LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com.

Our topic: The U.S. Economy 2025: Will It Bode Well or Worse for the Real Estate & Mortgage Markets. . Today is February 1st,, 2025. Call in to the live show at 901 535-9732

Introducing Mark Ruleman of Ruleman Asset Management & Planning

Mark Ruleman of Ruleman Asset Management & Planning, so glad to have you back in the Real Estate Mortgage Shoppe studio. You have been in the financial investment business fordecades. You are know in the networking circles as “The Great Communicator.”

Take a minute of so and tell our listeners a little bit about yourself and the services you offer your clients. (Mark Ruleman has about 1.5 minutes or so to intro himself and talk about the services he offers his clients.)

A View Into The Future

(JO) Imagine for a moment that discovered a large package on your front porch. When you opened it there were five Wall Street Journal newspapers stacked inside. But, not just ANY newspapers, but a newspaper dated for the end of the year over the next five years. What decisions would you make if you knew the future? Would you buy a home or a different home?

Even though no one has a crystal ball, if you know some history of the financial markets and

the cause and effects of when things move, you have an educated glimpse into the future.

Mortgage rates predicted by Corelogic and National Association of Realtors to ease down to the mid to low 6’s in 2025. MBS highway sees investment moving back into the bond market and making it possible mortgage rates might dip a little lower.

Watch out for inflation though If we see a weakening job market, lower shelter costs and lower prices on oil, these would be harbingers of some lower mortgage rates. However, when we see inflation rising, you can bet it will send mortgage rates higher. With the new Presidential initiatives, we have some focused efforts on providing more new, affordable homes and working on getting mortgage rates lower. Don’t depend solely on mortgage rates dropping because other economic initiatives going could send mortgage rates up again.

Mortgage rates have been driving the housing market for years. The early part of Sept 2024 we saw mortgage rates drop briefly into the low 6’s. Almost instantly, would-be homebuyers were jumping into the homebuying market. We believe if mortgage rates ease down in that range in 2025, demand will bolt upward. If we have that much demand-more than the housing market can supply, I believe the higher demand will push home prices up. Hint to the wise: If the deal works for you today, and you can afford it today, do it today.

If you are renting and plan to remain in the geographic area for three to five years, I encourage you to explore the financing options for buying a home. It’s free to talk, so let’s talk about where and how you want to live. Your journey to homeownership starts with the first step. A good mortgage officer can help you find the right mortgage product and make the process smooth for you. I would like to sign up for the job as your mortgage officer.

If you run into any barriers like not enough funds to close, there are solutions for that. Credit that needs some improvement? There are solutions for that and more.

Do you want to buy a home somewhere else but don’t want to give up the 3% to 4% mortgage on your old home? If you are willing to sell your old home and put the profit you make after paying off your mortgage as a down payment on the new home, you may be pleasantly surprised how low your new mortgage payment will be, even at the higher mortgage rates.

Stay tuned and you can walk on the road of some homeowners and homebuyers who were able navigate this market and come out on top.

(Jo) Mark Ruleman of Ruleman Asset Management and Planning, you keep your eye on the economy and advise your investment clients. What do YOU see happening in the United States economy? (Mark has a couple of minutes until the 9:15 am break and can continue after the break)

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will be hearing more from Mark Ruleman of Ruleman Asset Management & Planning. Realtor Sherry Harbur of Harbur Realty will also be joining us.

2nd segment 9:18 am – 9:30 am

LET’S TALK SHOP—TALK SHOPPE’S BUSINESS TIP FOR REAL ESTATE PROS:

2nd segment after 9:15 advertising break – (producer to start the song “Taking Care of Business” by Bachman Turner Overdrive –but bring the volume down on queue) It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the financial support of its sponsors. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) For our Talk Shoppe Business Tip today we have Talk Shoppe sponsor Sherry Harbur of Harbur Realty. Sherry you offer your homeowners and home buyers a wide range of your skills and resources when it is time for them to buy or sell a home. You work with first-time homebuyers, move up or down size homeowners and investors too. Take a moment and share some wisdom with us.

(Sherry Harbur shares her tip –about 1 minute or so)

Real Estate Tip#1

People who own real estate tend to have a higher net worth than those who do not. Several studies and wealth reports indicate that homeownership and real estate investments are major contributors to wealth accumulation. Here’s why:

-

Equity Growth – Homeowners build equity as they pay down their mortgage, which increases their net worth over time.

-

Appreciation – Real estate tends to appreciate in value, contributing to long-term wealth.

-

Leverage – Real estate allows for leveraging (borrowing against an asset), amplifying wealth-building opportunities.

-

Passive Income – Rental properties generate cash flow, providing income streams beyond wages.

-

Tax Benefits – Real estate owners can take advantage of tax deductions, depreciation, and capital gains benefits.

