how you can make financing on your home support you and your pursuit of your life dreams and I’ll share in the book a lot of stories like we hear on the radio in essential points about various mortgage products in situations to deep in your knowledge and understanding how you can use these financing tools to find your unique solutions

(Jo Rook) Who were did you have in mind when you were writing the book Choosing The Best Mortgage-The Quickest Way to the Life You Want?

(Jo Garner) I was thinking about the customers that I’ve worked with for over 30 years and some of their stories and how they were able to get over roadblocks on the journey to the life they wanted. I’ve use a lot of the stories on the air over the years and now I’m getting the chance to share with in more people who can pick up the book.

In the book and I had really two groups of people in mind. I had to consumers in mind- people who are interested in getting into real estate or refinancing or doing something to restructure their financing when it comes to real estate. It’s informative but it’s an entertaining the way to learn because there’s a lot of people stories that illustrate the points that we make.

The other group our real estate professionals. Years ago I was a realtor, so I know the realtors out there want to give their clients as many resources as possible. They want as many tools in their toolbox so when there’s a problem that comes up, they know how to fix it. This book was written with realtors and other real estate professionals in mind. As they read the book, they get tools in front of them they can use to help solve problems and help transactions get closed that might not have worked without that idea or tool to provide the solution. These same real estate professionals can buy several of these books at a bulk price to make it cost-effective for them to give to their clients.

(Jo Rook) It sounds like Choosing the Best Mortgage-The Quickest Way to the Life You Want is an essential guide for consumers and real estate professionals that will give them a good understanding of the loan products out there. They will have at a guide to the advantages the disadvantages of those loan products—when to use them and when not to use them.

The people stories give examples to help real estate professionals. Consumers that are looking now will benefit and I could easily see this book as a great resource for anybody in the future who want to buy real estate or restructure their finances using a mortgage.

The chapters and appendixes include a lot of resources with whole chapters to show you how to get over barriers like credit problems. Some of the chapters show you ways to get over barriers with not having enough income to qualify for the loan-especially for self-employed borrowers. Also, you show solutions for finding funds for a down payment to buy homes. You show ways to overcome difficulties with real estate appraisals.

(Jo Garner) I run into a lot with self-employed people who come in a bit of a panic because they wrote a contract to buy a house only to discover that their bank will not approve the loan due to not enough income showing on the self-employed person’s tax return.

They say things like, “I thought I made plenty of money. I have lots of money in the bank and I have good credit.”

In the book Choosing the Best Mortgage-The Quickest Way to the Life You Want I talk about the ways we can go to the back of the tax return and move forward. I list some of the expenses we can add back to the self-employed persons income for purposes of qualifying for the mortgage.

There are other common barriers and one of them is money to close. Customers come saying, “I don’t have any money to close. Where can I find money to close?”

There are so many ways to get around the lack of money to close. We go treasure hunting with a golden shovel. We can find money you didn’t even know you had.

We have a whole chapter on how to get around home appraisal problems.

(Jo Rook) Why did you write book?

(Jo Garner) PURPOSE OF THE BOOK : The purpose of this book is to present to you valuable principles of how you can make the financing on your home support you in the pursuit of your life dreams. I share stories and essential points about various mortgage products and situations to deepen your understanding of how you can use these financing tools to find your unique solutions.

This book is an informative and entertaining guide for real estate professionals, mortgage professionals, and other related industries industry professionals to use personally and share with customers and clients. As a licensed mortgage loan officer for over 30 years, I had the opportunity to to be on my mortgage customer’s journey to homeownership, or a positive life-changing refinance as their lender. Now you, the reader, get to go behind the scenes with me to experience some of these customers’ stories. I hope that you will glean something from their ideas and successful solutions to help you get quicker to the life you want.

(Jo Rook) What are some good reasons for owning your book Choosing the Best Mortgage-The Quickest Way to the Life You Want?

(Jo Garner) I wrote the book, Jo, because over the last several years of being on the radio and I’ve had so much good feedback about how stories really help people understand concepts, otherwise would cause your eyes to glaze over. I detail out essential information you need to know if you don’t have a lot of money to close. You can use the book and go to this chapter or a different chapter to solve a problem or inspire an idea. There are places in the book to help you solve problems with qualifying on your income, funds to close and more.

