Take A Little Time, Save A Lot Of Money On Mortgage Loans Types And Private Mortgage Insurance

Thank you for stopping by and hanging out with us at Real Estate Mortgage Shoppe! If you do not get the answer to your question, please let me know what you need and I will try and get you the answer. My email is jo@192.232.195.219 You can reach me directly at (901) 482-0354

On the podcast today, 1. You will hear about some of the most effective places you can spend a few extra minutes to prepare and compare that can give you big bragging rights on your real estate deal for years to come. 2. Kim Miller of Arch Mortgage and I will be sharing some examples of where other homebuyers and homeowners have saved significantly on their financing and home buying simply by taking a few extra moments to consider their options. She’s going to tell us about how the new ARCH MI Rate Star pricing engine can sock some money in homeowner’s pockets and even help lenders and realtors get more loans approved and closed.

_____________________________________________________________________________

Good morning, Memphis! And a wonderful Saturday to our friends across the 50 states. You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com. If you’re on twitter we can pick up your comments and questions at hashtag #JoGarner or if you’re listening while we’re live Saturday April 2nd, 2016, call us in the studio at (901) 535-9732 or outside the Memphis area (800) 474-9732.

Today our topic is “Take A Little Time, Save A Lot Of Money On Mortgage Loans And Mortgage Insurance.” Today we will cover 1. some of the most effective places you can spend a few extra minutes to prepare and compare that can give you big bragging rights on your real estate deal for years to come. 2. Kim Miller of Arch Mortgage and I will be sharing some examples of where other homebuyers and homeowners have saved significantly on their financing and home buying simply by taking a few extra moments to consider their options. She’s going to tell us about how the new ARCH MI Rate Star pricing engine can sock some money in homeowner’s pockets and even help lenders and realtors get more loans approved and closed.

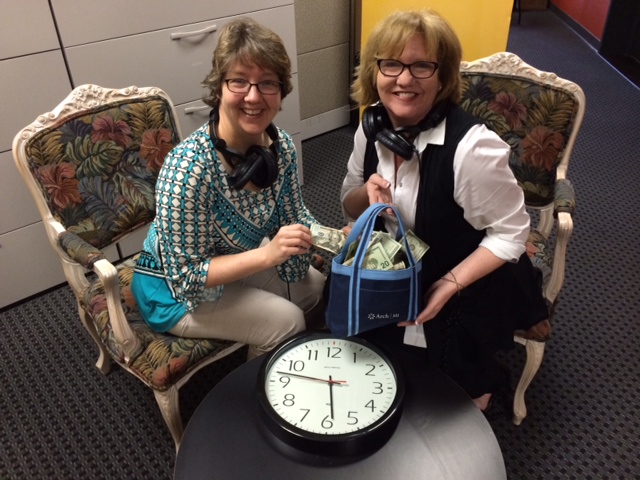

In the studio we have a Kimberly Miller of ARCH Mortgage Insurance Company. Kim is passionate about saving deals for her lenders and helping families live where they want to raise their families or be close to jobs, schools and other loved ones.. Kim, tell us a little bit about yourself and what ARCH MI does for its customers.

(Jo) Before we jump into a little extra time can save you lots of money, let’s take a moment to reflect where we are in the mortgage market. Yesterday, even though the job numbers were strong, they were close to the forecasted number and when the bond market didn’t react, lenders loosened their ties and the pricing on mortgage rates. Friday’s close saw conventional 30 year fixed rates at 3.625% to 3.875% and 15 year rates ranging 3% to 3.375% depending on various factors and mortgage loan types. JUMBO loans over $417,000 and the government FHA mortgage loans , VA home loans, USDA Rural Housing mortgage loan programs came in lower than the conventional rates. If you want to take a few extra minutes to explore how much money these rates and structures could save you now and over time, you can call me directly after this broadcast at 901 482-0354 (901) 482-0354 or connect with me at www.JoGarner.com

