What do you want YOUR life to be like? What do you want people to say about you? Who do you want around you on life’s journey? Does buying a home, renovating a home or restricting your debt play a part in getting you to where you want to be?

Today on Real Estate Mortgage Shoppe we will be sharing some wisdom from the pros on renovating your home. I will be sharing success stories of people who got a vision of what they wanted and steadily worked until they had it.

Host: #JoGarner #MortgageExpert I can help make your mortgage process EASY 901 482-0354

Co-host : #NicholasSammons #truvinerenovations (901) 313-6424 www.truvinerenovations.com

Also #CameronRuddle #truvinerenovations

Subscribe to get weekly Real Estate Mortgage Shoppe podcasts, show notes and pictures at www.JoGarner.com #memphismortgage #901renovations #mortgage #realtor #homeowner

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast

listeners across the 50 states! . Today is March 16th, 2024. Call us in the studio while we are live

at 901 535-9732.You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our topic today is YOUR HOME RENOVATION & YOUR MORTGAGE-THE POWER OF VISION FOR A BETTER LIFE

. Thank you to real estate attorneys, Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer Law Firm for sponsoring this episode of Real Estate Mortgage Shoppe. When you are ready to buy a home or refinance one, call attorneys Rob Draughon and Shelley Rothman at 901 752-1133 to take care of your real estate closing.

INTRODUCING NICHOLAS SAMMONS, TRUVINE RENOVATIONS

For the first time in the Real Estate Mortgage Shoppe studio we have home renovation expert, Nicholas Sammons, owner and contractor with TruVine Renovation and Cameron Ruddle of Tru Vine.s. Nick Sammons, you have built a good business with an A+ Better Business Bureau rating. Please tell our listeners a little bit about yourself and the services you offer your clients at Truvine Renovations. ( Nick has about a minute and a half to introduce himself and talk about the services he offers his clients)

(Jo) CLEAR VISION GIVES YOU ENDURANCE TO GET WHERE YOU WANT TO GO

Nick Sammons , just like you help people get a vision for how they want their homes to look once you have redesigned and renovated their homes, I help people design their FINANCING to help make their vision a reality.

Getting a vision in mind of what you yearn for your life to look like reminds me of something my sales coach told me a while back. He said, “When you have clear vision, you will have greater endurance. “

DIANA NYAD’S STORY

Then he told me the story of Diana Nyad, the first person known to swim from Cuba to Florida unaided. Diana tried several times to accomplish this goal and failed. Once she was attacked by a jelly fish. Another time she tangled with some aggressive sharks, but most of her failures came from sheer fatigue.

The final time she made the attempt to swim from Cuba to Florida, she was becoming extremely tired just in times past. But this time her coach, who was on a nearby boat, looked up and started yelling to Diana, “ Look up at the light! Do you see that light ahead?”

Diana was so worn out as she swam. She could barely see a light in the distance and thought it was a sunrise. Her coach started waving his arms and yelling louder, “That light is on the Florida coastline! Don’t give up, Diana! Keep swimming!” Once Diana got the clear vision of the Florida coastline, a new flood of adrenaline pushed her forward with a new endurance that bolstered her across to accomplish her vision. (By the way, Diana Nyad was in her 60’s when she made this record-breaking swim.)

USING VISION BOARDS TO GET WHERE YOU WANT TO GO

Who do YOU want to be as a human? What does your home and your home life look like the way you – 3 dwant it to be? How do you want your family situation to be? Do you want children, friends in your home? How to you want to feel on a typical day in your life? What do you want people to be saying about you?

I challenge you to build a vision board for yourself. My retired US Navy friend convinced me to make one and they really work. Print pictures that represent the way you want your life to look and feel– your home, your work and more. Cut pictures out of magazines, print pictures that you find online and paste them on your vision board. Then put your vision board where you can see it everyday and watch what happens.

I have been in the mortgage business for more than 30 years and have seen so many ways real estate has fortified a good life for my customers. I believe that you can accomplish ANYTHING owning real estate. And if you buy it right and keep buying more of it, the possibilities are endless on what you can do in life for yourself and others.

Make your plan. Let’s work your plan. If the deal works for you today, let’s do it today. I can help you find the right mortgage program and make the mortgage process easy. Connect with me Jo Garner, Mortgage Loan Officer at www.JoGarner.com

Nick Sammons of TruVine Renovations, take a few minutes and let’s keep talking about the power of creating a vision of what you want to do with your home and your wisdom on home renovations

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. What do YOU want to accomplish with YOUR mortgage. I can make the mortgage process EASY. Call or text me at 901 482-0354 or at JoGarner.com

When we come back we will be hearing more from Nicholas Sammons, owner and contractor for TruVine Renovations. See you back in just a moment.

