The Second Look—Solutions To Your Home’s Mold Problems—& A Second Look to Save Thousands On Mortgage Details

So glad you paid us a visit at Real Estate Mortgage Shoppe! In this podcast at the studio coffee table we are talking about how to find out if your home has mold, what type mold you have and how much. We are going to cover some very cost-effective ways to tackle the mold issues. We are going to look at some details you do NOT want to leave out when you are deciding on your home mortgage program.

If you still do not have the exact information you need, please contact me directly at (901) 482-0354 or jo@192.232.195.219 Let’s make it our mission to help you get the info you are seeking.

___________________________________________________________________________

Good morning, Memphis! And a good morning to our friends across the 50 states. You’re listening to Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com If you have a real estate or financing question or comment, let me hear from you by email at jo@192.232.195.219 or on twitter at #JoGarner or we can talk now while we’re live in the studio March 5th, 2016 at (901) 535-9732 or outside the Memphis area (800) 474-9732.

During this March 5th, 2016 show our topic is “The Second Look—Solutions To Your Home’s Mold Problems—& A Second Look to Save Thousands On Mortgage Details”

You will hear about how to find out if your home has mold, what type mold you have and how much. We are going to cover some very cost-effective ways to tackle the mold issues. We are going to look at some details you do NOT want to leave out when you are deciding on your home mortgage program.

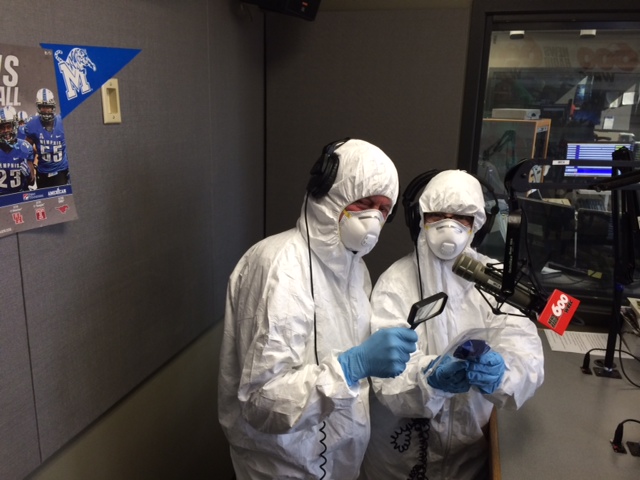

Joining us on the show today is Mark Cardona, owner of Environeeds, LLC. Since 2007 he has performed over 600 mold inspections and scores of remediation projects in West TN and North several designations three of which are the water restoration technician and applied microbial restoration technician and is a Certified Mold Remediator. Mark –the mold man—certainly can offer us some helpful information on our topic. Mark, tell us a little more about yourself and what you do for your clients?

(Jo) Mark, I have been an active mortgage loan officer for over 25 years. I work in the Memphis area and all around the United States. I work with realtors, investors and individual homeowners and home buyers on their financing for their primary residences, second homes and investment properties for purchases or refinances. One of the common setbacks to real estate deals getting closed is when the home inspector or appraiser notes in the report that there is possible mold infestation in the home. Mortgage regulations put a high priority on safety and habitability, so underwriters will lean toward requiring the mold issue to be remedied before they will allow the loan to close. If a certified mold expert can prove the amount of mold is small and the mold type is not dangerous, then (not all the time) with some simple fixes to stop the mold from growing, the loan is allowed to close. As a loan officer and former realtor, I am ALWAYS looking for solutions to any situation that could potentially delay or kill my client’s real estate closing. As a mortgage loan officer, besides always watching for ways to help my clients get their loans closed quickly, I am also keeping my eye daily on the mortgage rates and the market conditions driving them. This week February 29th through March 4th, 2016 mortgage rates started drifting back up again. Yesterday’s Jobs Report was a lot more robust than originally thought sending stocks and mortgage rates up to over a 1 month high, but still good for anyone who thought they missed the boat getting to refinance to much better terms. 30YR FIXED – 3.75% to 3.875% and 15 year conventional rates in the very low 3’s. The government FHA, VA Rural Housing loan programs coming in a little lower on the 30 yr fixed rate programs. The jumbo loan programs (loans over $417,000) are extremely good right now. Let’s don’t wait until the best rates are in the rear-view mirror. Call me and let’s take a look and a second look at the possibilities this market can give YOU. Let’s Make Your Plan, Work Your Plan. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY. Call now while we’re live at 901 535-9732 or call me after this show directly at (901) 482-0354 (901) 482-0354 or connect with me at www.JoGarner.com

