Today on Real Estate Mortgage Shoppe, we will be going over some of the City of Memphis down payment assistance programs offered to qualified homebuyers.

What do YOU want to accomplish with YOUR mortgage? I can make your home purchase or refinance mortgage easy for you. Let’s stay connected! Call or text me at 901 482-0354. Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

Jo Garner, Licensed Mortgage Originator NMLS# 757308 (901) 482-0354 Jo@JoGarner.com

Host of Real Estate Mortgage Shoppe and author of “Choosing the Best Mortgage-The Quickest Way to the Life You Want”

Ashley Cash, Director of the Division for Housing and Community Development for the City of Memphis https://www.memphistn.gov/downpaymentassistance/

(1st segment 9:06am to 9:15Am)

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! . Today is July 22nd, 2023. Call us in the studio while we are live at 901 535-9732.You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Originator. You can connect with me at www.JoGarner.com. Our general topic 2023 CITY OF MEMPHIS DOWN PAYMENT ASSISTANCE UP TO $25,000 FOR QUALIFED HOME BUYERS. Thank you to real estate closing attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer for sponsoring this episode of Real Estate Mortgage Shoppe. Connect with Rob and Shelley for closing your home purchase or refinance transaction at 901 752-1133.

Introducing Ashley Cash, Director of Housing and Community Development Memphis, TN

INTRODUCING ASHLEY CASH, DIRECTOR OF HOUSING & COMMUNITY DIVISION, CITY OF MEMPHIS

In the co-host chair we have for the very first time Ashley Cash, Director, Division of Housing & Community Development for the City of Memphis. Ashley, you have worked over the past ten years in varying areas of community development. Your work has centered on quality-of-life planning and ensuring that all neighborhoods have equitable access to basic needs, opportunities, and amenities. You are experienced in managing and implementing complex projects and leading teams to success. You certainly have brought some hope and excitement to aspiring home owners with the new City of Memphis Down Payment Assistance Program. Take a minute or so and tell our listeners a little bit about you and what the City of Memphis programs can do to help home buyers and homeowners. (Ashley has about a minute and a half to intro herself and briefly describe the programs available through the City of Memphis Down Payment Assistance Programs)

(Jo) A few days ago I was sitting in a big meeting hall full of realtors and lenders waiting excitedly to hear about the improved City of Memphis Down Payment Assistance program being launched that week. The down payment assistance programs offer up to 10% of the sales price or up to $25,000, whichever is lower. The buyer is required to invest 1% of the home price from their own funds. But 1% is very achievable for most people. Here are some of the City of Memphis Down Payment Assistance programs that are making dreams come true for so many people and their families.

The City-Wide Program for qualified homebuyers within 80% area median income for the number in their household. These buyers can buy homes anywhere in the City of Memphis city limits.

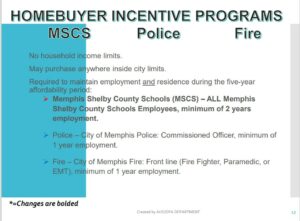

The Homebuyer Incentive Programs for Police and Fire Fighters who have been full-time working for the City of Memphis for a year or more. There are no income restrictions for these homebuyers and they can buy anywhere in the city limits of Memphis.

The Homebuyer Incentive Program for full-time employees of the Memphis Shelby County Schools who have been full-time for two years are more. There are no income restrictions for these buyers and they can buy anywhere in the city limits of Memphis.

The Homebuyer Incentive Program for Citizens who make over 80% of the median income for the area based on number of people in the household. These higher income-earning borrowers are limited to designated zip codes in the city of Memphis.

![]()

Gerry Glyckman (not his real name) has been serving as a fireman in the city of over a few years. His wife is currently a full-time mom taking care of their three children. The rent keeps going up and they want to buy a home closer to family for support and some help with child care.

Gerry had tried a few months ago to get qualified to buy a house, but his income wasn’t enough and he didn’t have enough money to pay for the down payment and closing costs. Back then the maximum assistance was only $10,000. I reworked the financing scenario for Gerry with the new down payment assistance terms of 10% of the home price up to $25,000 and now Gerry was only required to pay from his own funds 1% of the sales price. Gary now had enough to buy the house they wanted.