TOPICS COVERED BY NICHOLAS SAMMONS OF TRUVINE RENOVATIONS

-

How to choose the right contractor?

-

Licensed/Insured – do a fact check

-

Contracts & Clear Scopes of work

-

Who do you trust? Who understands your needs the most?

-

-

What does a remodel cost in 2024?

-

Depends on your specific needs and who you hire

-

Prices have gone up

-

The higher the price, the more value you should get

-

-

What are common maintenance practices?

-

Keep it clean. No harsh chemicals.

-

Recaulk every 3-5 years

-

Have your contractor educate you

-

-

What are new trends in 2024?

-

Bright, white, and open is not changing

-

Sage green and light wood tones are making a come back

-

Feeling of nature and peace in the home

-

-

Is the culture of contracting changing?

-

Yes. Boomers are leaving the trades

-

Yes. Clients are tired of fly by night contractors

-

Yes. Youth is coming in and not taking traditional college route

-

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

The right mortgage can get you quicker to the life you want…

The whole subject of renovation and repair loans reminds me of a this story

RENOVATION AND REPAIR LOAN- GI JERRY- FINDS HIS FOREVER HOME (BUT IT NEEDS WORK)

![]()

My phone was buzzing. When I picked it up a realtor friend was on the line. “Jo, you know I have been selling homes for many years but this client we just have to give him some extra help.”

The realtor, a former military veteran, told of his elderly client who also was a veteran. After his years in the military, our customer GI Jerry spent most of his life driving an 18-wheeler. He never bought a home because he stayed on the road all the time. Now he was a widower and retired. The restless feeling he had fought off over the years since getting out of the military really tugged at him how. He wanted to have his own home where he could put his feet up on his own front porch.

A few years went by and Jerry would go look at houses for sale. “There were some really big ones, “ he said. “There were some really pretty ones, but they didn’t feel like home.”

One day Jerry convinced his realtor friend to take him to see a home that had been sitting on the market for several months. The realtor advised Jerry that the old house was a waste of time. “It’s abandoned. It’s in terrible condition. No lender is going to want to lend on that house.”

But when Jerry stepped through the front doorway, his mind and his heart resonated with a blissful, secure feeling of being home. He told the realtor and later told me, “No rhyme or reason—I just FELT peace when I stepped through the door. I KNEW I can rest here. I was finally home.”

The roadblock for Jerry was the condition of the old home. But the realtor and our mortgage team went to work. We helped him get a good contractor with a itemized bid on what it would costs to fix up the old place.

We ended up getting Jerry approved for an FHA 203K renovation and repair loan so he could go ahead and close on his home and get draws from the repair escrow account gradually as the work was completed. Within a couple of months Jerry was able to move in to his newly renovated Home Forever Sweet Home.

If Jerry did not use the special renovation and repair loan, he would have been caught in a Catch-22 because the lender would not give him the mortgage until the structural repairs were done, but Jerry would not be able to do the repairs until he had the mortgage and owned the home. What do YOU want to accomplish with YOUR mortgage? Make your plan. Let’s work your plan. If the deal works for you today, let’s do it today. Call me so I can hear YOUR story (901) 482-0354 JO@JOGARNER.COM www.JOGARNER.com

Linden Lancey’s Story—4-Bit Budget, Big Dreams—and a Brilliant Idea

![]()

Linden Lancey (not her real name) reached out to me via email. She was a first-time homebuyer with big dreams but with a limited amount she could pay for a house note.

Kudos! to Linden for taking a full inventory of what income she had coming in each month and how much of her hard-earned money marched out each month to pay her bills. She knew her own comfort level on what she could pay down and how much she could comfortably pay per month. She told me no more than $1,200 per month and no more than $5,000 down.

Linden also knew all the things she wanted for her home. She knew the general area where she wanted to live and all the built in gadgets, bonus room-over-the-garage workshop and sitting areas with a view she had to have in the place she would call home.

But, the problem was …the home she wanted would tie her down with a monthly payment of $1,500 per month ($300 per month over her maximum comfort level.) The down payment plus some other costs would strap her with $7,000 to $10,000 depending on how much the seller would be able to help with her costs. She would be dipping into her emergency fund to pay out almost double the amount she was comfortable paying.

Linden’s voice wavered a bit, the enthusiasm dying off to resigned sigh, like someone giving up after almost winning a race. She really wanted her own home and she wanted it to be all that she dreamed but now it seemed financially out of reach. She and I talked a little more.

