Do you want to buy a home, but the home price and the mortgage payment is making it difficult to fit your budget? Here are financial tweaks you can use to make your home purchase and your mortgage more affordable. Clint Cooper of Redeemers Group is sharing how to determine if you have a problem with your home’s foundation and how to fix it.

Let’s stay connected! Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

Host: #JoGarner #MortgageExpert (901) 482-0354

Co-host: #ClintCooper #foundationrepair www.RedeemersGroup.com

#memphismortgage #foundationrepair #realtors #mortgageofficers #homeowner #homebuyer

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our general topic THROUGH WEATHER FOUL OR FAIR-KEEPING YOUR HOME AND FINANCIAL FOUNDATION FIRM. Today is July 27th, 2024 Call us in the studio while we are live at 901 535-9732

INTRODUCING Clint Cooper of Redeemers Group

(Jo) Our special guest on Real Estate Mortgage Shoppe today is Clint Cooper of Redeemers Group specializing in home foundation and basement repair. Clint, your company has made it multiple times to the Inc Magazine list of top 5,000 companies in the nation. You have also been voted best place to work. (Clint Cooper has about 1.5 min to intro himself and talk about the services he offers)

(Jo) As a mortgage officer for over 30 years, I have seen lots of change happening. Changes in people’s lives like getting married, having babies, job relocations, job losses, divorces, illnesses, death of a spouse or parent, and changes in the financial markets. It was a pleasure getting to know these customers as we discussed their plans to purchase a home or restructure their finances with a mortgage. The customers who planned ahead for the unexpected by harnessing their spending and keeping a healthy emergency fund -these were the people who could ride out an unexpected financial storm.

The Ant and the Grasshopper-Aesop’s Fable about Preparation

In a field one summer’s day a Grasshopper was hopping about, chirping and singing to its heart’s content. An Ant passed by,bearing along with great toil an ear of corn he was taking to the nest.

“Why not come and chat with me,” said the Grasshopper,”instead of toiling and moiling in that way?”

“I am helping to lay up food for the winter,” said the Ant,”and recommend you to do the same.”

“Why bother about winter?” said the Grasshopper; we have got plenty of food at present.” But the Ant went on its way and continued its toil. When the winter came the Grasshopper had no

food and found itself dying of hunger, while it saw the ants distributing every day corn and grain from the stores they had collected in the summer. Then the Grasshopper knew: It is best to prepare for the days of necessity.

HOW TO MAKE YOUR MORTGAGE MORE AFFORDABLE

Do you want to buy a home, but the home price and the mortgage payment is making it difficult to fit your budget? Here are some things you can do to make your home purchase and your mortgage more affordable:

-

Save more money to use for a larger down payment. The smaller loan amount allows you to enjoy a lower mortgage payment. Have you thought about borrowing against your 401k retirement fund instead of pulling the money out for the larger down payment? Gifts from family? Applying for down payment assistance?

-

Boost your credit score: The higher your credit score, the lower your mortgage rate and the more affordable your mortgage payment.

-

Pay off debt: You don’t have to pay off your debts completely. Paying your credit card balances down to show that you only use less than 25% of your credit limit on each card, has helping many of my clients enjoy a lot higher credit. Some of my clients have managed to restructure their debt without having to pay all of it off in order to make the new house purchase more affordable. I know plenty of ways others have done this successfully. Let’s explore YOUR options.

-

Find ways to make your house pay for itself: Check the covenants and restrictions for your neighborhood (Rent out the bonus room, move your office to your home, rent space for people to store their stuff, rent parking spaces, grow your own garden. Subdivide your land and more)

-

Research loans and assistance: Government-sponsored loans like FHA , VA. USDA , traditional conventional loans, can offer lower, fixed mortgage rate programs

MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, LET’S DO IT TODAY. Connect with me at www.JoGarner.com. Email me at Jo@JoGarner.com or just call me at (901) 482-0354.

(Jo) Clint Cooper of Redeemers Group. You are the expert on home foundation repair issues. What are some topics you are going to be covering after the commercial break? (Clint can give a preview or start launching into some of his topics until the 9:15 am break)

OUTRO: You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. What do YOU want to accomplish with YOUR mortgage? I can make the mortgage process EASY for you with the right mortgage. Connect with me at JoGarner.com When we come back, we will be hearing more from Clint Cooper of Redeemers Group.

2ND SEGMENT 13 MINUTES

2nd segment 9:18 am – 9:30 am

2nd segment after 9:15 break—It’s time for the Look Back Memphis Trivia Contest. The Look Back Memphis Trivia Contest is brought to you by Memphis notable historian, Jimmy Ogle www.jimmyogle.com,. Our Look Back Memphis Triva contest is sponsored by Mike Aukerman, a home inspector with National Property Inspections. Before you buy, call Mike Aukerman of NPI at 901 678-6868. Mike Aukerman is giving away a $50 gift card to the first person with the correct trivia answer. If YOU know the answer to our our trivia question, call us at 901 535 WREC 901 535-9732.

