WIN/WIN SOLUTIONS WHEN NEGOTIATING FOR REAL ESTATE & MORTGAGE TERMS

Thank you for connecting with me via this Real Estate Mortgage Shoppe blog post/podcast. In this post we’re talking about WIN/WIN SOLUTIONS WHEN NEGOTIATING FOR REAL ESTATE & MORTGAGE TERMS. If you do not find exactly the information you are searching for, please email or call me and let me know what you are looking for so we can dive in and get the information or resources you need. jo@192.232.195.219 or (901) 482-0354.

Here are some of the points we covered during the 12/12/15 show—

MARKET NEWS

QUESTIONS ANSWERED BY DON HUTSON

Don, do you subscribe to the idea that everybody is in sales?

What is your definition of VALUE? (How to determine your PROSPECT’s definition of value)

What are some of the major takeaways from the book Selling Value?

How can it help people involved in real estate transactions to be more well-versed in negotiations?

___________________________________________________

QUESTIONS ANSWERED BY TERRI MURPHY:

1) How would a buyer add a “selling value” component to the transaction with a seller?

a. Pre-approved vs. pre-qualified – working with an LO that has a real plan for TRID compliance and deliverables

2) How would a SELLER add a “selling value” component to a transaction to get it closed?

a. Red/Blue/Green chips when negotiating

3) What should both look for when working with a realtor and their loan partner? (TRID compliance, timeline, etc.)

QUESTIONS ANSWERED BY JO GARNER:

1. How do the principles from the book Selling Value apply to your customers trying to buy a home?

REAL ESTATE TIP OF THE WEEK presented by Don Hutson and Terri Murphy—(actions you can take to prevent yourself and your spouse or partner from allowing emotions to drive the negotiations)

A FEW CONTENT NOTES FROM THE 12-12-15 REAL ESTATE MORTGAGE SHOPPE-

Good morning, Memphis! Good morning to our friends across the 50 states. Are you looking for a real estate or financing solution to your scenario? Maybe you’re looking for some ideas for negotiating more successfully on the purchase or sale of your home? I’m Jo Garner, Mortgage Loan Officer and host of Real Estate Mortgage Shoppe. You can connect with me at www.JoGarner.com and you are welcome to share with us your idea, or question on Twitter by using #JoGarner while we are live December 12th, 2015. Our general topic today is WIN/WIN SOLUTIONS WHEN NEGOTIATING FOR REAL ESTATE & MORTGAGE TERMS. In the studio we have the experts –authors and national speakers Don Hutson and Terri Murphy of US. Learning. Terri is an Author, National Speaker, Consultant & Communication Specialist. She brings a depth of industry experience and education to the Real Estate Industry. Terri has been at the top of the real estate business… at a consistency of listing and selling over 100 homes per year for over 28 years in the Chicago area. Today she performs as a consultant to the real estate and general sales industry to help build communication systems and resources to keep true clients for life.

Don Hutson is the author or co-author of twelve books, including The Sale, and his two Wall Street Journal and New York Times International best sellers, The One Minute Entrepreneur and The One Minute Negotiator and just released his book Selling Value which we will be talking about later in the show. Don is also a national speaker and was inducted into NSA’s Speakers Hall of Fame. You can find out more about Don and Terri on the blog post for this show at www.JoGarner.com.

Don, its great to have you in the studio again. Please greet our listeners and give us some highlights of what you will be sharing about Win/Win Solutions When Negotiating.

(Jo) Terri, you always bring good info , hot real estate topics and a few good stories too. Please take a moment to greet our listeners and talk about how the topics we’re covering today directly affect homebuyers and home sellers?

(Jo) Don, in Chapter 11 of your book Selling Value, you talk about how the client talks about wanting to get the best price they can, but actually what they REALLY want are solutions to get rid of the hassles in their lives. But, you know what? It’s tremendous when you can offer solutions to make life easier AND do it at a lesser cost than the day before. That is what the mortgage market offered us yesterday—mortgage rates priced lower than the day before. General market anxiety ahead of next week’s Fed Announcement was the biggest reason. Conventional rates on the fixed rate 30 hit around 3.875% to 4% with no points for most lenders based on various factors in the borrower’s credit profile. FHA, the 100% VA loan and the 100% Rural Housing loans came in a tad lower. Word to the wise: CoreLogic predicts the Fed will gradually raise their rates by 1% by the end of 2016. Even though the Fed Rate doesn’t DIRECTLY affect mortgage rates, it usually DOES DIRECTLY AFFECT variable rate mortgages. If the FED really does start repeatedly going up on their rate and you’re sitting on a variable rate mortgage, it may be time to convert to a safer fixed rate loan. Call me. Let’s Make Your Plan, Work Your Plan. If The Deal Works For You Today, Do It Today. But you’ve got to talk with me personally. Call me directly after this show at 901 482-0354. (901) 482-0354.

