When is the last time you were faced with a big decision –one that you weren’t sure which direction to go or when? Today we will discuss the real estate market and predictions on what is to come. We will look at how some very successful celebrities have learned to make the right decisions.

Let’s stay connected! Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

#JoGarner #MortgageExpert (901) 482-0354

#TomKing #RealEstateAppraiser (901) 487-6989

Special tip from Santa Claus’ booking agent, Chuck Bohannon (901) 619-6436

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our general topic REAL ESTATE MARKET- BUY NOW & GET MY MORTGAGE OR WAIT UNTIL AFTER THE ELECTION? Today is October 19th, 2024 Call us in the studio while we are live at 901 535-9732.

This episode of Real Estate Mortgage Shoppe is sponsored by real estate attorneys Rob Draughon and Shelley Rothman of Griffin, Clift, Everton, Maschmeyer Law Firm. For title work and closing on your home purchase or refinance, call Rob and Shelly at 901 752-1133.

Introducing Tom King of Bill King Appraisal Company

(Jo) Our co-host today is Tom King, our expert real estate appraiser with Bill King Company. After experiencing some slow down this summer, Tom you have been getting busy appraising homes for home purchases and cash out refinances. (Tom has about a minute and a half to say something about himself and talk about the services that he offers. Tom talks about the market in the Mid-South, giving examples of the advantages for for home sellers and home buyers. His thoughts on people waiting until the election to make a move approx. 4 minutes )

![]()

(JO) When is the last time you were faced with a big decision –one that you weren’t sure which direction to go or when? When we know we need to move forward, but we are not sure which fork in the road take, we can suffer with “paralysis analysis.”

Over the last 30 plus years as a mortgage loan officer, I have walked with so many customers who want to own their home or they want to refinance and restructure their finances, but can’t decide which way to go or when to make the first step. You have probably experienced some of these common dilemmas.

Thomas Edison, the famous inventor of the light bulb, dealt with many failures. He reframed the way he thought about failure. He is famous for saying, “I have not failed. I have discovered 10,000 ways that won’t work.” Thomas Edison stepped out and used each decision, good or bad, to build better and better as he moved forward.

2. (Reason you are struggling to make a decision.) You are a perfectionist and feel there is only one right decision. You feel like a failure if you make a wrong decision. You are in great company with people like Apple’s founder Steve Jobs. Steve Jobs believed the perfect product was one that customers didn’t even know they wanted yet, which resulted in a world-changing product, the iPhone. However, what many people don’t realize is that, in order to create the perfect product, Apple produced several products that flopped on the market. Steve Jobs rested in his profound success when he redefined the definition of a perfect product. The perfect product was created through a process of producing some not-so-perfect products. Steve Jobs made the decision to do something and, then developed the perfect outcome along the way.

3. (reason you are struggling to make a decision) You procrastinate- maybe because deep down you know the right decision but self-doubt prevents you from moving forward or you feel overwhelmed and stressed about making the decision. Sometimes it is because you do not feel you have enough information. Count yourself among some highly successful people like, Leonardo di Vinci, Mozart and author J.K. Rowling. Ms. Rowling recounts in an interview that she struggled with procrastination when writing the Harry Potter series. She got bogged down in too much research. She confessed to spending too much time making a plan, and procrastinating by making tea and wandering around the house in the evenings.

To those listeners who are feeling overwhelmed trying to make a decision, consult with some reputable professionals like a good realtor. I would like to sign up to be on your team as your mortgage officer. Talk with people who are living your dream, doing the very things you want to do.

Good information and direction from professionals who know the road you want to take, can relieve you of stress and give you space to focus on what you really want in life.

What do YOU want to accomplish with YOUR mortgage? Whether you are buying a home or refinancing to achieve goal, put my experience to work. I know about traditional mortgage products, alternative mortgage products and even combinations of products that can help you get some bragging rights on your next mortgage. Let’s work together to get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will be hearing more from real estate appraiser Tom King and Chuck Bohannon, booking agent for Santa Claus will be joining us with a helpful tip.

