Quick steps to improving your credit score. Common habits of people who became wealthy over time. What do look for and what to do when your chimney springs a leak.

Subscribe for weekly Real Estate Mortgage Shoppe podcasts with show notes at www.JoGarner.com or call and we can explore YOUR options for financing a home purchase or refinance.

#JoGarner #MortgageExpert (901) 482-0354

#EdHill #MastersRoofing (901) 273-6594

#MarkMcLaurine #RefrigerationUnlimited (901) 216-7792

#midsouthmortgage #homebuyingassistance #memphisroof #chimneyrepair #memphishvac #realtor #memphisrealestate

LET’S GET STARTED…(Jo) (Good morning, Memphis! Welcome to our internet listeners and podcast

listeners across the 50 states! . Today is April 6th, 2024. Call us in the studio while we are live

at 901 535-9732.You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan

Originator. You can connect with me at www.JoGarner.com. Our topic today is

Please thank the sponsors of this show today. Doctor, Doctor, What’s The Health Of My The Roof Over My Head & My Finances. Thank you to attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer Law FirmFor your home purchase or refinance contact real estate attorneys, Rob Draughon and Shelley Rothman at (901) 752-1133.

INTRODUCING ED HILL OF MASTERS ROOFING

Back in the Real Estate Mortgage Shoppe radio studio is our Roofing Expert, Ed Hill of Masters Roofing. Like a good doctor, Ed Hill and his team can come out and inspect your roof to diagnose any problems your roof is having and knowing how to fix it. If you have roof damage, Ed’s roof team will come out and assess then damage and give you a solid estimate on what it will take to fix it. The assessment is FREE. Ed Hill, most of our listeners know who you are. Take a moment to introduce yourself to our NEW listeners. Talk about the services you offer your clients.

(Jo) What is the secret to a long, healthy life? Jeanne Calment was verified as the oldest known person to have ever lived. She lived 122 years.. They asked her what was the secret to her long life. She told them, the secret to her long life was lots of olive oil, cigarettes, chocolate, and wine. (probably NOT what the health professionals are suggesting today)

Most articles on how to live a long life include these habits: :

-

Eating raw vegetables and fruits and a well-balanced meal.

-

Get plenty of sleep

-

Exercise regularly

-

Stay hydrated.

-

Live a balanced life- work hard, play hard and spend time laughing with people you love.

Here are some habits for healthy finances:

As a mortgage loan originator for over 30 years, I have been on the homebuying journeys of hundreds of families and even helped them refinance and restructure their finances with a mortgage.

Here are three common habits of people who built wealth and happiness over the course of time.

-

They made a plan and worked daily toward the vision of what happiness looked like to them.

-

They spent less than they earned. These people regularly invested a portion of their income in things like stocks, bonds and real estate that generally went up in value and created a growing passive income for them.

-

They invested in giving a regular tithe to their church or donations to favorite charities, and they invested quality time with their loved ones.

You may be thinking, “it is too late for me. I’m too old.” A wise person said, “ The best time to plant a tree was 30 years ago. The second best time to plant a tree is RIGHT NOW.” It’s not too late to start building on your financial foundation. Let’s talk about your financing options for buying a home or restructuring your finances. Jo@JoGarner.com www.JoGarner.com (901) 482-0354.

(Jo)

(Ed Hill has until 9:15 AM. We can continue your topics at around 9:18 when we come back from an advertising break)

,

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. What do YOU want to accomplish with YOUR mortgage. I can make the mortgage process EASY. Call or text me at 901 482-0354 or at JoGarner.com

When we come back we will be hearing more from Ed Hill of Masters Roofing. Mark McLaurine of Refrigeration Unlimited has a tip for us from the H. See you back in just a moment.

TALK SHOPPE BUSINESS TIP FOR REAL ESTATE PROS

2nd segment after 9:15 advertising break – (producer to start the song “Taking Care of Business” by Bachman Turner Overdrive –but bring the volume down before the lyrics start) It’s time to talk shop with Talk Shoppe’s Business Tip For Real Estate Professionals. Talk Shoppe is a marketing company offering free education and networking to anyone interested in real estate or in business. Talk Shoppe is made possible by the financial support of its sponsors. For more about Talk Shoppe, go to www.TalkShoppe.com (shoppe) For our Talk Shoppe Business Tip today we have Mark McLaurine of Refrigeration Unlimited. Thank you, Mark McLaurine, for your contributions to our business community. You are known as the HVAC Strategist because you find the source of the problem and fix it. What is our Talk Shoppe Business Tip for Real Estate Professionals today? (Mark McLaurine shares his tip (about 1 minute)

Mark McLaurine of Refrigeration Unlimited

(901) 216-7782

TIP: Before switching your heating and air system from heat to air conditioning, check to make sure the fan works, the batteries to the thermostat are new or charged. Mark can come out and do the spring maintenance and clean up on your system to avoid repair costs down the road.