(Jo) US News had an article reminding us about the well-known commercial that says “15 minutes can save you 15% …” The point is that in initial investment in time can save you loads of money. US News goes on to talk about ways to take only 1 minute and save 5% to 50% when shopping on GiftCardsGranny online. And then there’s Craigslist. How many of you shop there or know someone who has bought what they wanted for 50% to 75% off the retail price with a new item? I could be happy paying 75% less for something I really want just because I spent a few minutes to shop on Craigslist. Think how much bigger and more important your mortgage on your home purchase is compared to a normal Craigslist item. Would you take some extra time to consider your mortgage options that will affect you for years to come? I would like VERY much to help you MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.Email me at jo@192.232.195.219 or call me directly at (901) 482-0354 (901) 482-0354. The most important questions I ask you are, what is your maximum comfort level on a house payment? What is your maximum comfort level on a down payment? How long do you plan on keeping the house? These questions help us get to the right loan products to compare in just a couple of minutes.

(Jo) If your goal is to get rid of the mortgage sooner rather than later but you plan to keep the house for the long term, one of the best ways I have seen my clients save tens of thousands of dollars is to refinance to a lower rate with a shorter term, say knocking off about 5 to 10 years from the loan term and getting the house payment less than what they are paying now.

Another success story I have seen with my clients is when they refinance and get a lower fixed rate on their first mortgage but combine some much higher interest rate debt into the refinance, saving over $500 to $600 per month which goes to paying the new mortgage down early. They get rid of the double digit interest rate credit card debt and then set up extra payments to come from the bank to pay off early this new mortgage. This has helped some of my clients who have gotten on the other side of family medical emergencies, divorce or other unexpected negative situations but are saddled with high cost debt. I would like to help. Call me directly and personally. If you are not working with me personally , you are not working with me. I want to work with you.

Kim, what are some considerations we need to think about when we are trying to decide if we want to pay private mortgage insurance and how much?

2nd segment after 9:15 break: It’s time for the Look Back Memphis Trivia Contest. The Look Back Memphis Trivia Contest is brought to you by notable Memphis historian, Jimmy Ogle. Jimmy offers free historic walking tours in downtown Memphis in the spring and fall. To find out more, ask Jimmy at www.JimmyOgle.com . Our Look Back Memphis Trivia Contest is sponsored by John and Jennifer Lawhon of Lawhon Landscape (901) 754-7474 the Lawhon’s can help you plan your landscaping if you have a BIG, BIG project or a smaller project . The Lawhons are giving away a $25 gift card to the first person with the correct trivia answer. If you know the We

Garner # 74 04/01/16

Walnut Grove

Question: I am a main east/west thoroughfare in Memphis with a pretty name. Who am I?

Hint: I was named for a residence built in East Memphis in 1918.

Hint: One of my owners introduced cultivated azaleas to the Memphis area in 1922.

Hint: From 1958 to 1961, residents of the area fought to not have me designated a Federal highway.

Final Hint: The owners of my home have the last name Norfleet.

Answer: Walnut Grove Road. Walnut Grove Road received its name from the home built by Jesse Peders Norfleet and Elise Vance Norfleet in 1918. A dirt road for many years, Walnut Grove actually came to a stop at White Station Road though most of the 20th century; and discontinued for two blocks to Oak Grove until 1961. At that time, the City Limits ended just east of Yates Road, and the I-240 South portion was being constructed to Poplar Avenue. In 1964 Walnut Grove was extended over the Wolf River and bisected the Shelby County penal Farm property all the way to Germantown Road, then a two lane road in Shelby County. The name “Walnut Grove” came from the cluster of walnut trees that existed in the area between Perkins Road and White Station Road. The Norfleets owned about 100 acres in this area, too.

Jesse Norfleet graduated from Vanderbilt and worked at Sledge & Norfleet Company, one of the pioneering cotton firms in Memphis. He was also head of the Clover Leaf Dairy Farm, which supplied Memphis with about one-third of its dairy products. He was very influential in the cotton business and financial circles in Memphis for more than fifty years. Elise Norfleet did introduce cultivated azaleas to Memphis in 1922.