If you want to talk with us right now while we’re live, call the studio at 901 535-9732 and outside the Memphis area (800) 474-9732.

Don, in the mortgage world, paying lesser interest cost is always nice but sometimes, like with someone with a variable interest rate who plans on staying in their home for a few years, the answer may be to refinance to a wee bit higher rate but one that is fixed. I call that buying peace of mind, especially if the budget is already tight. Peace of mind has a value. How do YOU define value, Don?

(Jo ) Terri, can you think of some examples of how someone selling their home can add value for a particular buyer to ensure both parties feel that got a good deal?

QUESTIONS ANSWERED BY DON HUTSON:

Don, do you subscribe to the idea that everybody is in sales?

What is your definition of VALUE

What are some of the major takeaways?

How can it help people involved in real estate transactions to be more well-versed in negotiations?

__________________________________________________________________________________

QUESTIONS ANSWERED BY TERRI MURPHY:

1) How would a buyer add a “selling value” component to the transaction with a seller?

a. Pre-approved vs. pre-qualified – working with an LO that has a real plan for TRID compliance and deliverables

2) How would a SELLER add a “selling value” component to a transaction to get it closed?

a. Red/Blue/Green chips when negotiating

3) What should both look for when working with a realtor and their loan partner? (TRID compliance, timeline, etc.)

__________________________________________________________________________________

QUESTIONS ANSWERED BY JO GARNER:

2. How do the principles from the book Selling Value apply to your customers trying to buy a home?

Jo’s answers-

A. Usually, especially with first-time homebuyers, the buyer doesn’t have a lot of funds to put down on the house so he makes his offer contingent on the seller paying the closing costs and the prepaid taxes and insurance for the buyer. The seller, on the other hand, wants to get the highest net profit from the sale of his house. The Win /Win answer in this case may be to have the buyer offer just a little bit higher price for the house so the seller can pay the buyer’s costs and still net out the same profit they wanted. In the end, the buyer pays a little bit more each month because of the higher price but over a 30 year term, it doesn’t make that much difference on the payment amount. The house will need to appraise for at least the sales price of course.

B. Another common story is the move-up buyer who needs to sell her current home to get the large down payment she wants to make before purchasing the new home but the seller of the new home wants to sell quickly and doesn’t want to wait on the buyer’s house to sell first. Looks like they are at an impasse.

C. I had a buyer like that who had been living in her current home a long time and only owed about 25% of the value on it. She did not want a large payment on the new home because she wanted to retire in a few years but she thought she needed to sell her house first so she could pay down a lot on the new house to keep her payment small. But she couldn’t sell her place in time to meet the seller’s deadline on the house she wanted to buy.

D. I got her a home equity loan as a 2nd mortgage on her current home. She used the funds from the 2nd mortgage home equity line for the down payment on the new home and closed right away. Several weeks later her old home sold and she paid off the little first mortgage and the 2nd mortgage equity line I had gotten for her. Now she was living in the new house that met her needs, she had a low payment because she was able to put a lot down. And the seller she purchased the house from got to sell her his house without having to wait on her to sell her old house first.

REAL ESTATE TIP OF THE WEEK: (Don and Terri have about 1.5 minutes to share a time-saving, money-saving, or risk-saving real estate related tip for our listeners)

Announcements: Talk Shoppe offers free education and networking to anyone interested in real estate or in business. This Wednesday December 16th, 2015 9A to 10A Talk Shoppe presents “How To Buy At Auction” with Lance and Terri Walker of Walker Auctions. Following the short tutorial, you can be a part of “Ms Vanna Goes Christmas Shopping Old Bag Sale.” You can donate items and get a short promotion for your business and you can BID and BUY at the auction. One of the items is a 5 day trip to Cancun. The proceeds go to raise money for swim scholarships to the YMCA for students who written essays and made posters to earn their scholarships. Talk Shoppe meets at the University of Phoenix 65 Germantown Court 1st floor Cordova, TN 38018 and that is where the auction is being held.