One major advantage of owning the book is that you have everything you need to know all in one place. You have the book in your hand. It is there for you anytime a day you need it. It may not be just for you. You may be talking to a loved one or a friend and you can say,

“I’ve got this book that can help you with that real estate decision.” If you own the book, it’s right there for you or someone who needs it. Everything is in one place.

(Jo Rook) There are common everyday things you may not normally think about in your own situation. Jo, the way you write the book, it reminds me of is a Sherpa who knows every trail on the mountain. For people going through a brand new mortgage, it is so nice having a Sherpa to help avoid hiccups along the real estate and financing process.

(Jo Garner shares a story from the book of Sam and Sally Smith)

Sam and Sally Smith are newly married and expecting their first child. Saddled up with student loan debt had kept them strapped for cash and existing in a small apartment, not large enough for their expanding family. Sam regretted his carefree days in college charging up the credit cards he accepted in the mail. It was so easy to use them –even for necessary items, but a few missed payments and a collection account tanked his scores.

When Sam tried to was denied credit to purchase a car he needed to get to work, reality came like a slap in the face. It was time to make a plan and stick to a plan to get his credit back working for him and not against him.

Sally’s story was a little different. She had stayed away from credit altogether and did not have a credit score at all. Her income was too low to qualify for a house on her own, so the plan was to build her credit and make Sam’s credit better.

Due to Sam’s bad credit, in order to get a car, he had to buy what he described as a “rust bucket on a roller skate.” He said he paid way over the blue book value for the car and had a loan that had an interest rate in the double digits. The payment he described as “Ouch!”

When Sam and Sally went to apply for a mortgage to try to get out of the cramped apartment and into a house, the news was not what they wanted to hear. Even if he could improve his credit score up to a 640 from his current 565 score, he would be paying about a half point higher on the interest rate. Over a period of time, the financing would cost him almost $10,000 more than what he would pay if his scores were higher. But he had a plan to move the dial up on his credit scores in just a few months. Sally’s plan would get her a decent credit score in only 30 days.

Sammy set up a payment plan with some of the past due balances that had been haunting him on his credit cards. He made a deal with the credit card companies not to report negatively on him as long as he was making regular payments to pay off the past due balances.

He went online and signed up for a well-known secured credit card. He put up $300 of his own money and kept a balance of no more than $25/month for 3 months which put an extra 50 points on his credit score.

Sally’s parents added her to one of their seasoned, low usage credit cards which just about instantly popped her credit score up to around 680 from zero.

Sam and Sally worked with the credit bureaus and their creditors to correct errors. They kept the usage on their credit card under 10% of the credit limit and paid on time. They did the work and were rewarded on the day they got to purchase their beautiful home.

(Jo Rook) You’re on Real Estate Mortgage Shoppe. I’m Jo Rook, guest hosting the show as we talk with regular host, Jo Garner, about her new book Choosing the Best Mortgage-The Quickest Way to the Life You Want. Connect with Jo Garner at www.JoGarner.com Jo Garner will be sharing more people stories and brilliant ways they overcame their roadblocks. We will be back in following this break.

(Jo Rook) Jo, let’s talk about some content you cover in your new book Choosing the Best Mortgage-The Quickest Way to the Life You Want.”

(Jo Garner) In the first chapter we try to help you identify the “Why” that motivates you to jump out of bed each morning ready to tackle another day. What is the underlying driver that inspires you to overcome obstacles to get to the life you want?

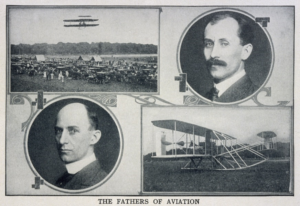

In his book Start with Why Simon Sinak describes the difference between having a compelling “why” to propel you further faster instead of simply a big goal. Sinak uses the comparison between Samuel Pierpoint Langley and the Wright Brothers. Does anyone remember Samuel Langley? Who remembers hearing the names Orville and Wilbur Wright and what they invented?

Samuel Pierpoint Langley had substantial funding from the United States Government to invent a successful manned flying machine. Langley also had a bevy of top brains from Harvard University to help him. The New York Times followed Langley and his team around, giving him all kinds of free publicity. Samuel Pierpoint Langley had the key ingredients to success—abundant funding, a brilliantly educated team, and the country’s best marketing.