TOPICS COVERED BY ED HILL OF MASTERS ROOFING

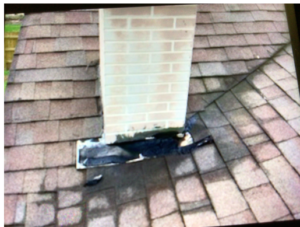

CHIMNEY CLINIC ISSUES AND ANSWERS

-

What are some of the ways a chimney can leak?

Exterior leaks and interior leaks

Chimney materials and chimney metals

-

How can a homeowner tell the difference between a structural issue and a roofing issue?

Sometimes they can’t, that’s why they need a roofer and maybe also a chimney company

Example: Rain dripping into the actual hearth area most likely comes from the chimney cap but stains on the ceiling often indicate leaking related to the roof

-

What are sources of chimney exterior leaks?

Rotten fiber board siding, rotten trim, damaged or poorly done chimney flashing work, rusted out chimney caps, fissures in masonry and bricks on brick and stone chimneys, and missing chimney criquetts

-

What is a good “one and done” approach to solving chimney issues?

Short Answer: Call Ed Hill, Masters Roofing 901-273-6594

Remove chimney exterior and install proper adhesive impermeable barrier, synthetic underlayment, step flashing or counter flashing and new shingles around chimney then replace the existing siding with either cement fiber board siding and PVC trim then caulk and paint OR clad the chimney exterior with vinyl siding and trim. For brick chimneys perform the initial steps mentioned above then seal existing exterior fissures with masonry patch or sealant

Ed Hill, Senior Consultant, Masters Roofing Memphis, offers experienced advice, detailed estimates and expert work for roofing and chimney issues. Contact him at 901-273-6t94

3rd SEGMENT 9:35 AM-9:45AM)

TOPICS COVERED BY JO GARNER, LICENSED MORTGAGE OFFICER

(Jo) I’m not a medical doctor or a certified financial planner, but based on my 30 years experience as a mortgage loan officer I have learned a lot from my clients and how they handle THEIR finances. Here are some common denominators of clients, some whose families I have let me be their lender over a couple of decades. I have worked together with them to structure financing terms that allow them to earn more, spend less, give more, live better.

#1 It is important to have plenty of emergency fund., For salaried people having a minimum of 6 months emergency funds and the ability to put, even a small amount ,into building that fund each month. For self-employed or 100% commissioned earners, savings to cover them for 12 months in an emergency is not too small.

#2 Earn more than you spend. I used to serve at my church in the financing ministry and it was AMAZING to me that people who came to us for budget counseling did not know what they spent each month. Some of them didn’t even know what they spent. I challenge you to take your most recent 3 months bank statements and credit card statements and make a list of where you spent and how much you spent. You will be SHOCKED! I decided to do that too and I WAS SHOCKED. I thought I knew what my income was and what I spent but there were things I was buying that I didn’t need and things I was paying way too much for. Unless you know the truth about what you make and what you spend, you can’t know where you to cut back, make more or make changes.

cash flow

CREDIT HEALTH

RACHET UP THE CREDIT SCORE TO RATCH DOWN THE PRICE OF MORTGAGE RATE-PHILLIP AND FARRAH FENTON’S STORY

![]()

Phillip and Farrah Fenton had been married over a year and expecting their first child. As newly- weds, they didn’t mind living cramped in a tiny house in a family member’s backyard. But, now they had the baby to think about. Phillip’s credit score was suffering because of some bills he had not paid and others he had racked up from his carefree college days.

In order to put himself and his family in a better position, Phillip and I talked about his plans. He disciplined himself with the help of his wife to aggressively pay down the balances on his revolving credit card accounts to keep the owed balances under 30% usage on each of the lines of credit. His credit score started improving.

After adding several points to his credit score, Phillip was in a position to get a lot lower mortgage interest rate. Bragging rights for the Fenton’s. They locked in a lower mortgage rate than they ever thought possible. Now they had more money to spend on their baby.

We are going to talk about some other strategies you can use later in this show. But the way you can get started using this one on improving your credit scores is pull the free credit report the government allows you to get once a year from www.annualcreditreport.com Review it for errors and look for ways to get your revolving credit balances paid down and maintained as low as possible —using less than 30% if possible on your credit lines and making your payments on time.

Do-It-Yourself Credit Fix-

If some of the negative credit reporting was not in error but was really bad credit on your part, then there may be some things you can do to lessen the negative blow.

If you have collection accounts showing with balances still owing, you may want to call he creditor a make a deal with them to get them to agree to stop reporting every month on that collection account. In the past collection agencies reported the collection once and never reported again. But today, they often continue to report month after month until.

Each time a negative late pay or 30 days or more or a collection account gets reported on your credit, it is like taking sucker punch to the gut because it drops your credit scores so badly. Even if you set up a small payment plan in exchange for the company not making any more negative reports about you.

A representative from Equifax Credit Bureau told me once that, the best authority on credit scores is the internet website www.myfico.com . This site gives you some great tips on keeping your credit score the highest it can be.

Some of the greatest credit scores are from 780-850

Really good credit scores that still give you the best in rate and terms on loans is around 740-779.

Still good but not considered the best are credit scores at 700-739.