(Jo) Some of the biggest decisions I regret in life are the times I got in a hurry and didn’t give my plan a second look before taking action. I try to get feedback from knowledgeable, reputable people when applies to the big stuff. Making a decision to buy a house and getting a mortgage is one of the BIGGEST investments people make in a LIFETIME. Kudos! to MY clients who allow me to ask them a few extra questions about their priorities, future plans and their personal comfort level on payments and down payments. We are able to take a first AND second look and compare more than one loan product to see which is more fits a little more comfortably for that client’s situation and which product can save them tens of thousands of dollars on interest or private mortgage expense. It is amazing to me that some people would actually go online and do an entire loan application online without talking to someone and getting a 1st and 2nd look. They probably wouldn’t THINK of buying their CAR that way. Why would they select their MORTGAGE that way? That investment is a lot bigger than a car loan.

Agricenter International

Question: Known as the “Versailles” of American agricultural technology, I opened in 1985. Who am I?

Hint: A part of my funding came from the 1982 Memphis Jobs Conference, by the State of Tennessee.

Hint: John Charles Wilson, my Executive Director, just recently announced his retirement after 15 years of leadership.

Hint: The Shelby Showplace Area was open as my neighbor in 1986.

Final Hint: My legacy, the Shelby County Penal Farm, was a “model farm” in the middle 20th century.

Answer: Agricenter International is a self-sustaining, not-for-profit organization that provides economic development and improved quality of life by facilitating agricultural research, educational programs, environmental conservation, natural area preservation and recreational opportunities. Public awareness of Agricenter’s role in society is demonstrated through efforts involving education, demonstration, environmental responsibility, conservation, wildlife preservation, and other agriculturally related items. The Agricenter has non-agricultural related activities to attract the public to Agricenter in order that they become aware of it many programs – Farmer’s Market, RV Park, Wildlife Observation Tower, Outdoor Classroom, Show Place Arena, public forums, and the exhibition center attract thousands of visitors annually.

The Agricenter develops alternative agriculturally related programs to attract and educate the general public. An example of an alternative program is the development of our 8-acre corn maze that provides education, recreation and generates revenue. The maze is open every September and October and is hosted through Mid-South Maize (Chris and Justin Taylor). For more information, you can visit cornfieldmaze.com. The Agricenter continues development of Farm Research by enhancing partnerships, providing service and leadership and use our urban farm for the scientific enrichment of society. www.agricenter.org.

Last Week: Cordova, Tennessee. After graduating from Princeton, Roscoe Field left the area in the late 1840s for the California Gold Rush to pan for gold in the Sutter’s Mill area known as Rancho Cordova. When Roscoe returned to this area in 1852, he married Emily Ecklin and gave her a wedding ring made from gold he acquired from that Gold Rush experience. When Roscoe was 78 years old, the railroad was looking for a name to replace Dexter, and Roscoe suggested Cordova! Through the middle 20th century, there were numerous dairy farms and at one time over 92% of the fresh flowers being sold in Memphis came from the Cordova area! “Forgotten Days Of Farms, Flowers And Fellowship in Cordova, Tennessee” is a new book by Darlene Sawyer and Jim Waddell covering the experiences and memories of many former residents and is available at Trustmark Bank, 1283 North Houston Levee Road.

