Have you ever thought about getting a great deal buying a fixer-upper home? Today on Real Estate Mortgage Shoppe I will be sharing ways I can help you push past the barriers so you can get the financing you need to nail that great real estate deal. Clint Cooper of Redeemers Group will be sharing how he can fix common home foundation problems for a house you want to buy or for the home where you live now. Kevin Yee of Save Energy Solutions will give you some information about how to get rid of bad air that cause allergies and other problems. Stay tuned.

Subscribe to Real Estate Mortgage Shoppe at www.JoGarner.com so we can stay connected. Let me know what areas of real estate or real estate financing interest you.

To Your Success,

Jo Garner, Mortgage Loan Officer and iHeart Talk Show Host for Real Estate Mortgage Shoppe

(901) 482-0354 jo@192.232.195.219

____________________________________________________________

Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! You’re on Real Estate Mortgage Shoppe where we provide solutions for your real estate and financing scenarios. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com. Our topic for this episode is “FINANCING A FIXER- UPPER & FIXING YOUR HOME’S FOUNDATION.” You can call us while we are live at (901) 535-9732 or outside the Memphis area (800) 474-9732 Today is January 7th, 2017.

Have you ever thought about getting a great deal buying a fixer-upper home? Today on Real Estate Mortgage Shoppe I will be sharing ways I can help you push past the barriers so you can get the financing you need to nail that great real estate deal. Clint Cooper of Redeemers Group will be sharing how he can fix common home foundation problems for a house you want to buy or for the home where you live now. Kevin Yee of Save Energy Solutions will give you some information about how to get rid of bad air that cause allergies and other problems. Stay tuned.

Clint Cooper of Redeemers Group, glad to have you back on Real Estate Mortgage Shoppe. Clint has been in the foundation repair business since 2007 and has published several articles on his areas of expertise. Most recently his first book entitled “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers for educating their clients about mold and mold prevention. He teaches CE classes for Memphis Areas Association of Realtors several times per year. Clint tell us a little more about yourself and what you do for your clients.

Clint Cooper with Redeemers Group

<Clint has about 1 minute or so to introduce himself and what he does for his customers>

(Jo) Before we drill into the good stuff, let’s survey the mortgage market environment for a moment. Yesterday was the 2nd best day for rates in more than a month. The Jobs Report indicated job growth slowing but the wage gains were stronger-than-expected, which made a case for inflation and THAT was what caused the slight increase in the price of mortgages. This week lenders and borrowers have been celebrating the lowest rates since early in December. But if we find rates moving higher again next week, the celebration will be over. The conventional 30 year fixed rates yesterday closed at around the 4.125% to 4.25% range and the 15 year fixed came in around the low to mid 3’s. Still great rates. Call me for rates on the myriad of other loan programs out there. Remember, MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, LET’S DO IT TODAY. You can talk with us today while we’re live in the studio at (901) 535-9732 or outside the Memphis area (800) 474-9732. Or let’s you and I talk directly off the show at (901) 482-0354 or connect with me at www.JoGarner.com

<Clint Cooper comments>

(Jo) The first home I ever bought several years ago was a fixer-upper. It was one of the most profitable real estate deals I have ever done. I sold the home later for close to twice what I paid for it. Let me show you how you can finance your OWN sweet deal. Later in our show, I’m going to talk about some of the real estate renovation and repair loan programs available that do not require much money down. But in order to get qualified for those programs you have to have an acceptable credit score and income-to-debt ratios that meet the loan programs’ requirements.

If your challenge is due to credit or a credit score that is too low for the loan program you need, my cracker jack assistant, Susan Belew and I are trained to use the Credit Simulation tools. The Credit Simulator is like a flight simulator. We can show you how to get the most points on your credit score in the quickest amount of time with the least money out of your pocket.

Now, if your challenge is that your income-to-debt ratios are too high, I know multiple ways to help you get those in line with what the loan regulations require. After seeing all of your income documents and credit, I have shown some of my clients how to rearrange their debt so that the income-to-debt ratios fall within the loan requirements.