Garner # 140 * 10/06/18

Berry Brooks

Question: I started on Cotton Row in 1922 and retired in 1972 as the head of my own cotton firm. Who am I?

Hint: I gave lectures at the Goodwyn Institute for 28 years and featured my film “Passport To Safariland” there.

Hint: I owned almost 300 acres in Raleigh that later became a country club.

Final Hint: In 1973, I was the first American inducted into the Hunting Hall of Fame.

Answer: Berry Brooks. Pink Palace visitors from 1948 to 1975 were fond of visiting the Berry B. Brooks African Hall. Brooks was a respected Memphian with a reputation as a huntsman, naturalist and conservationist. He was also a civic leader who was generous with his time, finances and big game trophies. Brooks was born in Senatobia, Mississippi, in 1902 and moved to Memphis when he was 12. He attended Washington and Lee University and then worked as a clerk before starting his own cotton company in 1929. Cotton gave him the resources he needed to engage in his favorite activity—big game hunting. In 1947, Brooks took his wife and daughter on his first of four African safaris. In addition to his hunting, Brooks also made films while on expeditions and gave a series of lectures for both the Goodwyn Institute and the museum. In 1973, Brooks was the first American elected to the Hunting Hall of Fame.

-*++++++++++++++++++++++++++++++++

TOPICS COVERED BY CLINT COOPER OF REDEEMERS GROUP

Issues in your home when we have rainy weather in a hot/dry climate

Topics:

what this scenario does to the soil

how this change in soil affects your home

symptoms to notice with these changes

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

-

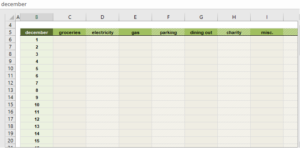

What is a quick and easy way to come up with a budget?

![]()

Get to the truth about your income and expenses.

The head of the finance team at our church was affectionately called Baaba Lou. We called him that because he and his wife served in a school in Zambia for a number of years, and the children called him Baaba, meaning “father”.

Lou was brilliant at budget counseling because he and his wife had lived through tough times and used the principles he taught to create wealth.. So many people found themselves spending more than they earned either because of loss of work, medical expenses, or legal bills. Here are some easy steps Lou suggested to get on track with your budget. As Lou Celli’s assistant, I got to witness families like the Hopkins (not their real name) finally enjoy financial freedom when they applied the steps of his program. Here’s how the Hopkins worked the budget program:

.Step 1: Set a timer for one or two hours and hit play on your favorite tunes. Commit to spending every minute of this time going methodically through each bank and credit card statement.

Just commit to go through the last four to six months bank and credit card statements if that is all you can do.. Don’t forget the car tags and other bills you pay once or twice a year.

Step 2: Assign a category for each expense. Record vendor and the dollar amount under designated expenses categories like mortgage, house expenses, car expenses, food, taxes, medical expenses, more. Remember the bills you pay less frequently like car tags, property taxes, homeowner’s insurance, and so on.

TIP: Check out apps online that can help you make the budgeting process not so daunting.

Step 3: Tally all expenses. Now is also a good time to examine each item. Where can you cut back?

Step 4: Determine your true income from pay stubs and bank deposits. Be sure and record your net income, after the deductions.

Step 5.: (Bargain) Ask for discounts. Call companies and see if you can get a discount on their products or services. One client succeeded at negotiating a much lower interest rate on his credit cards. He socked away quite a bit of savings just from this one step! You have not because you ask not. Why not ask?

Step 6: (Substituion) Replace higher cost items with comparable lower costs items.

When shopping and dining, don’t be afraid to ask questions to find the bargains.

Lou also taught me to find budget items that could be replaced with something similar but less costly. For example, if you love having pizza delivered to the house once a week for you and the kids, try buying some great frozen pizzas from the grocery store. Throw them in the oven while you are busy around the house or, even better, while you’re resting. Pizza is ready in 15 to 20 minutes and you paid a lot less for heating them in your oven than having them delivered from someone else’s.

(Sharing and Bartering) Personally I have shared my HULU account with a friend who was a single parent and on a budget. It didn’t cost me anything extra to do this. I have traded golf lessons from my golf pro buddy in exchange for teaching her how to play drums. Over that 3 year time span, I learned how to play golf, saved a bunch of money and enjoyed a fun friendship.

Step 7: Now you know the maximum house payment you can comfortably afford.