Jimmy Ogle gives free outdoor walking tours on the sidewalks and parks in Downtown Memphis during the Spring and Autumn of each year, with the next tour being the Great Union Avenue Manhole Cover & History Tour at 11:45am on Tuesday, April 5; the Bridge Walk on the Memphis & Arkansas Bridge on at 2pm on Sunday, April 24; the Fairgrounds Walking Tour at 2pm on Sunday, April 17 (assemble at the Coliseum). The D’Army Bailey County Courthouse Tour (indoors): Third Thursday each month at 12:00 noon – the next being Thursday, April 21.

Go to jimmyogle.com for the 2016 Spring Season schedule and locations.

___________________________________________________________________

QUESTIONS ANSWERED BY KIMBERLY MILLER:

⦁ Mortgage Insurance 101 – Why does a borrower need mortgage insurance? How does mortgage insurance benefit both borrower and lender?

⦁ What’s new at Arch MI? What is Arch MI’s RateStar? What is Risk Based Pricing? Share examples of how RateStar is helping borrowers lower their monthly payments and how RateStar is helping lenders provide better home mortgage options for their clients. What makes ARCH MI better than other private mortgage insurance companies.

⦁ Great River Mortgage Banker’s Conference, Memphis, TN April 13 – 15, The Peabody Hotel (Conference includes mortgage professionals from the States of Tennessee, Mississippi, Arkansas and, new addition this year, Missouri) – Talk about speakers, educational opportunities, sponsorship opportunities and golf tournament at Windyke Country Club.

⦁ Give some examples of how you have saved the deal for a lender and their mortgage customer. Kim tells a true story about a single mother just coming through a divorce but could not prove the child support income and could not get approved due to income-to-debt ratios being too high. Kim was able to run the credit and loan application information through Arch MI’s state of the art Rate Star pricing engine, drop the monthly amount on the private mortgage insurance significantly so that this lady’s loan was approved and she and her children could comfortably afford the house they really wanted.

⦁ How have you saved a deal for a home buyer by getting their payment lower?

⦁ Talk about the difference between a single premium and a monthly mortgage insurance premium?

⦁ Can lenders pay the pmi for the customer? When is this most common? (our example this week on about a $300K sales price and $285,000 30 yr loan. Monthly pmi .54% or $128/mo until the loan balance is at 78% when pmi is eliminated. Or single pay premium 1.24% upfront with no monthly pmi at all $3,534. In this case the buyer took a wee bit higher rate and had the lender pay the upfront PMI for him so we can enjoy lower payments without the $128/mo pmi to have to pay. ?)

⦁ What are some approximate calculations a borrower can do to get a general estimate of what monthly PMI would cost him on a $100,000 loan on a 90% loan-to-value on a 30 yr fixed rate? How would he calculate an estimate on a single premium PMI plan? A split premium private mortgage anymore.

10. Continuing along the “debunking the myth ” lines, I can talk about the importance that MI brings to the market place . allowing buyers the opportunity to obtain home financing and buy their homes without having to wait to save 20% down payment . .and enjoying the benefits the homeownership brings to families and communities 1) an investment tool / enjoying equity earned with home appreciation 2) tax benefits with deductions for some homeowners for their mortgage insurance 3) pride in home ownership and protecting property values and creating a since of community for neighborhoods. All this can be your for mere pennies on the dollar with our new pricing engine RateStar!

RateStar . .how it’s changing the MI landscape and creating greater home price ranges for some buyers! Learn a little more about private mortgage insurance rates and how to get a better one.

At the end, I’d like to plug Great River Mortgage Banker’s Conference April 13 – 15 . . mentioning speakers and topics of discussion!! This will be a fantastic conference for LOs to attend!

11. For general information about private mortgage insurance tax write offs, go to https://mi.archcapgroup.com/News-Resources/MI-Tax-Deductibility

QUESTIONS ANSWERED BY JO GARNER:

⦁ SHARE SOME RESULTS FROM YOUR REALTOR OPINIONS ON WHERE ARE THE BEST PLACES FOR THEIR CLIENTS TO SPEND EXTRA TIME TO SAVE MORE MONEY?