Orville and Wilbur Wright had no funding except the meager profits they eked out of their bicycle shop. The Wright brothers were not highly educated, and national newspapers were not marketing them. They had every reason to fail—no funding, no skilled team, and no marketing. But who do we remember as the first people to invent the airplane?

Unlike their competition from Langley’s camp, the Wright brothers had a driving cause, and a burning-in-the-gut desire to change the world’s course by inventing the world’s first manned flying machine. The Wright brothers were driven by such a strong “why” that they didn’t need fancy funding, a top team of engineers, nor did they need any marketing. They worked with blood, sweat, and tears, tirelessly day in and day out until they finally got the Wright Flyer in the air in Kitty Hawk, North Carolina, in 1903.

On the other hand, Samuel Pierpoint Langley was not compelled by a big “why.” He had a big goal to become famous and get a big paycheck. Langley and his team went to work every day for a paycheck, not a purpose. The day it was announced that the Wright Brothers invented the first motor-powered, manned airplane, Langley quit. He had a goal but not a big enough “why” to motivate him to overcome the obstacles.

The analogy of Langley’s story and the Wright Brothers’ story illustrates the difference between having a big “why” to fulfill a high purpose or cause compared to Langley’s only having a goal to be famous and make money. Alongside having a vital purpose or cause, you need to have a vision of what you want to accomplish.

Get A Clear VISION of What You Want For Your Life

What goal do YOU want to achieve? Why do you want to achieve it? Who do YOU want to be as a person? What do your work and home life look like the way you want it to be? Do you want children, friends in your home? How do you want to feel on a typical day in your life? What do you want people to be saying about you? Create a vision board that will be a reminder every day of the tasks you need to complete that will power you to your goal of living the life you want.

(Jo Rook) Jo, the way you work with your mortgage customers, helping them get quicker to the life they want to live reminds me of a Sherpa helping to guide people to the top of a mountain. You know just the right mortgage trail that will provide the best way for them to get to their mountain top.

(Jo Garner) tells a story from the book

MR. FIX-IT TAKES ONE STEP AT A TIME TOWARD HIS DREAM HOME

Meet Ricky. Ricky is barely out of his twenties and wants a shop next to his house so he could work on cars and fix stuff. He also wants to be in a particular upscale neighborhood. His dream house was like having champagne taste on a beer budget. Ricky engages his imagination and some ingenuity.

He found a house in a neighborhood that was going steadily up in value, even though it wasn’t the upscale area he initially wanted. The property had a garage. This house would not break the bank for Ricky. Ricky took action with a smart offer and beat out any competition to buy his house. Over time he transformed the garage into an awesome shop by installing a work bench and later some racks for his tools. The house was going up in value too. Ricky would one day be able to launch from this home up to the more upscale neighborhood he originally wanted.

(Jo Rook) Jo Rook has the customer call in to the show who is the real person who was the person irepresented in Ricky -Mr Fix It

(Ron Soldano) yes, it was an honor to work with her. I needed a lot of help and Jo Garner was my psychiatrist in the area of our mortgage. I followed her direction and I did what she said. I got one credit card and I used it exactly the way she described to me. I used it but never used more than 10% to 30% of the credit limit on the card. I made my payments on time. I started to work on my credit. Jo would call me and say, “Ron, how is it going with your credit project? One day, I told her I was ready to pull credit again and see if we were ready to buy our home. I had gotten into the habit of repairing what was broken and suddenly we were ready to qualify for our mortgage to buy our home.”

(Jo Rook) If you had to say one really good take away from working with Jo, what would you say and why would you recommend people get this book?”

(Ron Soldano) “It is because of who she is and what she believes in. I was especially surprised that everything happened so fast after all this time. I couldn’t believe it. It was an incredible experience. I thank God for our beautiful home”

(Jo Rook) Jo, if you could give one credit tip from the mortgage desk, what would it be?

(Jo Garner) Stay away from 12 months-Same-As-Cash. At first it sounds great on an advertisement. You think, “hey, I don’t have to make a payment for a year.” The bad news is it scores like a maxed out, brand new credit card. I have seen a new 12-months-Same-As-Cash account drop someone’s credit score by 60 points.”