According to the Federal Reserve’s Survey of Consumer Finances, homeowners have significantly higher median net worth than renters. While individual cases vary, real estate remains a key asset class for long-term wealth accumulation.

How do we contact you if we want to buy a home or sell one? 901 878-3308 HarburRealty.com

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

TOPICS COVERED BY MARK RULEMAN, RULEMAN ASSET MANAGEMENT & PLANNING

__________________________________________________________________]

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

and SHERRY HARBUR OF HARBUR REALTY.

Changes are coming and with changes we have volatility.

Mark recommends playing the long game in investments. The move for bringing oil production back to the US should help keep prices and inflation down,

Tariffs may cause more volatility . The Fed will jawbone to try and get their rates down

Artificial Intelligence will allow us to do more with less. Bringing costs and inflation down.

Mark says he is not an ecomomist He seeks out people who are wise Ed Yardini is one of the the people he quotes and follows.

Get organized to take your opportunities with changes occur in your life. For example, retiring, employer lays you off or health issues.

.

When you know ahead of time about changes, you can prepare.

Levers to help you prepare to deal with changes. Being a long time saver, will allow you to live from your savings for a little while if you hit a bump in the road,

Mark says he sees First possible scenario :

we are going into a low inflation time in the next few years. He sees us in the “Roaring 20’s.” (The real Roaring 20’s did not end well)

Second possible scenario: 90’s 5 years of 20% returns in the stock market that had never 2nd occurred before. We have just had 2 really good years in the stock market.

Last scenario—The wheels come off Geo political challenges

You Don’t Know Until You Do The Numbers

Jo Garner and Sherry talk about some of the trending real estate situations .

Harry Homeowner has been living in his home for over ten years. He wants to sell his house and move outside the city and be closer to his family. Harry Homeowner has been putting off moving because he does not want to part with his old mortgage at 3.875%.

“I really want to move, but I would be kicking myself for giving up a 3.875% rate and having to make a much higher mortgage payment when I buy a new home.”

Are you really going to have to make a higher house payment when you buy your next home, Harry?

Let’s do the numbers. Numbers won’t lie. They can answer the question.

Harry Homeowner purchased his old home over ten years ago. The price on the house was $325,000 and his mortgage was $300,000. The principal and interest payment on his 30-year fixed rate mortgage was $1,410/month. Today Harry’s house is worth $550,000 and he only owes about $200,000 on his mortgage.

If Harry buys the house he REALLY wants outside the city, he would have to sell his house and pay about $575,000 for the new home. The new rate would be around 6.75% on a new 30-year mortgage. But, Harry can put down $325,000 on the new home from his profit selling his old home. ($550,000 old home selling price minus $200,000 amount owing on his old mortgage=$350,000 net profit from sale.)

If Harry jumps out there and buys the house he REALLY wants for a $575,000 house, sells his old house and makes a down payment of $325,000, the monthly principal and interest mortgage note would be approximately $1,621/month –only $200 more per month and he is now living WHERE he wants to live the WAY he wants to live.

If Harry had bought a home outside the city that was price less than his current home, he could actually pay LESS per month, even though he was paying a higher interest rate on the new loan.

What if you can’t sell your current home right now but you REALLY want to buy a home somewhere else. Are you delaying how and where you want to live because you can’t get he money out of your old house until it is fixed up and ready to sell ?

If your income and credit can qualify for both the mortgage on the old house and the new mortgage on the new home, you have several options.

Scenario 1: Temporary bridge loan secured on some of the equity in your old home.

You would have to be able to make the payment on the first mortgage and the temporary bridge loan secured on your old house until you sold the old house. Then you would take the profit on selling the old house and pay off both mortgages.

Scenario 2: A piggy-back second mortgage secured on the new home. You would have to make the first mortgage payment and a separate 2nd mortgage payment until you could pay off the 2nd mortgage.

(You can take the profit from selling your old house and pay off the 2nd if you prefer)

Scenario 3: New Mortgage with a future RECAST option.

(On this scenario there are no second mortgages. You pay the minimum down payment and have a high mortgage balance with a high mortgage payment, until your old house sells later on. When your old house sells, you take the profit and make a prepayment to principal over well over 20% of the unpaid balance.

If you have a recast option on your new mortgage, the mortgage company can recalculate your mortgage payment to reflect the lower loan balance. A Recast is NOT a refinance. The mortgage company does not change the interest rate, but applies the large down payment you paid down later, after selling your old home, and amortizes the lower balance over the remaining years of the mortgage. I

It brings the amount of the monthly payment lower.

You don’t have to understand all the in’s and out’s of these financing scenarios. Just call me and it does not take very long to answer these questions.

Realtor Sherry Harbur shared a story of one of her young real estate clients who is a member of the Generation Z demographic who is buying a duplex for their first property. This client plans to live in one side and rent the other side for income.