Cordova is a community in southeast Shelby County. Cordova lies east of Memphis, north of Germantown, south of Bartlett, and northwest of Collierville at an elevation of 361 feet (110 meters). The majority of Cordova has been annexed by the City of Memphis. The remainder of Cordova is in unincorporated Shelby County, in the Memphis Annexation Reserve area. The boundaries of the Cordova community are inexact, but are generally regarded as the Wolf River on the south, Whitten Road on the west, Interstate 40 on the north, and Pisgah Road on the east. Parts of Shelby Farms are considered part of Cordova. The Old Cordova Area is centered on Macon and Sanga Roads, 3 miles east of Germantown Road. It consists of the former Town of Cordova, with some of the original structures still present.

Jimmy Ogle gives free outdoor walking tours on the sidewalks and parks in Downtown Memphis during the Spring and Autumn of each year, with the next tour being the Bridge Walk on the Memphis & Arkansas Bridge on at 2pm on Sunday, March 13; the Fairgrounds Walking Tour at 2pm on Sunday, March 20 (assemble at the Coliseum). The D’Army Bailey County Courthouse Tour (indoors): Third Thursday each month at 12:00 noon – the next being Thursday, March 17.

Go to jimmyogle.com for the 2016 Spring Season schedule

QUESTIONS ANSWERED BY MARK CARDONA:

⦁ Is all mold dangerous?

⦁ How long does mold take to grow?

⦁ Control the moisture, control the mold.

⦁ What can fungus do in my crawlspace, if I have one?

⦁ What is mold anyway? What is its purpose in nature?

⦁ What is toxic black mold?

⦁ How can I know for certain if I have mold in my house?

⦁ What are some of the health effects of mold?

______________________________________________________________________

QUESTIONS ANSWERED BY JO GARNER :

REAL ESTATE TIP OF THE WEEK:

⦁ What mortgage details need a second look before deciding on a loan program?

⦁ Compare the government FHA low-down payment loan to a low-down payment conventional. If the client has really good credit scores and is putting at least 10% down, the conventional loan can save them over $20,000 over the life of the loan using $100,000 loan as an example.

If your credit scores are pretty low, like down in the 600’s, but you’re putting down 3% to 10%, FHA or the veteran loan (if their veterans) or the rural housing 100% loan (if the property is in a not-so-densely populated area,) will probably be the best loan programs because FHA loan, the VA loan or the Rural Housing Loans aren’t going to penalize you as much for the low credit scores like the Fannie Mae or Freddie Mac conventional loans do.

⦁ The other detail that is important to consider when determining which loan program is best for you, is to look ahead at least 5 years (if you plan on owning the house that long) and calculate how much private mortgage insurance you’re going to pay on one loan program versus a different program. I quoted the other day a deal where the sales price was around $100,000. With 3.5% down on the FHA deal my client was going to have to add to the top of their loan $1,688 for upfront mortgage insurance plus they would have to pay the monthly FHA mortgage insurance of $68/mo for the life of loan up to 360 payments making it a total for lender mortgage insurance $26, 296. By putting down just a little more –like 5% on a conventional loan, my client would pay no upfront private mortgage insurance and the $42/mo they would pay would automatically go away when the loan was paid down to under 78% loan-to value. Over the full life of the loan, my client would pay about $21,000 less in mortgage insurance. Over a short 5 year period, the savings on mortgage insurance was over $5,700. Mortgage insurance only helps the lender –not the borrower—so the less you pay, the better you are.

⦁ There are other important details to consider on choosing a loan program depending on your specific career and life plans over the next 5 years, but the difference in interest costs and the difference in what you pay out for mortgage insurance are the two biggest considerations.

⦁ What kind of obstacles dealing with mold do you see on the mortgage side when people are trying to buy a home or refinance their home? A home appraiser lists information about surrounding homes and sets a dollar value on the house. The home appraiser is required in most cases. Home INSPECTIONS are not required by lenders but they are certainly advised. The home inspector inspects the condition of the structure, the appliances and other specifics regarding the house. Often the appraiser and/or the inspector makes comments regarding possible mold growing in the house. The mold in the may not be the deadly kind and may not be in great quantities. But Without a report from a certified mold expert, home buyers or mortgage underwriters are not sure if the home is safe and can refuse to allow the real estate transaction to close until the mold and its causes are removed and remediated.