2nd segment 9:18 am – 9:30 am

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business or health and wellness. Talk Shoppe is made possible by the financial support of its sponsors. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) For our Talk Shoppe Business Tip today we have Talk Shoppe sponsor Chuck Bohannon, booking agent for Santa Claus. Make your Christmas party more joyful and memorable this year. Book Santa Claus as your special guest.

(Santa Claus gives his tip and refers people to call his booking agent, Chuck Bohannon at 901 619-6436)

TIP: Keep safety in mind when placing your Christmas decorations near the fireplace or lit candles near anything flammable. A candle can be knocked over accidentally by you or a pet to start a devastating fire.

Live Christmas trees need to be watered once a day to keep them from getting to dry and brittle. Just a little heat from a Christmas tree light or other spark can set a dry tree on fire.

Stay safe. Enjoy peace and the love of family and friends this holiday.

TOPICS BY TOM KING, BILL KING APPRAISAL COMPANY

After a period of slowing down, the real estate market is showing signs of coming back to life. Tom has been busier over the last two weeks doing appraisals for real estate sales and for people refinancing their mortgage.

Average sales price is up 5.7% year-over-year in the MidSouth. Inventory is still a little short but keeping the market stable.

Currently we are in a good market for both the home seller and the home buyer.

Mortgage rates started back up again when the Federal Reserve dropped their rates. Last October 2023 mortgage rates on a 30-year fixed rate were in the 8’s. Today they are in the 6’s. On a $400,000 mortgage it will cost the borrower over $500 per month LESS than they would have paid last year.

Mortgage rates are predicted to move lower over the course of the next few months. Also predicted is that home prices will go up when mortgage rates slide downward. Will you really win to wait?

You don’t have to wait until after the election to buy a home or refinance one. 5Make your plan. Let’s work your plan. If the deal works for you today, let’s do it today.

________________________________________________________________________

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

Owning Your Own Home- A Hedge of Protection to Grow Wealth

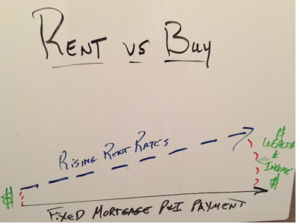

Whether you are in an election year or not, historically homeowners with a fixed-rate mortgage found a hedge of protection for their finances against inflation and unexpected financial fiascos. A national study was done by National Association of Realtors that showed homeowners were 40% wealthier than renters.

Here are a couple of major factors establishing this finding.

First, homes tend to increase in value over time. Homes have spiked up in value at a record pace over the last four years. Once these homeowners bought their home, their home gained value earning the homebuyer more and more equity value in the home over time. Renters gained zero equity to add to their net worth.

Secondly, homeowners who have a fixed-interest rate mortgage enjoy the fixed principal and interest payment for 30 years until the mortgage is paid off. Even though property taxes and insurance increase periodically, the principal and interest part of the payment never changes.

Homeowners can pay extra whenever they choose to get the mortgage paid off early.

Renters, on the other hand, deal with landlords who continue to raise the rent regularly, giving the landlord a profit but earning nothing but a tighter budget for the renter.

Thirdly, homeowners who have a mortgage have more options for overcoming unexpected financial hardships. Landlords can evict a renter for non-payment of rent in less than 90 days. A mortgage company tries to work with homeowners, giving them more time to work out mortgage payments.

-

For homebuyers it is important that you already know your comfort level on a monthly mortgage payment amount and the amount of money you can put down to buy the home you want. Stay within that shelter zone. Some common advice from financial advisors is the keep your total house payment under 25% of your gross income and no more than 33% of income. They suggested keeping the total of your house note and other minimum required payments on debt under 38% of gross income and no more than 45% of income.