Real Estate Investors: How do investors make money on buying rental property?

Sherry Harbur talks about how investors take different paths to making money buying investment property. If the investor is looking for a positive cash flow right up front, they are putting more cash down than in previous economic cycles because the higher interest rates make the mortgage payment higher.

Other investors are paying all cash.

These investors are looking at the long game, with expectations that their biggest profit will come from home prices continuing to rise.

More cash down payment so the mortgage payment is lower. This way the investor has a better chance of enjoying a positive cash flow from rents coming in

Other investors who have enough net worth to be allowed into a real estate buying syndicate, can invest into part ownership of a real estate syndicate. In other words you own a fraction of a group of real estate properties with other investors. No middle of the night calls from tenants. No complicated accounting .

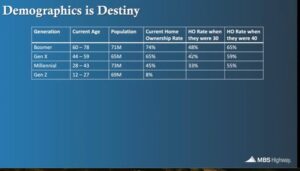

FUTURE FOR HOME VALUES – assuming Generation Z and Late Milliennials buy homes at the same rate as Early Milennials Gen Y and Boomers at age 30 and age 40. If this happens, we will see a burgeoning first-time homebuyer market over the next 10 years. We do not have enough affordable homes in the supply to meet the demand from these emerging market segments.

We currently are seeing 1.9 Million new households being formed each year but we are only creating 1.3 million new homes per year.

Check out this demographic chart from MBS Highway

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK

SHERRY HARBUR’S TIP (1.5 MIN)

Real Estate Tip #2

Real Estate may ebb and flow in value with the market trends, but it continues to rise in value —

While investors and homeowners wait on the fence for interest rates to go down, they often miss out on equity and appreciation growth in that waiting time.

Moral of the story — those sitting on the fence lose momentum in their real estate wealth building process.

Fence sitting is not advised! Call us or your realtor today to take advantage of locking up your assets while they are available.

MARK RULEMAN’S TIP : (about a minute and a half)

Jo Garner’s mortgage tip

What do YOU want to accomplish with YOUR mortgage? I have the knowledge and experience. Let’s look at traditional mortgage products, alternative mortgage products and even combinations of products. I can help you get you what you need and make the mortgage process EASY. Jo Garner, Mortgage Loan Officer 901 482-0354 www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Independent Planning Group’s conference room 110 at Clark Tower 5100 Poplar Ave 1st floor Memphis, TN

(Thank you Manny Corless and Ben Hunter (615-601-0568) outstanding Financial Professionals at Independent Planning Group for being Talk Shoppe’s location sponsor)

Talk Shoppe on Wednesday February 5th, 2025 “The Secret of Success Process” James Powell, Editor, Author and Speaker iamrenford@gmail.com

o to www.TalkShoppe.com and click the Events tab for the link to get into the event online.

Talk Shoppe could not offer the free educational networking events free to our community without some very giving sponsors.

Thank you to Talk Shoppe sponsor Real estate attorneys, Rob Draughon and Shelley Rothman of Griffin, Clift Everton and Maschmeyer. For your home purchase or refinance title work and closing, call Rob and Shelley at 901 752-1133.

Talk Shoppe is free to you because of the generosity of people like Brett Carter of ServiceMaster by Cornerstone. When you experience a fire, flood, or biohazard at your home or office, don’t go it alone, call Brett Carter at ServiceMaster by Cornerstone (901) 832-6005

6. Subscribe today for weekly podcasts with show notes at www.JoGarner.com

Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE DOES NOT ENDORSE 100% OF THE CONTENT ON THIS EPISODE. REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY, AND NOT AN OFFER TO LEND. EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND MOST ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS. JO GARNER IS A LICENSED MORTGAGE LOAN ORIGINATOR. (EQUAL HOUSING OPPORTUNITY)

QUOTE CORNER:

REJOINDERS:

-

Craig Jennings of Avalon Capital (Hard money lenders) 901 417-8427

-

Genell Holloway of Eagle Hollow Enterprises (health benefits ) 901 653-5323

-

Rob Draughon and Shelley Rothman of Griffin, Clift Everton and Maschmeyer 901 752-1133

Transitional Music: “Dollar Is What I Need by Aloe Blacc; “Money Changes Everything” by Cyndi Lauper; “Money” Pink Floyd; “Taking Care of Business” by Bachman Turner Overdrive for the Talk Shoppe Business Tip

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

On Amazon and Barnes and Noble

ABOUT MARK RULEMAN, WEALTH MANAGER

MARK B. RULEMAN

Wealth Manager

Ruleman Asset Management & Planning

A Wealth Strategy Boutique

35 years as financial advisor

Discretionary money manager for 27 years

Financial planner for 22 years

Previous property manager

901-800-2329. www.markruleman.com

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

www.JoGarner.com (901) 482 0354 jo@jogarner.com X @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating

*Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”