The payment was still too high. To help the Glyckman family get an affordable payment. I found a first mortgage for them through Tennessee Housing Development Agency Homeownership for the Brave, which gave him a mortgage rate about a point and a half lower than the market mortgage rates because he was a city firefighter. Now he had the funds to close with the 2nd mortgage City of Memphis Down Payment Assistance AND he could afford the payment on his special program on the first mortgage. It was time to confidently go and buy the house they wanted. Do you have a dream of owning your own home? MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, LET’S DO IT TODAY. I can make the mortgage process easy. Connect with me at www.JoGarner.com You can email me at Jo@JoGarner.com or call me at (901) 482-0354

Ashley Cash, you have been dedicated to bringing in funding & building neighborhoods &communities. Take a minute or so to tell us about what you will be covering right after our advertising break. (Ashley has about 1 min until break)

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, licensed mortgage loan originator. What do YOU want to accomplish with your mortgage? Connect with me at www.JoGarner.com When we come back, you will be hearing more from Ashley Cash, director of the City of Memphis Housing and Community Development Division. We will also hear from Trudie McClelland of United Housing Inc.. See you back in just a moment.

2nd segment is after 9:15 break from about 9:18Am to 9:30 AM break

LET’S TALK SHOP—TALK SHOPPE’S BUSINESS TIP FOR REAL ESTATE PROS:

2nd segment after 9:15 advertising break – (producer to start the song “Taking Care of Business” by Bachman Turner Overdrive –but bring the volume down before the lyrics start) It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the financial support of its sponsors. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) For our Talk Shoppe Business Tip today we have Trudie McClelland, Lending Department manager and Loan Officer at United Housing, Inc. handling the low-to-moderate-income home repair loan program. Trudie serves her clients from the heart. Trudie, you have been such a help to so many who come to the United Housing for assistance. What is our Talk Shoppe Tip for Real Estate Pros today

TIP #1 –

Homeownership education classes provide general, unbiased information to a group of people about the home buying process; how to assess readiness, how to manage money and credit, how to shop for a home, how to obtain financing and how to maintain a home after purchase; using adult education techniques and interactive activities in a classroom setting. Individual counseling sessions supplement group training by focusing on problems and issues that are specific to a particular homebuyer, such as establishing a family budget, developing a savings plan, resolving credit issues and selecting a home. In depth group homebuyer education classes develop quality homebuyers, and individual counseling provides the necessary personal attention that a potential homebuyer needs to address his or her own issues. The home purchase process is costly and complex. Most consumers, regardless of income, age or ethnicity, are intimidated by the process. At least eight hours of in-depth education and training prepares consumers emotionally and financially for the commitment and investment of buying a home, generally the largest purchase they will ever make. Homeownership is about more than the loan approval process. Consumers also need to know how to assess their home-ownership readiness, how to manage their finances and credit, how to shop for a home and financing, how to handle the closing process, and how to maintain their homes and finances after purchase in order to be successful homeowners for a sustainable period of time. It’s impossible to cover all of the necessary information well in anything less than eight hours. An in-depth homebuyer education program, consisting of at least eight hours of training, not only helps a family purchase a home but also promotes life skills that can ensure long-term success as homeowners.

TOPICS BY ASHLEY CASH, DIRECTOR OF MEMPHIS HOUSING AND COMMUNITY HOUSING DEVELOPMENT

-

New changes to the downpayment assistance program – after evaluating the program, doing market research, the City has relaunched it’s program with higher limits, a new debt to income ratio, made all MSCS employees eligible, not just teachers and raised the home price limits.

-

Taste of Memphis neighborhood event – September 7th from 5pm to 10pm. At the Memphis Sports and Events Center. The goal is to connect and engage neighborhood for a stronger Memphis.

-

Community Development – We’ve got major projects completed and underway – Memphis Sports and Events Center at Liberty Park, Historic Melrose, the former Melrose High school being redeveloped into a library and genealogy center. Southwest Twin the Plot twist predevelopment activity at Third and Raines. We have a summer blockbuster event July 29th from 4p to 8pm.