I have gotten calls from successful self-employed people with good credit. They say, “Hey, Jo. I’m so frustrated with my bank and I even went to a different bank. They keep saying I don’t make enough money to qualify for anything. But I make plenty of money! I just write off a lot of stuff on my taxes.” Here’s my reply—“There are lots of ways to pull rabbits out of the hat on this one. It doesn’t always work but many times it does work.” If you are in a position like that person I just described, send me all pages of you last 2 years tax returns and I can start at the back of your tax returns and move toward the front. I know the types of expenses that we can add back to your income that many companies either don’t know about or don’t want to take the time to dig for it. Call me. I want to talk with you PERSONALLY. But you have to talk with me personally so I can work with you. You can connect with me at www.JoGarner.com or call me directly at (901) 482-0354. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY!

Clint, I have been talking about qualifying for a first mortgage to buy a home. You are in the foundation and basement repair business. You work with both people who want to buy a home and people who need help with the house where they already live. What are some common problems you solve for your clients?

<Clint launches his topic until the 9:15 am break>

____________________________________________________________

LET’S TALK SHOP—TALK SHOPPE’S BUSINESS TIP FOR REAL ESTATE PROS:

[2nd segment after 9:15 advertising break – (producer to start the song “Taking Care of Business” by Bachman Turner Overdrive –but bring the volume down before the lyrics start) It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the financial support of its sponsors and advertisers. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe)