The Kenner’s story- Creating the Home The Wanted One Step At A Time

Ms. Kenner (not their real names) who gradually upgraded and added features to the home they purchased until they could eventually make the home everything they wanted.

Jerry Kenner and his wife had a few tough breaks in life with health issues and helping their adult children get to a place where they could support themselves. What they really yearned for was a house with a sunroom, a deck, a small pool and a not-so-small workshop for Jerry.

The Kenners’ challenge- There was no such house available on the market and nothing anywhere even similar in the price range they could afford without putting a lot of money down. But they would never be able to have this dream come true in the little house where they had raised their children for so many years. .

The Kenners’ Strategy- The Kenners’ realtor really listened to what they wanted but knew their financial limits. The Kenners had prioritized the things about the house were the most important to them and given their wish list to their real estate agent.

Since the Kenners were now empty-nesters, they could buy a home outside the crowded city neighborhoods with not so many strict covenants and restrictions and zoning rules. Their agent helped them find the perfect house in a more rural area with enough space so that, over time using money the Kenners gradually saved and using some of their home equity line of credit money , Jerry and his wife could build their sunroom one year, the deck and the small swimming pool another year and the not-so-small work shop too. But Jerry opted to build the workshop first.

What do YOU want to accomplish with your mortgage? I can make the mortgage process EASY. Connect with me at www.JoGarner.com

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK

Clint Cooper has about 1.5 minutes to share a real estate tip: Fix any foundation problems quickly before they become bigger and more expensive.

Jo Garner’s mortgage tip:

Credit tips Keep revolving accounts showing where you use less than 25% of the credit limits on each card

Stay away from 12-months-same-as-cash accounts

Pay bills on time

If the collection accounts are old, you might be better to pay them off AFTER you buy your home and not before.

Connect with me, Jo Garner,licensed Mortgage Loan Oifficer, at JoGarner.com (901) 482-0354.

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday July 31st , 2024 9AM CT

This Wednesday July 31st, Talk Shoppe will be meeting in an alternate location Talk Shoppe will be sponsoring the “Meet & Greet Business Networking Mixer” This event will be hosted by Mid-South Home Helpers at their place of business at 5865 Ridgeway Center Parkway Ste 300 Memphis, TN For more info about Talk Shoppe and the special location on this date, go to www.talkshoppe.com/upcoming-events

Talk Shoppe is free to you because of the generosity of our sponsors

Like Ben Hunter and Manny Corless of Independent Planning Group. Contact Ben Hunter at (901) 831-0051 and Manny at mcorless@iplanninggroup.com

3. Here is a shout out to Yates at Yates Electric in Menphis for your great service and affordable cost for home electrical work If you need electrical work done at your home or office, call Yates at Yates Electric at 901 351-7470

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

REJOINDERS:

-

-

Leah Anne Morse of All Things New (Moving company and organizing service) 901 488-9733

-

Ed Hill of Masters Roofing in Bartlett, TN 901 273-6594

-

Tim Flesner of Mid-South Home Helpers (901) 414-9696

-

Transitional Music: “

“Stormy Weather” by Billie Holiday; “Riders on the Storm” by the Doors; “Feeling Stronger Everyday” by Chicago; “Memphis” by Johnny Rivers for the Look Back Memphis Trivia Contest

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

ABOUT CLINT COOPER, owner of REDEEMERS GROUP

-

Clint was born and raised outside of Nashville, TN and is a graduate of MTSU.

-

He served in Iraq with the Marine Corps Infantry before returning home to Tennessee to live and work in Memphis.

-

In Nov 2007 he started Redeemers Group.

During his time with Redeemers Group, Clint has published several articles on his areas of expertise. Most recently his first book entitled “Mold Prevention Science” was published and is used by entire the Basement Systems and Foundation Supportworks’ network of dealers to help them communicate with their clients about mold and mold prevention. He teaches CE classes for Memphis Areas Association of Realtors several times per year.

He has also earned the following certifications and licenses:

-

Basement Systems Waterproofing Certification

-

Basement Systems Crawl Space Repair Certification

-

Foundation Supportworks Diagnostics School Certification

-

National Association of Mold Remediators and Inspectors License

-

Blue Institute- LEED Training Certification, Member ID#:

-

Green Building Council, Certification

-

TN State Board for Realtors CE Authorized Instructor

Clint lives in Germantown, TN with his wife and two children.

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

(currently working with Everitt Financial dba Supreme Lending)

ONLINE LOAN APPLICATION : https://jogarner.supremelendingLO.com

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in helping her clients find the right mortgage program and making the refinance or home purchase mortgage process EASY. She offers conventional, FHA, VA or other loan programs for primary residences, second homes and investment properties.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 30 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 30 years.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes

Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”