(Jo Rook intro after Rejoinder and music) “We’re back with you on Real Estate Mortgage Shoppe. I’m Jo Rook, guest hosting today as we talk with regular host Jo Garner, about her new book Choosing the Best Mortgage-The Quickest Way to the Life You Want.

-

(Jo Garner) tells the story of the Binghams and how a strategic refinance saved them financially so they could concentrate on helping their daughter fight a critical illness.

Jo describes the step 1, 2,3 process of making the refinance strategy work

When refinancing to a higher rate makes sense –blend other debt to mend the cash flow

![]()

Mr. and Ms. Bingham had always worked hard, paid their bills on time, and felt a sense of satisfaction in the way they handled their finances. Life was good until it wasn’t.

One day their daughter came home from college with what seemed like a recurring migraine headache. Later the headache morphed into a crippling illness. Their daughter was fighting for her life and needed her parents fighting with her.

Mr. and Ms. Bingham took time off from their jobs to support their daughter. When the income slowed to a trickle, the monthly debts and other expenses continued to mount higher. Mrs. Bingham took a leave of absence from her job.

Without thinking, the Bingham’s began racking up debt balances on their credit cards over 24 months, using their savings to bridge the gap. Their focus was on supporting their daughter and just borrowing a little here and there to make it. After a while, the debt had snowballed beyond what they could truly handle.

They had continued to make the mortgage payment on time without being late but would soon not be able to make the payments on the credit cards.

The Bingham’s sat across the desk from me with their financial information. They had quite a bit of equity built up in their house. They had some money in their retirement funds at work. There was hope to keep out of bankruptcy court.

The solution for this example was to refinance their current mortgage as soon as possible, even though the mortgage rate would be higher. (rates and numbers represent the market when this story took place.)

Solution:

Since the Bingham’s had made their payments on time up to this point and were only just before going into delinquency, they could still be approved for a refinance on their mortgage. We rolled into the new mortgage some other high payment debts to get them on a lower interest rate stretched out over 30 years to get the overall monthly debt payments lowered by almost $1,000 per month.

As the Bingham’s daughter’s health improved, Ms. Bingham went back to work, bringing more income into the cash flow.

Stage two goal was to take some of the $980 per month savings and start making extra principal payments to get their mortgage paid off in 15 years or less.

(Jo Rook) Jo, you tell the story in your book about the Flannerys.

(Jo Garner) The Flannerys- pushing from heavy hardships to homeownership

One particular young family, the Flannerys, lost their jobs, their cars and they were losing their home during the economic downturn around 2010. They had two young children and yearned to own their own home again so their children could play outside safely and not be cooped up in an apartment.

The loss of the car and health issues delayed this couple getting the better-paying jobs they needed so the cycle of hardship pressed down on them. Mr. Flannery said, “Time after time I would finally get up on my feet and something else would crash in on me and take me down again. It was like a terrible movie where you just want to click off the television, but you can’t because the movie is about you and you are the actor on the stage and the film is still rolling.”

The Flannerys considered signing up for a program to help them resolve some debt issues, but there was a cost to the program. They tried something else but it didn’t work either. No quick fixes. They went to a special meeting about managing finances at church one evening and that is where I got to meet the Flannerys.

Through a strong faith in God and just tenaciously working on their budget and applying any extra to paying off some debt and paying down some credit cards, the Flannerys emerged debt-free a few years later. I got to be on their homebuying journey as their lender. It was a spectacular celebration that day at the loan closing.

(Jo Rook) I have a surprise for you, Jo. We have John Flatman (aka Mr. Flannery) on the phone.

(John Flatman) John talks about the dire financial situation he and his family was experiencing back during the Great Recission. He talks about the home in Florida that had a wrap-around mortgage he was paying. But the person with the underlying mortgage had not been paying their part of the mortgage on time, which was destroying the Flatman’s credit. The were in danger of losing the home. Car break downs and health issues were preventing the Flatmans from getting ahead. The Flatman’s prayed for help. The home miraculously sold just in time for the Flatman’s to begin their credit make-over process. They were on a journey to buy their own beautiful home.

(Jo Rook) John, talk about your mortgage journey with Jo Garner. Why would you recommend her book?