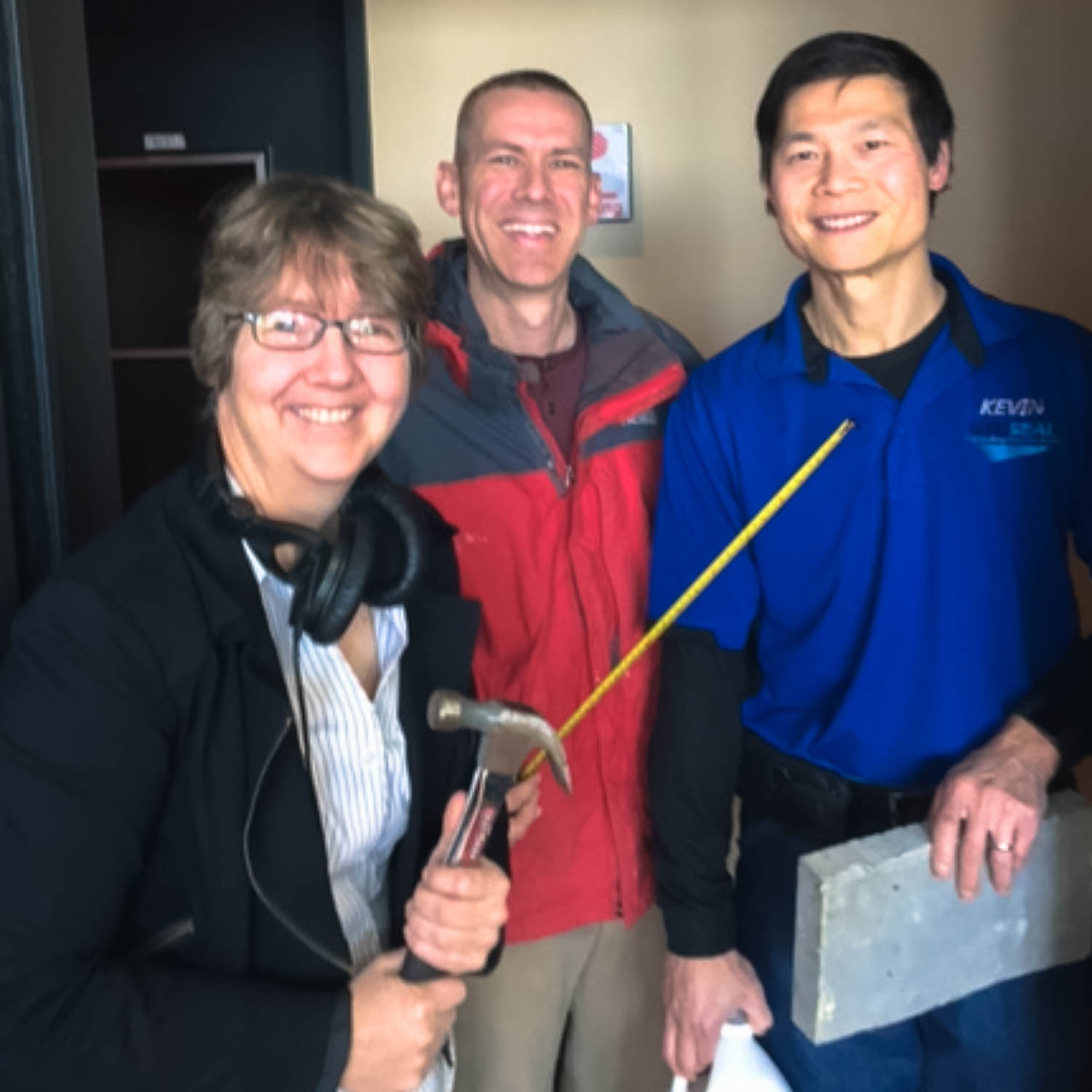

For our Talk Shoppe Business Tip today we have Talk Shoppe advertiser, Kevin Yee, owner of Save Energy Solutions. Kevin stops bad air from coming into a home by sealing leaky duct systems. He has been the solution for allergy problems, mold and other problems. He has been able to help his clients lower high utility bills. Kevin Yee what is our Talk Shoppe Business Tip for Real Estate Professionals today? <TS guest gives a 1 minute tip> (Jo says, “Thanks, Kevin Yee of Save Energy Solutions. How can we contact you?

Kevin Yee | Save Energy Solutions, LLC

____________________________________________________________

Clint or Jo can ask Kevin a couple of questions:

-

Give us an example of how you have helped your clients before by getting rid of bad air in the house?

-

What other services do you offer?

____________________________________________________________

QUESTIONS ANSWERED BY CLINT COOPER:

Topics:

-

What are you hearing a lot about right now?

Cold floors in people’s homes.

Clint: Discusses why people’s floors are cold, and what solutions are appropriate.

Clint mentions that he have a lot of articles on his website that talk about these very topics.

2. We have a had a wet winter… What effects do you see from that?

Clint: Discusses how the ground swells and foundations begin to settle. Symptoms of structural issues begin to appear.

-

Redefine movement

-

Clint, you were mentioning you have rolled out a new purpose statement within Redeemers Group. Can you share what that is and why?

Clint: This is something we are really excited about. We have been blessed to grow very quickly, and we want to make sure we are smart about it as well. We don’t want to just complete projects and move on, and be an ok place for employees to work. We are passionate about Redefining our industry. When we say that we mean the contracting industry. Most people have had experiences with contractors in their homes, and it isn’t often that you hear that the experience was stellar. More often you hear about unreturned phone calls, contractors not showing up on time or at all, doing a mediocre job, and the list goes on. The saddest part of that is that, as homeowners, we have come to accept that as part of working with contractors.

Call Redeemers Group to remedy this problem under the house!

We think that’s ridiculous. We believe that customer experiences should and can be remarkable. We want to redefine customer expectations in our industry, leaving no room for expectations of mediocrity.

( Jo talk about her experiences with contractors—like advice to use companies with an A+ Better Business Rating like Redeemers Group).

Clint: This also applies to our employees. Every one of us has had bad jobs, and bad bosses, and have been in work situations where we feel like we are just a means to an end. We believe we have a responsibility to our employees to help them see a better version of themselves, and we bestow the gift of high expectation on them. We believe if we create an environment where employees feel a burning passion and fulfillment from their work, they go home to create a happier family. Happy families create happy neighborhoods and happy communities.

Redeemers Group at work

-

Talk about the second office you opened?

Clint: We are currently in the process of establishing a 2nd office in Little Rock. About 40% of our business right now is in the state of Arkansas, and this was a natural progression. Going back to talking about making customer experiences remarkable, we believe this is one step in accomplishing that for our Arkansas customers.

Topic Mentions:

2 projects coming up under the Redeemers Group Love Well Initiative:

2/17/17: we are doing extensive pro-bono structural repair work for a home being rehabbed to become a Safe Families property.

___________________________________________________________

QUESTIONS ANSWERED BY JO GARNER:

Jo Garner

-

What are some common fixes that can smooth out the mortgage loan process?