-

Aspiring home-buyers have to be persistent at making offers on homes until they get their offer accepted on a home. The most effective strategy was we see it from the mortgage desk, buyers who are prepared with a strong preapproval letter win the competitive bidding game many times—even if they did not make the highest offer price, can be the winner over other would-be buyers. It might just be that the seller is not looking for the highest offer, but the surest offer

Confidence in Your Decision by Creating Positive Exit Strategies

Rent vs Buy—Lindsey’s Smart Solutions

Lindsey has just graduated college with a business degree and has landed a pretty good job right here in town. She feels pretty certain she is staying in the area for the next 3 years or more, but what if she has the opportunity to be transferred with a promotion? She is grinding and pacing over whether to buy a home or rent. She keeps putting off making a decision because she doesn’t want to regret making a bad choice.

Lindsey and her mother called a realtor that had been referred to them by close friends. Reba the realtor met with Lindsey and her mom and really listened to what was important to Lindsey. Lindsey had given me, her mortgage officer, permission to talk with Reba. I sent over the mortgage preapproval information so that Reba the Realtor would know the right price range and mortgage parameters.

Reba selected some houses that would be in an acceptable price range and had amenities of the greatest interest to Lindsey. Reba and Lindsey and Lindsey’s mom went shopping for the perfect house.

I made sure the mortgage terms also fit Lindsey’s comfort level on a house payment and move-in costs too. We chose a low fixed rate government mortgage that had an assumability clause that would allow someone later to assume the loan from Lindsey if the market was tough at the time she needed to sell. Reba showed her homes in stable neighborhoods that had some increase in value, just to make sure Lindsey would have room to make a profit should her career cause her to have to transfer to a different city.

Even though Lindsey was excited when she found the perfect house, she sat down and asked herself the questions that successful people ask when they make big decisions. Here are some of the facts that let Lindsey know without a doubt that she was making the right decision to buy the house instead of trying to rent:

The homes in the neighborhood where Lindsey wanted to buy had rent rates of about $1,300/month and rising about 5% per year. The total house payment on a government FHA loan was going to be around $935/month including taxes and insurance and FHA mortgage insurance.

Lindsey consulted with a tax accountant, her realtor and me, her mortgage officer. If she bought the house, she would be:

-

Paying almost $400/month LESS by not having to pay the higher rent rates.

-

She would avoid the steadily rising rents in the area at 5% or more each year in rent hikes.

-

Her tax accountant showed her how she could write off the mortgage interest to reduce her taxes owed to the government. “Hmmmm…..getting a tax refund each year would be nice,” she thought with a smile.

-

Her mother gave her a gift for the down payment and some of the closing costs and ask the seller to pay the rest.

-

Even if she did end up having to transfer out of the city with her new job, she had at least three exit strategies to avoid getting stuck with the house

-First she could get Reba to sell the house.

– Second, even if she couldn’t sell outright, if the mortgage rates had gone up by then, she might attract a buyer who could qualify with her mortgage company and be allowed to just assume the mortgage obligation with the lender’s permission

-Third, with the rent rates going up so fast, she could get a property manager to rent the home to reputable tenants and manage the property for her, hopefully at a nice profit.

When Lindsey went to close on her house that day, Reba the realtor and I were there to celebrate with her. Lindsey, announced with a confident smile, “I know that I know that this is the right decision. Let’s do this!”

Jimmy Jen Does the Math Then Refinances to Pay off Variable Rate Debt

![]()

Jimmy Jen had been living in his home for many years and had paid his mortgage down to a little over $100,000. His home was worth over $500,000. Jimmy owned his own business that he almost lost during 2020. To survive the long shutdowns in 2020 Jimmy racked up variable rate debt on an equity line of credit and on his credit cards. With the Federal Reserve going up on their rate, making alarming hikes and promising to make more, Jimmy could see into the future that the cost on his variable rate debt would be hiking right along with the Fed. He called me after listening to Real Estate Mortgage Shoppe and said, “Then what can I do to lock down my debt into a fixed rate? “

The mortgage rate I quoted him to refinance and pay off his old mortgage was higher than the rate he was paying. At first, Mr. Jen hesitated –not wanting to give up his lower mortgage rate. But he discovered he was paying well over 15 % interest on the credit card debt and the interest and payments on this equity line of credit was moving up too. Mr. Jen did some math in his head and decided the refinance of his old mortgage and roll into the new mortgage the variable high-interest rate debt—this refinance would slam the lid down on the variable rate rising costs. With the money he saved each month, he could make prepayments to principal and pay the new mortgage off early.