Kevin Figg, instructor at Success Real Estate School— Get preapproved before making an offer. If you are ready with a preapproval letter before the next competing offer, chances are better that you may get your offer accepted because you are prepared with your lender letter and the person who was going to offer more on the house was not. Yay, You!

Pat Goldstein, Realtor with Crye-Leike has been on Real Estate Mortgage Shoppe before and has shared with her clients the importance of reading through the entire home purchase contract BEFORE the excitement of writing the actual offer sets in.

Terri Murphy, real estate and lender coach at Terri@TerriMurphy.com talks about the difference between pre-qualification and preapproval on a loan. Preapproval includes a lot more details on the customer’s credit, income and assets. Also Terri recommended that home buyers spend a little extra time researching what market and logistical trends are for the home that they want to buy. Knowing where traffic snarls are and when going from their work to home or from home to work. Knowing if the values are going up or down can help a homebuyer know about how long it will take to get rid of the private mortgage insurance.

⦁ GIVE SOME EXAMPLES OF CLIENTS WHO TOOK TIME TO CONSIDER AND COMPARE LOAN PROGRAMS.

I had one particular client the other day that said she kept hearing me on the radio saying “Trying to decide to buy or rent? Either way you’re going to make a mortgage payment—yours or your landlord’s.” Their rent had steadily been going up. She took a little time to look at the areas where real estate values seemed to be going up. She called me and said, “I’m tired of making my landlord’s mortgage payment. It’s time for me to build something for ME.” Her house payment was lower buying and the house was bigger than where she was renting. Now when she makes her house note, she knows part of it goes to pay down the mortgage, building some value for HER and not someone else.

Parents have called me who have kids going to college. Instead of just gritting their teeth and paying for student housing near the campus, they have taken some time, called their realtor and me. We have found some of these parents a very nice investment that keeps giving back month after month. Their children have lived in the rental home during their school years and rented some of the rooms to their fellow students, keeping their own boarding costs at zero or negative. Thinking outside the habitual box CAN bring you wealth and prosperity, but put experienced, reputable professionals around you like a good realtor, lender, closing attorney and the list goes on. Your team of experts can save you loads of cash by leading you around pitfalls and common expensive mistakes.

___________________________________________________________________

REAL ESTATE TIP OF THE WEEK: (Jo talks about the fact that Fannie Mae and Freddie Mae have raised the price on the mortgage rates on loan products where the first mortgage is at 80% loan-to-value or less with a line of credit piggy-back 2nd loan up to around 90% combined-loan-to-value. In the past, savvy homebuyers would use the piggy-back 2nd loan scenario on top of the new first mortgage to avoid private mortgage insurance and still only put down 5% or 10% instead of 20%. Now that Fannie and Freddie has priced up the pricing on the first mortgage on the piggy-back scenarios, in many cases, it is much more cost-effective to go ahead and pay some private mortgage insurance and get the lowest mortgage rate on the first mortgage since there is no piggy-back 2nd mortgage insurance. )

ANNOUNCEMENTS: Announcements: This Wednesday April 6th, 2016, 9A-10A CT Join other business people to hear notable Memphis historian, Jimmy Ogle present “Selling Others On Memphis—Past and Present.” Talk Shoppe offers networking and education to anyone interested in real estate or business every Wednesday 9A-10A at University of Phoenix in Memphis 65 Germantown Court 1st floor across from Germantown Parkway from the Ag Center. For more about Talk Shoppe, go to www.TalkShoppe.com

Talk Shoppe events are free for the next two months thanks to one of our advertisers, Tim and Katie Gilliland of www.BackupRX.com. Let them give you peace of mind about your data with Cloud Services, Data Backup & Recovery Plans. (901) 507-6816.

Talkshoppe.com and JoGarner.com Thank you, Kim Hummel of SauceMemphis.com for throwing some flavor into our online marketing. www.saucememphis.com

FOR THIS PODCAST OF REAL ESTATE MORTGAGE SHOPPE AND MORE, GO TO JOGARNER.COM

Call me. MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

Thank you to the following realtors and real estate pros for being a part of our survey for today’s show.