If YOU would like to play a positive role in supporting children learning to swim at the YMCA, contact Lynn McDonald of Erin McDonald Insurance Agency at 901 849-7101 or www.JOGarner.com. Be a part of something very positive and your business can be promoted all at the same time. To find out more, contact me at 901 482-0354 or connect through www.JoGarner.com For information about Talk Shoppe, go to www.TalkShoppe.com

This program on December 12th, 2015 was sponsored by the Mortgage Division of Evolve Bank and Trust

• To hear today’s podcast of Real Estate Mortgage Shoppe and others, go to www.JoGarner.com

Call me and Let’s “MAKE YOUR PLAN, WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.”

Quote Corner: from Don Hutson’s book Selling Value- Don quotes Paul “Bear” Bryant “It’s not the will to win that matters—everyone has that. It’s the will to prepare to win that matters.”

____________________________________________________________

Transitional songs used during this show—“I’m Winning” by Steve Winwood; “How Much Is That Doggie In The Window” by Patty Page; “Signed, Sealed, Delivered” by Stevie Wonder

REJOINERS BY:

Clint Cooper of the Redeemers Group- www.redeemersgroup.com

Nancy Beaudoin, Lewiston, Maine

Donna Bellinger, www.GroupEndeavors.com (866) 208-3254

SPECIAL MENTION: Lynn McDonald, Insurance Agent with Erin McDonald Insurance Agency (901) 849-7101

____________________________________________________________________________________

Bio

For

Don Hutson www.DonHutson.com

Don Hutson successfully worked his way through the University of

Memphis selling real estate, graduating with a degree in Sales. After becoming the #1 salesperson in a national training organization, he established his own

training firm and was soon in demand as a professional speaker.

Don’s client list includes over half of the Fortune 500, and he is featured in over 100 training films. He is CEO of U.S. Learning, Chairman of Executive Books, and makes some 75 speaking appearances per year. Perhaps you have seen him on national television where he has been featured on ABC, PBS and Fox News.

He is the author or co-author of twelve books, including The Sale, and his two Wall Street Journal and New York Times International best sellers, The One Minute Entrepreneur and The One Minute Negotiator.

He was elected by his peers to the presidency of the National Speakers Association, and has received its coveted “Cavett Award,” as member of the year. He has also been inducted into NSA’s Speakers Hall of Fame.

Terri Murphy

Author, Speaker, Consultant & Communication Specialist

Terri brings a depth of industry experience and education to the Real Estate Industry. Having earned the GRI, CRS and other designations has helped Terri perform at the top of the real estate industry… at a consistency of listing and selling over 100 homes per year for over 28 years in the Chicago area. Today she performs as a consultant to the real estate and general sales industry to help build communication systems and resources that foster relational capital that result in true clients for life

About Terri:

An active member since 1988 of the National Speakers Association

An active member of NAR since 1978

NAR Game Changer Coach for 2 project initiatives, 2009-2010

Currently the Chief Information Officer for U.S. Learning, Inc.-Memphis, TN.

Founder-President: WomensWisdomNetwork.com

Authored weekly newspaper column for Copley News & Lakeland Press – “Murphy on Real Estate”

Served as 2006 Chairman of the National Association of Realtors Membership Information Committee

Former Vice-President of Interactive Business Television Network (IRTV): Writer & Producer for Muzak’s Business Satellite Television 1995

Staff Writer for RealtyTimes, Broker Agent News, FrogPond Publishing, Memphis Woman’s Magazine and Mortgage Originator Magazine, Mortgage Planner Magazine

Hosts a Weekly Internet Radio Program: www.WomensWisdomNetwork Success Radio

Former host of Weekly Radio Program – “Murphy on Real Estate” for WKRS/Chicago

Staff contributor to www.RealBlogging.com

Author of “Terri Murphy’s Listing & Selling Secrets” published by Dearborn Publishing in l995

Author of “Terri Murphy’s E-Listing & E-Selling Secrets: for the Technologically Clueless” – published November 2000

Author: Taking Charge, Lessons in Leadership, published by Insight Publishers – September 2003

Contributing Author: Real Estate Confronts the Future – published by Thompson Southwestern – Real Sure – 2005

Contributing Author – Donald Trump: “The Best Real Estate Advice I Ever Received – Rutledge Press – 2006

Founder of the Illinois Lake County Chapter of Women’s Council of REALTORS® 1989

Served as President of Illinois State Chapter of Women’s Council of REALTORS®

NAR Executive Committee 1998

Conducts continuing education and distance learning seminars – Program Information Available

Industry Consultant to: (abbreviated list)

National Association of Realtors

KODAK

ACUMA (American Credit Union Mortgage Association)

Mortgage Professional Training Network

Great Harvest Franchises

YRC World Wide

FedEX Institute of Technology

Harris Bank of Chicago

Countrywide Funding

RE/MAX International

MUZAK

First American Title Company

Entreport, Inc.