I shared my personal story of learning from my mortgage clients over the years how to buy a home that needed some upgrades and clean up. My first home needed a LOT of things. But I started right away gradually adding things to my first house, like replacing an old sliding door with beautiful French doors, and building the pantry I wanted in the empty corner of the kitchen. Over the years living in my first home I scrapped the linoleum and added ceramic tile to the kitchen and bathrooms. Then added amenities to the front garden area, the garage and more.

I confessed to my client Linden Lancey that it was fun each time I was able to do that extra improvement. It was really a celebration when, one day, I sold the house and made a nice profit so that I could continue leveraging up on the quality of my personal home which feels like my castle.

Linden was hanging up to call her realtor. Our conversation had already sparked some of her own ideas on how she could buy a lower priced home in the area she wanted to live and gradually finish out the bonus room upstairs to make into her dream work shop. She was off to find the home she would love.

How do I get financing when the house I want requires repairs?

If you have repairs that fall under the category of Structure, Sanitation and Security of the home and the appraiser mentions these repairs on the appraisal, your mortgage company is probably going to require these type repairs to be completed BEFORE closing.

If you are in that situation, feel free to call me and we can discuss specific remedies you may be able to use, depending on your situation

Renovation and Repair Mortgage Programs

Negotiating the seller to pay for the repairs, especially if you are paying full price or a little over full price. The seller might only agree to pay for the repairs if you are fully approved with the mortgage company you are using.

If the repairs are weather-related and the weather is not suitable to complete the repair, OR windows or other components are on back order, you might be able to put up 1.5 times the cost of that repair and hold it in escrow at closing until you can get the weather-related repair completed or the components are delivered and installed. If the cost did not exceed the quote, then you would get back the extra half percent you paid into the escrow account.

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK –Nick Sammons of Truvine has about one minute and a half to share a tip about home renovations

Jo Garner’s mortgage tip: There is a solution to every challenge As you start take action toward the life you want, you will run into obstacles. Don’t give up. Explore all of your options. If you want to buy a home or get cash out on a refinance of your home to restructure your debt, let’s find the mortgage program that will be your best fit.

Please call me, text me or connect with me however you wish. I would like very much to be on your mortgage journey, whether you are here in the Mid-South or wherever you are in the country. What do YOU want to accomplish with YOUR mortgage? I can help you find the right product and make the mortgage process EASY.

(901) 482-0354 Jo@JoGarner.com www.JoGarner.com

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday March 20th, 2024 9AM CT “Wellness of Working Past Retirement Age” Connie Horton, Business/Leadership Consultant Pina Elite Restaurant Group. This is a Health Talk powered by Resource4care, sponsored by Home Helpers-Home Care with a Heart and hosted by Talk Shoppe.

Talk Shoppe events are free thanks to sponsors like Peggy Lau of Club Seacret If the life you want includes first-class vacations with people you care about, Peggy Lau of Club Seacret can show you how to get those first-class vacations at a bargain price. Contact Peggy Lau at 901 289-0747.

3. Thank you to Talk Shoppe’s business coach, Vincent Demps of Masterchek.com Masterchek does investigations to protect your business from cyber criminals. Masterchek can investigate insurance claim fraud and more. Contact Vincent Demps at 901 799-1003

4. Subscribe at www.JoGarner.com and you can get our weekly blog posts with podcasts conveniently in your inbox.

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER Ben Francia—“ The distance between your dreams and reality is called action”

____________________________________________________________________________________

REJOINDERS:

-

Sherry Harbur of Harbur Realty 901 878-3308

-

Ed Hill of Masters Roofing 901 273-6594

-

Craig Jennings of Avalon Capital 901 417-8427

Transition Music “Handyman” by Jimmy Jones; “Live Your Dream” by MSK & Sparsh Dangwal;; “Million Dreams” by Pink; ;

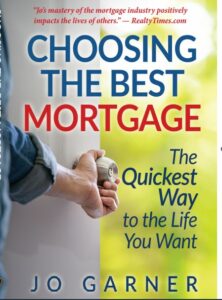

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

ABOUT NICHOLAS SAMMONS, TRUVINE RENOVATIONS

Nick is the owner of TruVine Renovations and is a seasoned professional with experience in the contracting world since 2008. A simple yet powerful mission drives him: to “do the right thing.” This ethos was born from his experiences in the industry—witnessing practices he alike.

The turning point came during the Covid-19 pandemic, sparking the inception of TruVine Renovations. With a faith-based approach that’s evident in action rather than words, Nick has built a company that stands out for its integrity, quality, and commitment to truly making a difference in the homes and lives of its clients.

901 313-6424

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes and Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”