-

Affordable Housing – we’ve got funding for housing development that will be affordable for multifamily and repair or rehab of single family. Some projects underway are Tillman Cove, open by the end of the year. Edgeview and Legends Park, senior housing. Northside Renaissance – the former Northside High School. Place of Grace – north Memphis development. We’re supporting new construction for homeownership in Uptown and South Memphis with Habitat for Humanity and the Works. Additional smaller housing developments in Orange Mound, Alcy Ball, North Memphis.

-

FREQUENTLY ASKED QUESTIONS ABOUT THE DOWN PAYMENT ASSISTANCE PROGRAMS:

What are the requirements to get approved for one of the City of Memphis Down Payment Assistance programs?

-

First Time Homebuyer (define what is a first-time homebuyer) For the programs requiring household income to be less than 80% Area Median Income based on number of household members-first-time homebuyer is defined as someone who has never owned a home.

Programs for higher income borrowers define a first-time homebuyer as someone who has not owned real estate in the last three years.

-

Does the City of Memphis require both spouse to be first-time homebuyers even if only one spouse is on the loan and the title? Only the borrower who is on the title to the home is required to be a first-time homebuyer.

-

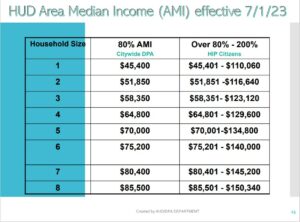

Income guidelines (see chart below)

-

Properties that are eligible-primary residence only

-

Minimum Credit score 550

-

Maximum house payment to income ratio 33%. Maximum house payment including other minimum required monthly debt payment to income = 45%.

-

Borrower required to invest 1% of the sales price from his/her own funds

-

Required home inspections from the City of Memphis designated inspection company. Inspection ordered by lender from City of Memphis inspection company on all programs.

-

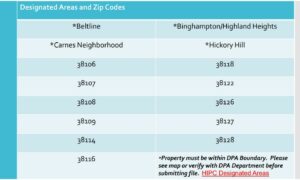

What are the designated zip codes allowed for Homebuyer Incentive Program Citizens higher income borrowers? (see chart below)

-

House payment not to go under 23% of gross income

-

Maximum sales price for programs 80% of Area Median Income and below is $300K

-

Maximum sales price for programs above 80% Area Median Income is $350K

-

Must own and occupy the property for the next five years or the down payment assistance will be due and payable for a balance of 1/5th for each year remaining of the five year commitment.

Minimum 23% Housing Ratio Rule

(3rd SEGMENT 9:35 AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

How the 2023 City of Memphis Down Payment Assistance Programs Work

Recapping the types of Down Payment Assistance Programs for 2023 from first part of our radio show:

The City-Wide Program for qualified homebuyers within 80% area median income for the number in their household. These buyers can buy homes anywhere in the City of Memphis city limits.

The Homebuyer Incentive Programs for Police and Fire Fighters who have been full-time working for the City of Memphis for a year or more. There are no income restrictions for these homebuyers and they can buy anywhere in the city limits of Memphis.

The Homebuyer Incentive Program for full-time employees of the Memphis Shelby County Schools who have been full-time for two years are more. There are no income restrictions for these buyers and they can buy anywhere in the city limits of Memphis.

The Homebuyer Incentive Program for Citizens who make over 80% of the median income for the area based on number of people in the household. These higher income-earning borrowers are limited to designated zip codes in the city of Memphis.

I told the story about a city fireman and how the Homebuyer Incentive Program for Fire Fighters finally made his family’s dream come true for homeownership they could afford.

Penny Pago’s Story

![]()

Penny Pago had been married to her career. For the first ten years out of college she was at work early and did not get home until late. Her apartment was like a crash pad and she liked not having the responsibilities of keeping up a house. She earned a good income and invested the money left over into retirement funds and other investments.