Kevin Figg, instructor with Success Real Estate School 901-360-0854. (Kevin shared on the air that she has 5 things buyers can do to save money on their financing and home purchase. Contact Kevin to get her top 5 tips for saving money.)

Pat Goldstein, Crye-Leike realtors (901) 606-2000

Terri Murphy, real estate and lending coach www.terrimurphy.com

Lynn McDonald, Insurance Agent Erin McDonald Insurance Agency (901) 849-7101

⦁ KIM MILLER OF ARCH ANNOUNCES HER BIG EVENT—– Great River Mortgage Banker’s Conference, Memphis, TN April 13 – 15, The Peabody Hotel (Conference includes mortgage professionals from the States of Tennessee, Mississippi, Arkansas and, new addition this year, Missouri) – Talk about speakers, educational opportunities, sponsorship opportunities and golf tournament at Windyke Country Club.

_________________________________________________________________________________

QUOTE CORNER:

“Time is a great healer, but a poor beautician.” Lucille Harper

“There’s never enough time to do it right, but there is always enough time to do it over.” Jack Bergman

“Time is money, especially when you are talking to a lawyer or buying a commercial.” Frank Dane

REJOINERS:

JOE ROJAS-The Elite Team at Fearnley, Martin & McDonald 901 289-5821

TOM KING-APPRAISER WITH BILL KING COMPANY 901 487-6989

DAVID LENOIR, SHELBY COUNTY TRUSTEE TN.

_________________________________________________________________

Transitional Music: “If I Could Turn Back Time” by Cher; “Give A Little More Time” by Chairman of the Board; “Time” by Pink Floyd; “Memphis” by Johnny Rivers for the Look Back Memphis Trivia Contest

_________________________________________________________________

ABOUT KIMBERLY MILLER

Kim Miller is the Account Manager for Arch Mortgage Insurance in Tennessee. Building upon deeply valued relationships cultivated with over 20 years in mortgage sales, Kim uses her experience and enthusiasm to promote Arch MI’s mortgage insurance innovative solutions to support her client’s business strategies. Supported by an amazing team at Arch MI, her goal is to provide the Tennessee mortgage community with superior and responsive service along with extremely competitive products for clients and their borrowers.

A graduate of the University of Tennessee in Knoxville, Kim began her career as a Loan Originator moving quickly into Retail Management with Pulte Mortgage! Moving from retail sales, Kim focused her career on B2B sales as the Wholesale Account Executive for SunTrust Mortgage followed by an Account Executive opportunity in correspondent sales with Flagstar Bank. Kim’s most important role is that of “Mom” to her two children and she enjoys watching her son play high school basketball and soccer and her daughter play golf as a freshman at Tennessee Tech University!

Account Manager – Tennessee

Arch Mortgage Insurance Company

3003 Oak Road Walnut Creek CA 94597

kmiller@archmi.com | www.archmi.com

Mobile 615.424.1500 |

ABOUT ARCH MORTGAGE INSURANCE COMPANY-

Arch MI is the strong MI partner that can help distinguish you in the 2016 marketplace. Our unique and innovative MI solutions for growing your share of new originations include Arch MI RateStarSM, a dynamic risk-based rates program that more precisely matches MI rates to individual loan risk. archmi.com/ratestar

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@192.232.195.219 twitter @jogarner

Jo describes her job description: “As a mortgage loan officer, my job is to give my client the benefits they want from their financing terms– listening to my client and determine what’s of the most value to THEM– What is their comfort level on a house payment, how much are they comfortable paying down, what type of financing do they need to get the house they want to buy or refinance. Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income. Whatever their personal priorities are, my job is to put together a mortgage with comfortable terms that will help them achieve their goals.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 20 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 20 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com She was also the editor of Power Shoppe, a free weekly e-zine designed for real estate professionals and others indirectly connected to the real estate industry and currently publishes on her blog www.JoGarner.com