(John Flatman) John explains that there didn’t really look like there was a good solution out there for them and no one to help them. He said that, after talking with Jo Garner, they had a plan and they had hope. They took the journey together. The Flatman family worked hard on their credit. It was truly a celebration the day they got their mortgage and the keys to their beautiful home.

John recalls that working with Jo reminded him of the Bible scripture from Luke 6:30. He said that his journey with Jo Garner was all about helping them. “Jo helped us without any expectation of return. Jo had the knowledge and wisdom on how to fix the problem without an expectation of receiving anything in return.”

He went on to say that it was an example of Christian people helping each other as a church family.

(Jo Rook) tell a reason that you would recommend the book Choosing the Best Mortgage -The Quickest Way to the Life You Want.

(John Flatman) This book will help so many people and give them hope …

Jo Garner talks about the four common barriers that borrowers often have to overcome. Chapters in the book cover in more detail ways to get over these challenges.

The four common barriers to overcome. (Money to close, Credit, Income, Appraisal) Jo gives an example of a self-employed borrower who will lose his earnest money if he does not get his loan approved. The customer’s bank and another lender turned him down for lack of income on the tax return. A good loan officer knows how to start at the back of the tax return and move forward. Sometimes there are certain expenses that can be added back to the borrower’s income for loan qualifying purposes. Jo spells out some of these expenses in her book.

(Jo Rook) Jo, tell our listeners something they may not know about you personally.

(Jo Garner)

Put People Around You Who Are The Best At What They Do. Then, Let Them Do What They Do Best

Examples of this principle at work on mortgage teams and at Talk Shoppe. If you put people who are the best at what they do together and let them do what they do best, great things happen.

Model What Works: If you know what you want to do in life but you are just getting started on your journey to get there, find someone who is successfully living your dream and model what they are doing.

When I first decided to pursue a career and real estate and financing, Robert G Allen was a best-selling author who was living my dream at the time. I was living in Memphis, TN and Bob Allen was in Southern California. I called and asked him if he would mentor me. The answer was yes but for a price. As a bonus, he invited me to join him along with others who also wanted to be taught by him—so the cost was less. I am still connected with some of the people from that mentor group.

Nugget: The answer is no if you never ask

Nugget: Model someone with your good values who is living your dream.

( Jo Rook) Jo Garner serves her community. In 2003 she founded Talk Shoppe, a networking group that offers the community free education and networking to help business people in real estate, business and health and wellness build their businesses. She and other business people continue to sponsor Talk Shoppe and making it a valuable resource to others.

Jo founded the radio show Real Estate Mortgage Shoppe in 2011. Real Estate Mortgage Shoppe offers solutions to real estate and financing scenarios in an informative, entertaining and inspiring way.

(JO ROOK OUTRO TO FINAL SEGMENT ) Thank you for joining us today on Real Estate Mortgage Shoppe. I’m Jo Rook, guest hosting for Jo Garner today. You can reach me at www.JoRook.com Connect with our regular host, Jo Garner, Mortgage Loan Officer and author of the book Choosing the Best Mortgage-The Quickest Way to the Life You Want at www.JoGarner.com you can pick up the book on pre order there too.

What do YOU want to accomplish with YOUR mortgage? Subscribe to get Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

END OF SHOW

____________________________________________________________

FOR BLOG POST

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

The quote of the week: ““You are only one decision away from a totally different life.” Anonymous

____________________________________________________________________________________

REJOINDERS:

-

Eve Sotiriou, Waterville, Maine

-

Real Estate Attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer Law Firm in Memphis, TN (901) 752-1133

-

Sonia Balcer, Rocket Scientist in Montrose, California

Transitional Music: “Big Money” by Rush; “Classical Gas” by Mason Williams; “Popcorn” by Jean Michel Jarre

ABOUT JO ROOK

Rev. Jo Rook, Director of Healing at Church of the Harvest in Olive Branch, MS. loves the Lord and ministers divine healing to others. Her teachings include videos “Let’s Chat Healing”, interviewing others in “Healing Belongs to You” plus writing for “Healing Messages”. She is a teacher, preacher, writer and real estate investor. Jo Rook serves from her heart with a genuine love for people. She encourages others that “You Might As Well Be Awesome”. View her teachings at http://midsouthharvest.org/healing or www.JoRook.com

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308 (currently working with Sierra Pacific Mortgage, Inc)

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com