But Penny had been watching the housing market and watching her friends who owned homes get wealthier year after year. Yes, they had to spend a little more time and money maintaining their homes, but the fixed rate 30-year loan kept their house payments low and steady. The values on their homes was adding tens of thousands of dollars to their net worth yearly.

Penny decided she wanted to buy a home too. Penny called me to see if she could get a mortgage preapproval letter. She told me the house had a beautiful stone exterior and brought back wonderful memories from her childhood. She wanted this house.

She was a first-time homebuyer but her income exceeded to the low-to-moderate 80% of the area median income, so she did not qualify for many of the local down payment assistance programs. The seller on the home she liked already had a couple of other home purchase offers. She could not make an offer and ask the seller to pay her closing costs because the seller would probably take a different offer. She would have to sell some of her investments to get the down payment and closing costs covered. Or would she?

Penny was income was indeed too high for most of the down payment assistance program, but the stone covered home she wanted was located in a designated zip code listed by the City of Memphis Down Payment Assistance Program as being in an special geographic zone.

We got Penny approved on an FHA first mortgage and submitted her loan file to the City of Memphis Down Payment Assistance program under the Homebuyer Incentive Citizen’s Program. This program would allow household income over 80% to 200% and it allowed these higher-income earners to use the City of Memphis Down Payment Assistance Program if they bought a home in the Designated Zip Code Areas to get 10% of the price or up to $25,000 in assistance. Penny had to invest 1% of the sales price

What do YOU want to accomplish with YOUR mortgage?

I can make the home purchase or refinance loan easy for you.

It is EASY to get started. Just call or text me at 901 482-0354

Email me at Jo@JoGarner.com

Or connect at www.JoGarner.com

4th segment following 9:45 am break about 9:48 to 9:56 am

REAL ESTATE TIP OF THE WEEK

ASHLEY CASH HAS 1 MINUTE TO ADD A TIP TO HOME BUYERS USING MEMPHIS DOWN PAYMENT ASSISTANCE

Trudie McClelland, United Housing Inc has a 1 minute tip about the United Housing programs for low-to-moderate income borrowers

Jo Garner’s mortgage tip:

Know your budget limitations. Stay within those limitations with your house note.

C. Keep an adequate emergency fund at all times—especially right after closing on your new home. You will have extra expenses with moving and settling into your new castle. That is another reason why using the down payment assistance programs can be a good idea. Some programs allow you to have a healthy amount of savings on the accounts you disclosed to the lender. A few assistance programs will not give you the full amount of assistance if you have a hefty amount of money left in the bank account you disclosed to the lender. http://www.benefits.va.gov/homeloans/

D. Get preapproved with a reputable lender BEFORE you go out looking at houses with a realtor. Once the lender has seen your last 2 years tax returns, your W2s and 1099s for the last 2 years and your latest paystub, you can feel fairly confident they are calculating your income correctly. Be sure and disclose to the lender debts that may not show up right away on the credit report. Allow the lender to review the last 2 months bank statements. The last thing you want is to fall in love with a nice big home only to have your hopes and dreams dashed when you discover that you cannot qualify to purchase it. The other advantage to having a strong preapproval letter is the competitive edge it gives you if you are making your offer on a house along with others with competing offers. There are some sellers who are looking for the surest deal, not necessarily the highest price. Let’s talk about your plans to buy YOUR home. Let’s review your income, asset and credit information and get you a STRONG preapproval letter so you can get some bragging rights on your financing and the house that you will be proud to own. Call me personally at (901) 482-0354 after the show (901) 482-0354 or email me at jo@jogarner.com Let me be on your home buying journey with you. MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

Connect with me at (901) 482-0354 Jo@JoGarner.com www.JoGarner.com

ANNOUNCEMENTS FROM SPONSORS:

Talk Shoppe offers free networking & education to anyone interested in real estate or in business or in health and wellness. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar the 1st floor in the Memphis Clark Tower and also on zoom. Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday July 26th, 2023 join other business people for the “Mastermind Principle-based on the book ‘Think and Grow Rich’ by Napoleon Hill”