If your challenge is due to credit or a credit score that is too low for the loan program you need, my cracker jack assistant, Susan Belew and I are trained to use the Credit Simulation tools. They are like flight simulators and we can show you how to get the most points on your credit scoreboard in the quickest amount of time with the least money out of your pocket.

If your challenge is that your income-to-debt ratios are too high, I know multiple ways to help you get those in line with what the loan regulations require. After seeing all of your income documents and credit, I have shown some of my clients how to rearrange their debt so that the income-to-debt ratios fall within the loan requirements.

There are lots of ways to pull rabbits out of the hat on this one. If you are self-employed and the banks are telling you that you don’t have enough income, send me all pages of you last 2 years tax returns and I can start at the back of your tax returns and move toward the front. I know the types of expenses that we can add back to your income that many companies either don’t know about or don’t want to take the time to dig for it.

-

How can you help a home loan deal that is stuck because the appraisal lists repairs that need to be done before the buyer and seller can go to the closing table?

When the appraisal comes back listing a host of repairs that will be needed on a home, this can throw the buyer and seller into a catch 22, especially if the items needing repair that are listed are structural in nature or very expensive items.

In some cases, the realtors work out something where perhaps the sellers agree to pay for the repairs and have them done before closing or maybe the buyer meets them part of the way by raising the price to help the seller net enough profit to pay for the items to be done before closing. The house would have to have an appraised value high enough to do this.

In other cases, if the repairs are not major structural items or items seriously affecting the habitability or safety of the house and are less than $5,000 in costs, some loan programs will allow the repairs to be done AFTER the closing. But whoever has agreed to pay for them would be required to bring 1.5 times the amount the appraiser or certified person says the cost to repair will be. After the repairs are done, the extra .5% would be refunded by the escrow agent.

In some cases, particularly on foreclosure sales, a new heating and air central unit can be installed the day after closing and certified by a licensed HVAC person that it has been installed properly and is working. This allowance is made frequently to prevent theft of the unit from the vacant home.

-

Talk about the renovation and repair loan programs that can help your clients finance a great buy on a fixer-upper?

In cases where you can get a great price on the house but it needs over $5,000 worth of repairs or renovations or maybe even $100K or more in repairs, depending on the house, there are renovation and repair loans available so you can finance the price of the house and the repairs too.

I have two programs that we can compare. One of them is the government FHA 203K Renovation and Repair loan. For as little as 3.5% down or a little more, you can buy the house and fix it up. The other first mortgage renovation loan is a conventional program but works in a way similar to the FHA program but with a minimum down of 5%. On these two programs, the work has to be performed by licensed contractors.

If you are thinking, “I want to buy a fixer-upper at a great discounted price, fix it up and sell it at a profit.” There are plenty of ways to get the funds to do this outside the traditional loan programs. Let’s talk. I believe I can help you too. You can call me off the air at (901) 482-0354 or email me at jo@192.232.195.219

____________________________________________________________

REAL ESTATE TIP OF THE WEEK

(Clint Cooper has about 1 minute or so to add a money-saving, time-saving real estate related tip )

Kevin Yee can add another short tip or repeat and expound on the one he used for the Talk Shoppe Business Tip for Real Estate Pros.

(Jo offers the tip on how to pick the right type of fixer upper so you can get the best price with not so much competition. To cut down on the number of people competing with you on a bid to buy a bank owned property, pick a house that has structural repairs or other types of repairs that would scare away other would-be buyers. Make sure you can get a low enough price on it so that after building in the price of repairs and closing costs, you have enough equity built in to make the project worth the extra trouble.)

____________________________________________________________

ANNOUNCEMENTS:

- Talk Shoppe offers free networking & education to anyone interested in real estate or in business. Talk Shoppe meets every Wednesday 9A-10A CT at Nova Copy 7251 Appling Farms Parkway Memphis, TN. This Wednesday January 11th, 2017 Talk Shoppe presents: “Hit The Ground Running Through Effective Goal Setting” with Eric Eurich of Focal Point Coaching. www.ericeurich.focalpointcoaching.com For more information about Talk Shoppe, go to www.TalkShoppe.com

- Following this presentation, Coach Eric Eurich will be helping our Talk Shoppe advertisers and supporters plan their strategy for reaching their dreams in 2017. If you are interested and building your business and helping others build theirs, connect with me about joining the Talk Shoppe advertising team. Jo@JoGarner.com

- Talk Shoppe events are free thanks to sponsors/advertisers/supporters like Leah Anne Morse of Cartridge World of Collierville. You can save over 30% on your printing costs. Leah Anne can give you some tips on how to get your next printer free. Call Leah Anne at Cartridge World at (901) 853-3230.