Average scores come in around 660-699

Once your scores are below 660, you pay a lot higher interest rate on loans you apply to get and your payments are high.

Many of the mortgage companies across the country have set limits to the minimum credit scores they will accept from 620 to 640.

Jump-starting your credit scores-

The site www.MyFico.com shows you where to concentrate on getting the best and quickest results on jump starting your credit scores.

-

Make your payments on time, never going over 30 days late. Payment history makes up about 35% of your credit score

-

Keep the balances on any revolving accounts like credit cards UNDER 30 % usage. If your usage is 10% or lower, then you could raise your score even more over a short time. Credit usage percentage makes up about 30% of your credit score

Example: Credit limit $10,000 on your credit card.

30% usage on a $10,000 credit line means for you to never allow the balance owed to go over $3,000 at anytime during the month. (Make your payment on time)

-

-

out credit card and can drop your scores 60 to 100 points quickly

-

Old, established history on credit cards gives you better credit scores. Length of time on a credit account makes up about 15% of your credit score

-

Credit inquiries and getting new credit makes up about 10% of your score. Be careful about getting a lot of inquiries on your credit report because too many can drop your score. (if you are shopping for a mortgage and only other mortgage companies pull your credit within a 14 day period, the inquiries show up but are not supposed to penalize you on your score so that you can shop around without it hurting your score.

4th segment following 9:45 am break about 9:48 to 9:56 AM

REAL ESTATE TIP OF THE WEEK –Ed Hill shares a tip

Walk around your house periodically and look for rotted wood, damaged flashing. Leaks inside your home from the chimney, Call Ed Hill to inspect and give you the diagnosis for what is needed for your chimney and roo.

901) 482-0354 Jo@JoGarner.com www.JoGarner.com

National Association of Realtors came out with a survey last year, Did you know that home OWNERS are roughly 40% wealthier than RENTERS”

Some people are not homeowners yet because they feel their credit is not up to par. Others believer they have to have a lot of money to put down to buy a house.

Credit can be improved and nowadays homebuyers do not need a lot of money to buy a home.

Let’s explore YOUR options for a home purchase mortgage or refinance.

ANNOUNCEMENTS:

Talk Shoppe equips with education, engages by offering connection opportunities between business people and empowers businesses in a supportive community. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (Clark Tower).

Go to www.TalkShoppe.com and click the Events tab for the link to get into the event online. This Wednesday Aoril 10th, 2024 9AM CT “Sources of Retirement Income” Ben Hunter and Emmanuel Corless of Independent Planning Group will be presenting.

Talk Shoppe events are free thanks to sponsors like business coach Keith Potts of Evolve Business Coaching. Keith Potts helps business put together winning strategies. Connect with Keith Potts at Keith@EvolveBusinessCoaching.net

3. Thank you to Talk Shoppe sponsor Brett Carter of ServiceMaster by Cornerstone for your contributions to our business community through Talk Shoppe When you experience a fire, flood or bio hazard in your home or office, don’t go it alone, call Brett Carter of ServiceMaster by Cornerstone 901 832-6005

4. Subscribe at www.JoGarner.com and you can get our weekly blog posts with podcasts conveniently in your inbox.

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

- QUOTE CORNER:

- Erma Bombeck-“Never go to a doctor whose office plants have died.”

- Groucho Marx-“A hospital bed is a parked taxi with the meter running.”

____________________________________________________________________________________

REJOINDERS:

-

Troy and Lynn McDonald of Erin McDonald Insurance Agency 901 849-7101

-

Rob Draughon and Shelly Rothman of Griffin, Clift Everton and Maschmeyer Law firm 901 752-1133

-

Suzan David of webandstorymedic.com

Transition Music: “”Doctor Casey” John Loudermilk; “Like a Surgeon: by Weird Al Yankovic; “Doctor, Doctor” Robert Plant; Taking Care of Business” by Bachman Turner Overdrive for the Talk Shoppe business tip.

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

Now on Amazon and Barnes and Noble

ABOUT ED HILL OF MASTERS ROOFING

Ed Hill has been in the residential roofing industry since 2008 and has been Senior Consultant with Masters Roofing Memphis TN since 2010. He has personally assisted about 800 homeowners with roof replacement and many others with roof and exterior repairs. He is an active member of the Greater Memphis Business Network International chapter and is the official Masters Roofing consultant to TPC Southwind. He holds three earned degrees including a doctorate but tries not to let those get in his way of serving his customers! For free roof advice, free inspections, and free estimates and bids for roof replacement or roof repair call Ed Hill at 901-273-6594. Learn more at #EdHillMastersRoofing and at MemphisHomeMaintenanceShow.Podbean.Com

Ed Hill, Senior Consultant

Masters Roofing

2845 Stage Center Cove

Bartlett TN 38134

901-273-6594

EdHill.MastersRoofing@gmail.com

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She grew up in West Tennessee and got her start in real estate in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com Pick up Jo Garner’s book on Amazon or Barnes and Noble “Choosing the Best Mortgage-The Quickest Way to the Life You Want”