LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our general topic How to Make the Right Choice with Your Mortgage & Home Improvement Project. Today is September 28th, 2024 Call us in the studio while we are live at 901 535-9732.

This episode of Real Estate Mortgage Shoppe is sponsored by real estate attorneys Rob Draughon and Shelley Rothman of Griffin, Clift, Everton, Maschmeyer Law Firm. For title work and closing on your home purchase or refinance, call Rob and Shelly at 901 752-1133.

Introducing Nicholas Sammons, owner of Truvine Renovations LLC

(Jo) Our special guest on Real Estate Mortgage Shoppe today is Nicholas Sammons, owner of Truvine Renovations in the Mid-South area. Nick, you are a seasoned professional with experience in the contracting world since 2008. You have a simple yet powerful mission that drives you to– “do the right thing.” You have built yourself a great reputation in the marketplace, especially in the Business Network International community. Take a minute or so and tell our listeners a little bit about yourself and the services you offer your Truvine Renovations. (Nick has about a minute and a half to say something about himself and talk about the services that he offers with Truvine)

Decision Based on Long Term Vision or Short Term Comforts

(Jo) How do you make big decisions? Do you look weigh the short term AND long term affects of your decision? Does your decision answer what you truly want in life? What are the pros and cons? Are you willing to take a chance?

Long-Term Vision

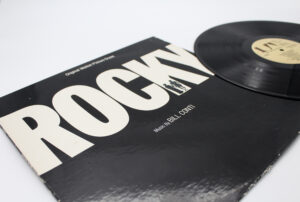

Sylvester Stallone is a “rags to riches” story from a man who had a passion for boxing but was so broke he couldn’t pay for groceries and had to sell his beloved dog to keep them both from starving. He had penned a story about a poor boxer who, against all odds fought to become a champion. Sylvester Stallone was offered $100k for the script, but he knew, if he could be an actor, his ticket would be paid to the life he wanted. He told the film company he would not sell it unless he could star in the movie.

He went hungry until finally someone offered him $25,000 and the starring role in the move “Rocky.” The movie and Stallone became a wild success. Stallone got the life he wanted and… went and bought his dog back.

Sylvester Stallone had a clear picture in his mind what he wanted in life and how he wanted to attain that life. In the short run, he was willing to do what a lot of people would NOT do, in order to enjoy things later in life others COULD NOT afford to do.

Short-Term Needs

Back in the late 70’s the movie Star Wars was being produced on a shoestring budget. Even the crew and the starring actors were convinced this movie would never make it. George Lucas, the mastermind of the movie, in an attempt to save upfront costs, made an offer to James Earl Jones to be the voice for Darth Vader in exchange for a percentage ownership in the profits of the movie instead of a flat $7,000 one-time payment. Jones said, “Seven thousand dollars was big money for me in those days. I was broke and needed the money to pay rent and buy groceries!” He took the one-time cash payment.

As we all know, Star Wars went on to become a massive international smash hit and cultural phenomenon, earning $775 million at the worldwide box office. Mr. Jones says today that he regrets his short-term strategy and wishes he had used the long-term strategy of taking a percentage ownership in the movie. How much did Jones give up? In a 2010 televised interview, Jones admitted this short-sightedness eventually cost him “tens of millions of dollars.”

Buying a Home and Getting a Mortgage -Top Tips From the Pros

-

Have a clear vision and feeling for the life you want in the next year, five years and ten years.

-

Assess and control the income you receive and the money you pay off each month. (Budget)

-

Determine what you can comfortably pay each month on a house note and what you need to keep in an emergency savings fund.

-

Explore the neighborhoods where you would like to live. (You may have to start small and move up later.)

-

Explore mortgage programs and financing options.

-

Consult with your financial advisors

-

Get a reputable and experienced realtor on your team

-

Don’t get discouraged.

Make your plan. Let’s work your plan. If the deal works for you today, let’s do it today. Contact me for exploring your mortgage options at 901 482-0354 and at www.JoGarner.com

(Jo) Nicholas Sammons of Truvine Renovations, you have been in this industry for many years and have a lot of wisdom on what works and what doesn’t work for people wanting to renovate their home or office. (Nick has a couple of minutes or until 9:15 am to start covering some of his topics and can continue after break)

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will be hearing more from Nick Sammons of Truvine Renovations.

2nd segment 9:18 am – 9:30 am

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

TOPICS COVERED BY NICHOLAS SAMMONS, OWNER OF TRUVINE HOME IMPROVEMENTS, LLC

Topic 1: Why different is better than better:

-Most contractors say they have quality work, good prices, and a satisfaction guarantee, so how do you tell the difference between who to hire and who to avoid?

1.) Avoid any estimate that doesn’t have a legal contract (written on paper, a napkin, texted)

2.) Avoid the unprofessional looking guy

3.) Avoid contractors without a process (if they make it up on the go that’s a no-no!)

Topic 2: Quit wasting your time!

