Good morning, Memphis! Welcome to our internet listeners and podcast listeners across the 50 states! You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. You can connect with me at www.JoGarner.com.

Our general topic is Network for Smarter Real Estate Choices–Fixing Credit, Finding Income, Fast-Tracking to Funds. Thank you to real estate closing attorneys Rob Draughon and Shelley Rothman for sponsoring Real Estate Mortgage Shoppe today. For your real estate closing, call Rob and Shelley at 901 752-1133. Subscribe to get our weekly blogposts with podcasts at www.JoGarner.com. Call us while we are live today December 4th, 2021 at 901 535 9732.

Today on Real Estate Mortgage Shoppe you will meet people, and connect with resources to help you make smarter real estate choices. Terri Murphy, author and real estate trainer, will be sharing some places to go and educational resources you can tap as a real estate pro or as a homebuyer or seller. I will be covering some customer stories of how some of my clients found ways to overcome common barriers to financing. Want to know how to help your credit? Do you need a fast-track to closing funds? Do you need to find more income to qualify for your mortgage? Stick around for the rest of Real Estate Mortgage Shoppe.

Introducing Terri Murphy

Back in the studio we have national speaker, TED Talk Speaker, author and real estate and business trainer, Terri Murphy. Terri you have been connecting real estate professionals together for years with training programs, e-zines and networking groups. You have been featured on ABC, NBC, and CNBC News as a sales expert. Take a moment to tell our listeners a little more about you and what you do for the real estate industry. (Terri introduces herself and talks about some resources available to real estate professionals)

(Jo) Famous English statesmen Francis Bacon, taught that Knowledge is Power. Even a person who is physically frail, can change the world with the knowledge they wield. If you are planning to buy a home and you have not spent your life learning all you can about real estate, then put people on your professional team like an reputable, experienced realtor, a knowledgeable loan officer (I would like to sign up for the job as your lender), and a good real estate attorney.

This reminds me of a story I saw on the internet about a big ship that broke down as it was leaving a port headed on a tight deadline to another part of the world. The captain summoned his engine mechanic to fix the engine. The mechanic and his entire team tested and inspected the engine from top to bottom but could not fix the engine.

The captain, under pressure to get to the next port on time, demanded that someone be found to fix the engine so they could be underway. An old retired engine mechanic was brought onboard. He hobbled with a cane down to the engine room and began inspected the engine. A little while later, the old mechanic sighed, pulled out his hammer and tapped a couple of times on the side of the engine. Suddenly the engine sprung to life.

This story is proof that you can be physically frail, but with the right knowledge you can change the world—even move a ocean going behemoth across the seas.

Some versions of this story include the part where the mechanic handed the captain a bill for $10,000. The captain became angry again and demanded to see an itemized bill. The mechanic handed him a bill that read, “tapping on engine with hammer two dollars. Knowing where to tap $9,998.

Call to action: If your desire is to buy a nice home with an affordable payment, Step 1 Make sure you have an expert realtor representing you and a dedicated, experienced loan officer ( I would like to sign up for that job) The experienced team members helping you can lead you clear of many time-consuming and expensive mistakes either because they have made those mistakes themselves in the past or know someone else who has. Knowledge is power and can save you time and money

Intermediate action: If you are planning to buy a home and a vacation home or other rental property, put the experienced experts on your team, but go an extra step in reading on a regular basis newsletters (examples realtytimes podcasts and blogposts from real estate mortgage shoppe, real estate reports from your local area

Advanced—all of the above and join a reputable real estate investment club, or real estate mastermind group, serve on a committee from your local real estate association etc

(Jo) Terri Murphy, as a real estate trainer in the business for many years, you have a lot of wisdom to offer. Tell us about some of the resources you recommend….

Realty Times- Terri Murphy is senior editor for Realty Times-a real estate e-zine offering you a library of 20,000+ relevant SEO-driven articles , market reports, how-to’s, industry news items and agent features that is constantly updated with new content. Totally FREE resource www.realtytimes.com

Mortgage Girlfriends– an expanding group of like-minded women who are passionate about succeeding in the mortgage industry. https://mortgagegirlfriends.com

Womens Wisdom Network

Smart Women, Smarter Choices (for entrepreneurs)

You’re on Real Estate Mortgage Shoppe. I’m your host, Jo Garner, Mortgage Loan Officer. What do YOU want to accomplish with your mortgage? Make your plan. Let’s work your plan if the deal works for you today, let’s do it today. When we come back Terri Murphy of www.TerriMurphy.com will be sharing more of her advice and some stories of people who used networks and knowledge to make smart real estate choices.

2nd segment after 9:15 break: It’s time for the Look Back Memphis Trivia Contest. The Look Back Memphis Trivia Contest is brought to you by notable Memphis historian, Jimmy Ogle. To find out more about Jimmy, www.JimmyOgle.com . Our Look Back Memphis Trivia Contest is sponsored by John and Jennifer Lawhon of Lawhon Landscape (901) 754-7474 the Lawhon’s can help you plan your landscaping if you have a BIG, BIG project or a smaller project . The Lawhons are giving away a $25 gift card to the first person with the correct trivia answer. If you know the answer to our trivia question, call us at 901 535 WREC 901 535-9732.