- FOR THIS PODCAST OF REAL ESTATE MORTGAGE SHOPPE AND MORE, GO TO JOGARNER.COM

- Real Estate Mortgage Shoppe reminds you that…

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

- 3/4/17: 2nd annual Love Well 5k & Festival to benefit the Boys & Girls Club of Memphis. Registration is now open for that event, and we are looking for participants and vendors. Lovewell5k.com.

____________________________________________________________

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY.

____________________________________________________________

QUOTE CORNER:

“A Clean House Is The Sign of A Broken Computer.”

-Anonymous

“Normal people…believe that if it ain’t broke, don’t fix it. Engineers believe that if it ain’t broke, it doesn’t have enough features yet.”

–Scott Adams | American Cartoonist

____________________________________________________________

REJOINERS:

- Mary Lou Nowak, Mid-South Home Helpers (901) 496-1515 www.homehelpershomecare.oom Mary Lou knows what to do when it comes to caring for your loved with non-medical assistance in the home, keeping them happy and safe.

- Sonia Balcer, Montrose, California Rocket Scientist

- Jana Cardona, Arlington, TN Executive Director of Business Network International West TN and North Mississippi www.bnimidsouth.com Local Business Global Network

____________________________________________________________

Transitional Music: “This Old House” by Stuart Hamblen; “The Talkin’ Song Repair Blues” by Alan Jackson; “I’m Your Handyman” by Jimmy Jones; “Taking Care of Business” by Bachman Turner Overdrive for Talk Shoppe’s Tip For Real Estate Pros.”

____________________________________________________________

Story behind the song “This Old House” 1954:

Stuart Hamblen was riding his horse out in the woods on a bitter cold day when he saw a cabin partly hidden in the woods. He rode up to it hoping to find a hot cup of coffee. Instead he found the windows broken and the door blown down by a storm. A starving, freezing dog hobbled out of the cabin and looking pleadingly up at him. Stuart said he knew this dog would not remain in a cold abandoned place like this to die of starvation unless his master was near. There was no fire in the fireplace and Stuart begin to make his way into the cabin led by the loyal old dog.

Sure enough, he found the old man lying on the couch next to the broken window, snow collecting on his chest where the storm had blown the weather in on him. Stuart could not tell how long the old man had been dead. It was cold in the house and he just looked like he was asleep.

Pretty curtains blew back and forth from the window. A woman must have lived here. What happened to her? The next stop was the old shed out back where he found a broken toy wagon with only three wheels on it. Where were the children who used to play with these toys? A very sad story began to unfold of a man who had somehow lost his wife and children but lived with his loyal best friend—his dog.

The original song, “This Old House” that we used at the first break on Real Estate Mortgage Shoppe today was supposed to be a slow sad song, but the record company wanted an upbeat sound. Stuart Hamblen released the song in the 1950’s at the fast pace, like the record company wanted with a happy though resigned theme. But the real song, still playing in Stuart Hamblen’s mind, was slow and very sad and one that never left his heart.)

____________________________________________________________

About Clint Cooper

Facebook: Redeemers Group of Memphis

Twitter @redeemers_group

Instagram @redeemersgroup

Clint was born and raised outside of Nashville, TN and is a graduate of MTSU. He served in Iraq with the Marine Corps Infantry before returning home to Tennessee to live and work in Memphis. In Nov 2007 he started Redeemers Group.

During his time with Redeemers Group, Clint has published several articles on his areas of expertise. Most recently his first book entitled “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers to help them communicate with their clients about mold and mold prevention. He teaches CE classes for Memphis Areas Association of Realtors several times per year.