-Most people have never been to customer school so they either make up the process in their mind the way they want it or they go based off past experience

1.) If you’re tired of contractors not showing up for estimates: ask for a phone consultation where you can find out things like timeline and money

2.) Before we go out we ask you to send us photos so we can schedule a 15min conversation to see if we are a good fit for you

3.) Communication is key. If it’s already hard to communicate with a contractor, it’s an indication it will be difficult in the future

Topic 3 (if we have time): Don’t be afraid to follow your gut

1.) It’s okay to hold off on a project to ensure a good experience

2.) Who do you know, like, and trust? Who is answering your questions? What is their content like? We have lived in a digital age for over 20 years now.

3.) Ask for references, customer testimonials

________________________________________________________________________

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

How to Make the Right Decision Getting Your Mortgage

Earlier in the show we looked at how famous people made big decisions. Sylvester Stallone, famous actor who starred the movie “Rocky” took the long term view of what he wanted and life and stepped out in faith and with a plan to get it.

Earle Jone, voice of Darth Vader in the Star Wars movies took the short term approach in the late 70’s and he estimates he lost ten of millions of dollars on that decision.

You know what you want in life for yourself and your family. What do you need to do to make that life a reality? Are their tools and resources available to help you get to that life quicker?

In the book “Choosing the Best Mortgage-The Quickest Way to the Life You Want” I share stories of some of my hall-of-fame mortgage clients who found a way to get to the life they wanted quicker by using just the right mortgage product or combination of products.

You can get this book for yourself on Amazon or Barnes and Noble.

If you want to buy a home but don’t think you have enough money, check around (or just call me and I can help you explore to find the right mortgage that could give you down payment assistance.) Is it difficult to get the right documents to verify all of your income ? There are other mortgage programs that have other options to help you qualify.

A TRIUMPHANT ENDING-The Johansson’s story

![]()

(Jo) On this show you could say we are beginning the show talking about The END-the end of the home buying and mortgage process that culminates at the real estate closing table. Earlier this week I got to attend the closing with two of my mortgage clients—a married couple who have spent much of their lives serving others overseas. On returning stateside they really wanted to own their first home. Their challenge was not having the funds to close on a home and not having a large income to afford a payment on a house like the one they needed.

The Johanssons (not their real names) put a good realtor on their team who listened to what they really wanted and needed in their home. The realtor watched the market daily for months until she found a home that the Johanssons knew was meant to be their home.

But the challenge was that the price of the house with a normal down payment would wreck their budget and leave them no emergency funds. The Johanssons laid out their boundaries on payments and move-in costs. Because of their income level and the location of the home they wanted to buy, they qualified for a special down payment assistance product that offered $15,000 down payment assistance and a lower than market interest rate. Using this product, the house was well within their grasp. The payment was comfortable and they had emergency funds left over too.

When we all arrived at the title office to complete the closing of the loan and transfer of title to the Johanssons, it was a celebration time. While Mr. Johansson signed the papers, Ms. Johansson talked excitedly about how she planned to decorate the home and make it a happy place for their family and friends to come visit. When the last paper was signed and notarized, Mr. and Ms. Johansson rushed into each other’s arms in celebration of achieving he their dream of owning their own home. We were all laughing and cheering. It was a long won victory.

As we took pictures and shared more stories of the Johansson’s journey to homeownership, I felt that rush of happiness and fulfillment, knowing I had a part in making a lifelong dream come true for this very deserving couple. I reminded myself, “This is why get up, get ready and get to work each day. This is why I do what I do as a mortgage loan officer.”

What do YOU want to accomplish with YOUR mortgage? Make your plan. Work Your Plan. If the Deal Works for your today, Let’s do it today. Call me at (901) 482-0354 or email Jo@JoGarner.com

Also in the book “Choosing the Best Mortgage-The Quickest Way to the Life You Want” you can find the “Get It Right the First Time Mortgage Checklist.” I am happy to go through the checklist

THE GET-IT-RIGHT-THE-FIRST-TIME-MORTGAGE-CHECKLIST

BY: Jo Garner, Mortgage Loan Officer NMLS# 757308

(901) 482-0354 Secure online loan application https://jogarner.evolve.mortgage

-

What is the maximum house payment I can afford right now?

A. Several financial gurus say that your total house note including principal and interest, taxes, homeowners insurance, and/or mortgage insurance and homeowners association fees needs to be between 25% and 30% of your gross income. Your total income-to-debt ratios, including the new house payment and payments on other debt does not need to exceed 38% to 45% of your gross income.

-

Mortgage underwriting software can sometimes approve you income-to-debt ratios of 45% or upwards to 55% of your gross income. Stay within your PERSONAL comfort level though, regardless of what the mortgage software tells you.

-

Consider where you plan to be in the next year, the next five years, and the next ten years.

-

Are you planning to retire? What will your income be when you retire? Will you still be living where you are living now?

-

Are you planning to get married? Do you plan on expanding your family? Do you plan on taking an aging family member into your home? How much do you estimate your living expenses go up? Will your income likely increase too? How much?