Talk Shoppe could not offer the free educational networking events free to our community without some very giving sponsors. Thank you to Talk Shoppe sponsor Ed Hill of Masters Roofing for all you do for our community. Thank you for spending the extra time and going the extra mile to help your customers who need a roof repair or replacement. Your reputation is stellar. If you need a roof repair or a replacement, contact the Happy Roofer Ed Hill of Masters Roofing at 901 273-6594

Thank you to Talk Shoppe sponsor Realtor Pat Goldstein of Crye-Leike Realtors—Pat can help you buy a home or sell a home in West Tennessee and North Mississippi. She is known as the “Gold Standard in Real Estate.” Call Pat today at 901 606-2000

Subscribe to get weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

LEGAL STUFF: SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY AND NOT AN OFFER TO LEND.. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER “Napoleon Hill “What the mind can conceive, it can achieve.

Jim Rohn “If you are not willing to risk the usual, you will have to settle for the ordinary.”

Napoleon Hill “A goal is a dream with a deadline.”

Anonymous “Dreams Don’t Work Unless You Do”

____________________________________________________________________________________

REJOINDERS:

-

David Corwin, Deputy Director of USDA Rural Housing Development Harrisburg, Pennsylvania

-

Taylor Morse, Cartridge World of Collierville 901 854-3230

-

Genell Holloway, Eagle Hollow Enterprises (health benefits) 901 270-1127

Hall and Oates “You Make My Dreams Come True;” “Lean On Me” Bill Withers ; Head Full of Dreams by Coldplay “Taking Care of Business” by Bachman Turner Overdrive for the Talk Shoppe Business Tip for Real Estate Pros

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

ABOUT TRUDIE MCCLELLAND, UNITED HOUSING AGENCY

I am the Lending Department manager and Loan Officer at United Housing, Inc. a non-profit that has been in existence more than 25 years.

I was born and raised in Nashville in a Real Estate family. My grandmother was the first female realtor in the State of TN.

I hold a BBA from the Business school at Memphis State and a Masters of Art for Teaching from the University of Memphis 😊

(Note the first time I graduated and the second )

I am a walking scorer volunteer for the Fed Ex St. Jude championship for the past 22 years.

The pride of my life is our precious one year old granddaughter, Anna.

Ashley Cash

Director, Division of Housing & Community Development, City of Memphis

Ashley Cash is the Director for the Division of Housing and Community Development for the City of Memphis. Most recently, Ashley has worked to provide support and manage federal funds that address challenges brought on to communities, families, and individuals related to the pandemic. This includes collaborating on solutions around homelessness support, ensuring people remain in their homes and other related issues. She previously led the effort to develop the first comprehensive plan for the City of Memphis’ 650,000 residents and 340 square miles in nearly 40 years. Ashley managed accessibility and beautification improvements for the Jimmy Carter Work Project with Habitat for Humanity. She also helped several Memphis communities receive the Obama Administration’s Building Neighborhood Capacity Program Grant. Ashley has a bachelor’s degree in legal studies from the University of Tennessee and a master’s degree in city and regional planning from the University of Memphis. Ashley has worked over the past ten years in varying areas of community development. Her work has centered on quality-of-life planning and ensuring that all neighborhoods have equitable access to basic needs, opportunities, and amenities. She is experienced in managing and implementing complex projects and leading teams to success.

Ashley is a member of the National Trust for Historic Preservation, the American Planning Association, the Urban Land Institute, and a Leadership Memphis Alum. She also sits on the Board of the Downtown Memphis Commission. She has twice been the recipient of the Outstanding Planning Award for the Tennessee Chapter of the American Planning Association, most recently for the Memphis 3.0 Comprehensive Plan. When she is not working, Ashley enjoys spending time with her husband and their young daughters.

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

(currently working with Cardinal Financial Company, Limited Partnership NMLS #66247 equal housing opportunity 2645 Appling Rd 102 Memphis, TN 38133 ) Online loan application https://online.cardinalfinancial.com/#/p/apply/jogarner

www.cardinalfinancial.org for licensing info www.nmlsconsumeraccess.org/EntityDetails.aspx/company/66247 “Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes and Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”