I-Succeed.com

Ben Franklin Savings Banks

First Midwest Banks

American Back Centers for Chiropractic Medicine

Intelitouch

Steelcase-MBI

New York Times

WREG-TV

MGIC

Mortgage Originator Magazine

Realty U

Dearborn Financial Publishing Company

Media:

ABC Sunday Morning News

NBC Sunday Morning News

CNBC – Expert Segment

Twin Cities LIVE

Focus On Lake County

Live@9 – Memphis

MPTN-Mortgage Professional Training Network

CBS-WREGTV–Live@9 Regular Guest

Staff Writer/Articles Featured in:

PC World Magazine

Frog Pond Publishing

Computer Age Magazine

Real Estate Professional Online Magazine

Broker Agent News (Staff Writer)

Mortgage Originator Magazine (Staff Writer)

National Association of Mortgage Bankers

Women’s Council of Realtors® Magazine

Executive Relocation Magazine

Copley News

Real Estate Executive Magazine

Memphis Woman’s Magazine

MCAR Magazine

Certifications:

• Licensed Real Estate Agent 1978

• Licensed Real Estate Broker 1979

• Graduate: Real Estate Institute (GRI)

• Certified Residential Specialist (CRS)

• Leadership Training Graduate (LTG)(PMN)

• Certified Counselor of Real Estate (CREC) 2001

• Illinois CRS of the Year 1993

• Licensed Continuing Education Instructor (Programs approved in 26 States – 2000-2007)

• 50 Women Who Make A Difference –Memphis, TN. 2008

• ReMax Hall of Fame 1994

• Coldwell Banker Intl. Elite Presidents Club 1997

• Alma S. Thorsen Award – 1987

• 50 Women Who Make A Difference – Memphis, 2008

• 50 Top Real Estate Women – Memphis, 2010

Websites:

TerriMurphy.com

MoreUnited.com (Mortgage Originators/Real Estate United.com)

MurphyOnRealEstate.com

CertifiedMilitaryResidentialSpecialist.com

USLearning.com

For more information: Visit http://www.TerriMurphy.com www.MurphyOnRealEstate.com or call 847-970-2717

ABOUT JO GARNER, MORTGAGE LOAN OFFICER –

www.JoGarner.com (901) 482 0354 jo@192.232.195.219 @jogarner

Jo describes her job description: “As a mortgage loan officer, my job is to give my client the benefits they want from their financing terms– listening to my client and determine what’s of the most value to THEM– What is their comfort level on a house payment, how much are they comfortable paying down, what type of financing do they need to get the house they want to buy or refinance. Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income. Whatever their personal priorities are, my job is to put together a mortgage with comfortable terms that will help them achieve their goals.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 20 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 20 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com She was also the editor of Power Shoppe, a free weekly e-zine designed for real estate professionals and others indirectly connected to the real estate industry and currently publishes on her blog www.JoGarner.com .

For real estate financing solutions, plug into the Real Estate Mortgage Shoppe program. You can find mortgage rates, FHA Streamline refinance with no out-of-pocket costs, refinancing options, home purchase loan programs, answers and real estate, money-saving tips and more.

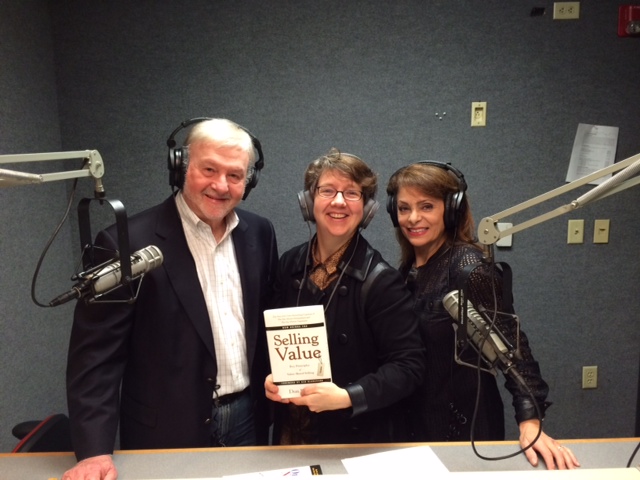

PHOTO GALLERY FROM REAL ESTATE MORTGAGE SHOPPE 12-12-15