He has also earned the following certifications and licenses:

- Basement Systems Waterproofing Certification

- Basement Systems Crawl Space Repair Certification

- Foundation Supportworks Diagnostics School Certification

- National Association of Mold Remediators and Inspectors License

- Blue Institute- LEED Training Certification, Member ID#:

- Green Building Council, Certification

- TN State Board for Realtors CE Authorized Instructor

Clint lives in Germantown, TN with his wife and two children.

______________________________________________________________________________

About Kevin Yee, Save Energy Solutions, LLC

Kevin Yee founded Save Energy Solutions (SES) in 2007 in search of ways to reduce energy usage for home owners. Before this, he spent over 15+ years as a Professional Engineer in various engineering titles: Industrial Eng’r, Packaging Eng’r, Manufacturing Eng’r, & Plant Engineering in the Commercial Industry. With his technical background, He easily crossed over to the study of Building Science and Home Performance Industry. As of June 2012, he passed the TN State HVAC exam and registered as a TN Licensed HVAC Contractor #65878.

Committed to continuous knowledge in the HVAC industry, he contracted with many HVAC business and Home Performance companies. He obtain National Certification as a Certified Professional from BPI (Building Performance Institute, Inc.) and a Certified Quality Contractor from TVA EnergyRight Solutions. Instead of improving “efficiency / quality in PLANTS”, he now working on improving “efficiency / comfort / safety in HOMES”.

He did extensive research, taking many Building Science classes /seminars and on-hands training from various national organizations.

Today, he openly share his knowledge and uses his experiences to improve many homes Indoor Air Quality in the Mid-South. Many customers’ breathing problems has made dramatic improvements. NOTE: Many homes that has insulations made of Rock Wool, caused noses bleed and headaches. After we sealed their duct system, they do not have this problem.

Full Service Duct Cleaning Company: Full Contact (brush & vacuum) and Negative Cleaning Process (high pressure air hose & Vacuum).

Full Service Duct Sealing Specialist. All locations: Attic, Basement, Crawlspace, Underground, Behind Wall.

Home Air Sealing: Home Envelope Structure: Top Plate, Recess Light, Plumbing Pipe, Electrical / Video hose, drop ceiling, open cavity.

Specialized Service Training:

- Air-Care – Factory Trained and Certified (Residential and Commercial Duct Cleaning)

- Aeroseal – Factory Training & Certified (Residential Duct Sealing)

- BPI – Home Performance Home Audit & Envelope Professional Certification

- TN HVAC Contractor License – CMC-C Mechanical HVAC / Refrigeration

- Efficiency First – home performance training webinars on today’s industry changes

- Building Performance Institute (BPI) training webinars on home performance changes

- TVA – Home Performance QCN Training , Heat Pump Training, Weatherization Training

- Ruud Refrigerant 410A Course

- Career Training Institute – 2007 HVAC Graduate: (RSES Approved)

- Zerodraft – Air Barrier Sealant and Weatherization Seminar and Training program

- EWC – Zoning Technology Training Class

- Flir Preventative Maintenance Seminar (Thermography Training)

- Mainstream 608 Universal Refrigeration Certification license

- AHR Dallas Expo – Building Science Classes

- ACCA Fundamentals Load Calculation & Certification

- ACI New England Conference – Building Science Classes

Kevin has a strong knowledge of the “whole-house approach” from attending seminars and classes as well as hands-on experience in many homes, helping home owners improve their indoor air quality and save money on their utility bills. See our Test Result Page and read the customer’s comments (top right of each sheet).

__________________________________________________________________

ABOUT JO GARNER-MORTGAGE LOAN OFFICER

Jo Garner, Mortgage Loan Officer

cell: (901) 482 0354

Twitter: @jogarner

Jo describes her job description: “As a mortgage loan officer, my job is to give my client the benefits they want from their financing terms– listening to my client and determine what’s of the most value to THEM– What is their comfort level on a house payment, how much are they comfortable paying down, what type of financing do they need to get the house they want to buy or refinance. Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income. Whatever their personal priorities are, my job is to put together a mortgage with comfortable terms that will help them achieve their goals.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 20 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 20 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com She was also the editor of Power Shoppe, a free weekly e-zine designed for real estate professionals and others indirectly connected to the real estate industry and currently publishes on her blog www.JoGarner.com