_________________________________________________________________________

ANNOUNCEMENTS: Talk Shoppe offers free networking & education to anyone interested in real estate or in business. Talk Shoppe meets every Wednesday 9A-10A CT at the University of Phoenix 65 Germantown Center 1st floor Cordova, TN. This Wednesday March 9th, 2016 Talk Shoppe presents “Branding Your Business For Success—3 Things You Must Consider” with Kim Garmon Hummel, Founder and Creative Director of Sauce Marketing. Shoppe events are free for the next couple of months thanks to our advertisers like Gwen Christensen, owner of Builders Floors and Interiors Gwen has been able to beat the big box stores on the price to install flooring. www.buildersfloorsandinteriors.com and Chef Eric Meyers, Eat at Eric’s Grill and Catering (901) 277-4428 Because Life Is Too Short For Ordinary Food.

3. FOR THIS PODCAST OF REAL ESTATE MORTGAGE SHOPPE AND MORE, GO TO JOGARNER.COM

4. Call me and let’s MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

______________________________________________________________________________

QUOTE CORNER: “When Life Gives You Mold, Make Penicillin” -“unknown

Here’s a question to you, Mark, from Louis Tomlinson-“Why did the mushroom go to the party? Mark answers—-“Because he was a fun gi”

_____________________________________________________________________________

Transitional Music: “Watch Out” Abba; Weird Al Yankovik “Foil”: “Take A Look Through My Eyes” by Phil Collins;“Memphis” for Look Back Memphis Trivia Contest

______________________________________________________________________________

REJOINERS:

Mary Lou Nowak, Home Helpers (901) 414-9696

Sally Baker, Memphis, TN. The Source, Professional Organizer and Event Planner (901) 258-4775

Jeri Jeffries, Tiger Paws Carpet & Upholstery Cleaning jjeffries@tigerpawscarpet.com

____________________________________________________________________________

ABOUT MARK CARDONA, OWNER ENVIRONEEDS, LLC

Mark’s first and longest career (to date!) was serving as a Church pastor for almost 30 years. After resigning from the ministry in 1998, he tried several endeavors from Real Estate to Insurance to Financial Planner, but none of them “worked.” Then in 1999, he became an Executive Director for BNI, the largest referral organization in the world. He directed and raised up chapters here in the West Tennessee, and later in North Mississippi as well. After 9 years, his wife, Jana took over as BNI Executive Director, and Mark began to do mold inspections and remediation.

Since 2007 he has performed over 600 mold inspections and scores of remediation projects in West TN and North MS. He holds the WRT (water restoration technician) and AMRT (applied microbial restoration technician) from the Institute of Inspection, Cleaning and Restoration Certification (IICRC), along with the Certified Mold Inspection and Certified Mold Remediator designations from MICRO and NORMI.

Mark is also a TN licensed Home Improvement Contractor, and certified as a biocide applicator by the TN Department of Agriculture.

Married to Jana for over 46 years, they have two grown and married children in the area along with almost 8 grandkids. Mark and Jana have lived in Arlington, TN for 28 years.

Mark Cardona Owner, CMI, CBA, CMRC Environeeds, LLC

IICRC/ THE CLEANTRUST CERTIFICATIONS: WRT AMRT

LICENSED BY THE STATE OF TENNESSE FOR MICROBIAL PEST CONTROL #4639

LICENSED HOME IMPROVEMENT CONTRACTOR #7039

901-277-8976 mark@environeeds.com

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@192.232.195.219 twitter @jogarner

Jo describes her job description: “As a mortgage loan officer, my job is to give my client the benefits they want from their financing terms– listening to my client and determine what’s of the most value to THEM– What is their comfort level on a house payment, how much are they comfortable paying down, what type of financing do they need to get the house they want to buy or refinance. Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income. Whatever their personal priorities are, my job is to put together a mortgage with comfortable terms that will help them achieve their goals.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 20 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 20 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com She was also the editor of Power Shoppe, a free weekly e-zine designed for real estate professionals and others indirectly connected to the real estate industry and currently publishes on her blog www.JoGarner.com