-

Are you just getting started in your career? Is it likely your income will go up? Will you need to relocate? How long is it likely you will keep the house? What would it cost to rent versus buy a home like the one you want?

-

Do you own a house with a lot of equity that you plan on selling within a year of buying the new house? Do you plan to make a very large prepayment to principal once you sell your old home?

-Try doing a bridge loan so you can enjoy the benefits of a much lower payment on your new home without having to sell your old home right away

– If you decide to close on your new home first and then, later sell your old home, here is an example of how that can work for you.

Do you plan on starting your own business or acquiring income-producing real estate? This might require you to keep your mortgage payment low so that you can afford to finance other investments.

-

What is the maximum down payment that is comfortable for you?

Several financial gurus say that if you enjoy a stable, salaried job, you probably need about 3 months of living expenses in an emergency fund. But, if you are self-employed or get a 100% commission income, you probably need about 1 full year of living expenses in an emergency fund

-

What kind of property are you purchasing?

-

If the property is a fixer-upper with lots of needed repairs, you may want to consider a Renovation and Repair loan so you can finance some of the repairs.

-

Is the property you are purchasing going to be your primary residence, a second home or a rental property?

-

Is the property you are financing a condominium or a manufactured home?

-

Is the property located in a place where special financing is available?

-

What special mortgage programs are available to you specifically?

-

Are you a military veteran? Are you eligible for the Veteran Administration 100% VA home loan?

B. Are you a first-time homebuyer, not having your name on title to real estate within the last 36 months? There may be down payment assistance programs available to you, even if you are not a first-time homebuyer.

-

What methods can we use to develop more than one exit strategy?

-

Is the property in an area that is going up in value? If you really needed to sell the home one day, you could probably do it profitably if the value is stable or headed upward.

-

Is the property in an area that is a strong rental market? In a pinch, you could possibly rent the house and get a nice income from the home.

Is the mortgage you have an assumable loan? If mortgage rates go up, one day someone may be willing to pay you good money to have the opportunity to quality to assume your low interest rate mortgage when they buy your home

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK

NICHOLAS SAMMONS TIP OF THE WEEK: Tip of the Week:

-Modifying your kitchen can cost you more than a full replacement: labor rates have skyrocketed, especially for specialty trade work. If you’re thinking you might save some $$$ by making modifications, you might be surprised. Story about Charlie Vega.

Jo Garner’s mortgage tip How much do you owe on credit cards or other high interest or variable rate credit lines? Some of my customers allowed their credit card balances to run up so high, my customer realized they could never get the credit cards paid off. When they discovered the credit card company was charging them over 20% interest on the accumulating debt, they called me and we refinanced his home into one, fixed interest rate mortgage. We paid off the old mortgage and the high interest credit cards, saving him several hundred dollars per month. If that is you, call or text me today. Let’s explore some refinance strategies you can brag about. Currently we are offering to pay a couple of thousand or so dollars on your next refinance, so if you close now on your refinance mortgage with us and mortgage rates go down enough, you can refinance again with us at a much reduced cost.

Connect with me, Jo Garner,licensed Mortgage Loan Officer, at JoGarner.com (901) 482-0354.

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday October 2nd, 2024 9AM CT “ How Human Trafficking May Be Affecting Your Business” presented by Angie Garrett

Angie@dsg.us • 901-336-4500

Talk Shoppe is free to you because of the generosity of our sponsors like Leah Anne Morse of All Things New. Leah Anne Morse can help you organize your move. Her moving company can move you anywhere in the country, whether you are downsizing, upsizing or making a lateral move. To make the moving process easy, call Leah Anne Morse at 901 488-9733.

Thank you for your support of our business community, Chuck Bohannon, Mid-South booking agent for Santa Claus. To make the best holiday memories, book Santa Claus as a special feature to your family Christmas gatherings, office parties and other events. Contact Chuck at 901 619-6436.

-

Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

6. subscribe today for weekly podcasts with show notes at www.JoGarner.com

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

Hazrat Khan- “ Some people look for a beautiful place. Others make a place beautiful.”

REJOINDERS:

-

-

Marx Sterbco, Sterbco Law Firm New Orleans, LA

-

Clint Cooper, Redeemers Group foundation repair Germantown, TN redeemersgroup.com

-

Terri Murphy, author, trainer, speaker www.terrimurphy.com

-

Transitional Music: “

Transitional Music: “Do the Right Thing Simply Red; “Going in the Right Direction Robert Randolph and the Family Band;” “You are the Future” OneRepublic

;

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

_________________________________________________________________________________________________________________________________________________________________________________

Nick Sammons is the owner of TruVine Renovations and is a seasoned professional with experience in the contracting world since 2008. A simple yet powerful mission drives him: to “do the right thing.” This ethos was born from his experiences in the industry—witnessing practices he alike.

The turning point came during the Covid-19 pandemic, sparking the inception of TruVine Renovations. With a faith-based approach that’s evident in action rather than words, Nick has built a company that stands out for its integrity, quality, and commitment to truly making a difference in the homes and lives of its clients.

901 313-6424

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes

Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”