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK

Santa Claus’ second tip:

The world desperately needs more joy. Love others. Do good to others and love them. Make everyday like Christmas in your love for one another.

Tom King’s Real Estate Tip:

Most mortgage products allow for a certain percentage of the price for the seller to pay for the buyer’s closing costs. The dollar amount contributed by the seller to pay the buyer’s closing costs is not reduced dollar-for-dollar off the value of the home. Most loan programs also allow the seller to pay the buyer’s real estate agent commission in addition to the limit on closing costs.

Jo Garner’s mortgage tip October 2023 30-year mortgage rates were in the 8’s. This October 2024 mortgage rates are in the 6’s. On a $400K loan, you pay over $500 per month LESS than a year ago.

Opportunities. If forecast are correct and home prices continue going up next year, are you really going to win buy waiting? Marry the house. Date the interest rate. Buy the house you want at today’s price and refinance to a lower rate and payment later if the mortgage rates go down enough.

Are you short on funds to close? There are loan programs that provide help for the down payment buying a home. Loan secured on retirement funds, gifts from family, loans secured on a different asset.

Can’t verify all of your income? Get around having to use paystubs and tax returns. We can calculate qualified business income deposits from your last 12 consecutive bank statements.

Credit issues? We have credit simulators that can show you the fastest method for improving your credit scores with the least money out of your pocket.

Make your plan. Let’s work your plan. If the deal works for you today, let’s do it today. Contact me for exploring your mortgage options at 901 482-0354 and at www.JoGarner.com

Connect with me, Jo Garner,licensed Mortgage Loan Officer, at JoGarner.com (901) 482-0354.

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday October 23rd, 2024 9AM CT “ The Power of Branding” presented by Hadonica Murphy, photographer.

Talk Shoppe is free to you because of the generosity of our sponsors like Brett Carter of ServiceMaster by Cornerstone. When you are faced with a fire, flood or biohazard, don’t go it alone, call Brett Carter at ServiceMaster by Cornerstone 901 832-6005

Brett and the ServiceMaster by Cornerstone team have been working to help restore damaged homes for the people in Florida following Hurricane Helene and Hurricane Milton.

A shout out to home Certified Public Accountant, Carlin Stuart, for your contributions to our business community through your volunteer work helping set up the weekly events at Talk Shoppe. If you are looking for a CPA or CFO to manage your financial operations with your business, contact Carlin Stuart at 901 355-5019.

-

Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

6. Subscribe today for weekly podcasts with show notes at www.JoGarner.com

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

Jack London “You can’t wait for inspiration. You have to go after it with a club.”

REJOINDERS:

-

-

Donna Roach, Hearthside Senior Living donna@hearthsideseniorliving.com

-

Leah Anne Morse of All Things New (moving and organizing company) 901 488-9733

-

Clint Cooper of Redeemers Group (foundation and basement repair) www.RedeemersGroup.com

-

Transitional Music: “This Time” Bryan Adams;; “To Morrow” by the Muppets; “Why Not Now” Daughtry; “Taking Care of Business” by BTO for talk shoppe business tip

;

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

_________________________________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________________________________

ABOUT TOM KING, APPRAISER WITH BILL KING COMPANY

Tom is a well- respected and sought after appraiser in Memphis, Tennessee. He is a second generation appraiser with 40 years of experience. He has been elected to the Memphis Area Association of Realtors Board of Directors three times.

Tom is a certified residential appraiser in Tennessee. He have appraised over 20,000 homes in his career. A graduate from the University of Tennessee with a degree in real estate, Tom is also a Certified Relocation Professional (CRP). Tom also has vast experience in dealing appraising real estate for pre-listing sales, cash buyers, divorce settlements, estate settlements. (901) 487-6989

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes

Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”