ANSWER: ANNESDALE PARK

Question: WHO AM I?

Hint 1: I was developed in 1903 by Brinkley Snowden and T.O. Vinton

Hint 2: I am called the first subdivision in the “South.”

Hint 3: My early residents were Tennessee Govenor Malcolm R Patterson, State Supreme Court Justice Arthur Buchanan

___________________________________________________________

TOPICS COVERED BY TERRI MURPHY, NATIONAL SPEAKER, AUTHOR AND TRAINER

Terri talks about the window of opportunity right now with our current real estate and mortgage market.

If you are a renter and plan to be in the area for 2 to 3 years or more, consider buying a home instead of renting. Values have been going up significantly over the last few years and are predicted to continue the upward climb. You can build wealth over time just by owning real estate. If you need to move, you can always sell the home or rent it for a profit.

Don’t wait to buy real estate. Buy real estate and wait.

If you want to improve your home or modify it to accommodate other family members moving into your home, the higher home value can allow you to do a cash out refinance or other financing to fund the renovation.

TOPICS COVERED BY JO GARNER, MORTGAGE LOAN OFFICER

Fixing credit

RACHET UP THE CREDIT SCORE TO RATCH DOWN THE PRICE OF MORTGAGE RATE-PHILLIP AND FARRAH FENTON’S STORY

![]()

Phillip and Farrah Fenton had been married over a year and expecting their first child. As newly- weds, they didn’t mind living cramped in a tiny house in a family member’s backyard. But, now they had the baby to think about. Phillip’s credit score was suffering because of some bills he had not paid and others he had racked up from his carefree college days.

In order to put himself and his family in a better position, Phillip and I talked about his plans. He disciplined himself with the help of his wife to aggressively pay down the balances on his revolving credit card accounts to keep the owed balances under 30% usage on each of the lines of credit. His credit score started improving.

After adding several points to his credit score, Phillip was in a position to get a lot lower mortgage interest rate. Bragging rights for the Fenton’s. They locked in a lower mortgage rate than they ever thought possible. Now they had more money to spend on their baby.

The way you can get started on improving your credit scores is pull the free credit report the government allows you to get once a year from www.annualcreditreport.com Review it for errors and look for ways to get your revolving credit balances paid down and maintained as low as possible —using less than 30% if possible on your credit lines and making your payments on time.

As you prepare for a mortgage application, check with your lender before paying off a collection. When you pay it, the creditor reports you “paid.” Most see this as a good thing. Human underwriters seem to look favorably when they see that the borrower has paid the bill. However, the credit scoring machine sees it as another derogatory report because a numerical code for the “collection tradeline” is updated in the system.

Depending on the amount owed and the cumulative amounts owed on multiple collections, the mortgage underwriting may require you to pay them off, anyway; but, if the collection accounts are old, they might not have a great impact on your scores at the moment the credit bureau pulls the report. Check with your lender before taking action if you are about to make a major purchase.

Stay away from 12-months-same-as-cash accounts. Don’t open any new accounts while your mortrgage loan is in process. Wait until afer closing.

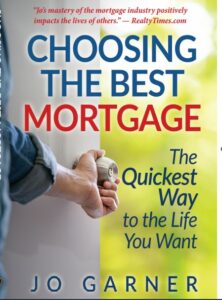

There are some more tips and resources on keeping your credit in tip-top shape in the book “Choosing the Best Mortgage—The Quickest Way to the Life You Want.”

Fast-tracking to funds to close

Alia Abbey-Trauma to Triumph

![]()

When I talked with Alia Abbey the first time she said, “Look, I am calling you because I found a house that would be perfect for me. My realtor told me to call you to get preapproved, but I don’t believe I can really buy a house. Every time I have tried in the past, some catastrophe hits my life and the deal falls through. So … I gave up a long time ago.”

Alia had okay credit and a good steady income, just not the money for down payment, and she had no idea about the down payment assistance programs available to her. We looked at one such program to project her monthly payment and calculate the tiny sum she would need at closing. For the first time, Alia let herself get excited.

Once approved, Alia’s program would provide her with over $10,000 in the form of a second mortgage to apply toward her down payment and closing costs. After living in the home 15 years, the second mortgage would be considered satisfied even though she had never made a payment on it.

As we got closer to closing, Alia started getting cold feet! Suddenly, she was once again ready to sabotage her chance of owning a home.

I started asking questions.

She shared about a traumatic childhood experience when her family’s home was destroyed by a catastrophic event.

BINGO!

With the encouragement of Alia’s realtor, her friends at work, and of course the mortgage team, this lady went to her closing and laughed, then cried (for joy), and then laughed again. With the help of a down payment assistance program and some great real estate professionals, buying her own home was not just about owning a house, it was a breakthrough and a turning point for Alia Abbey.

Ask an experienced, reputable realtor in your area what programs they recommend. Good realtors usually know which programs are good and which might be less advantageous. You can also check with Rob Chrane at Down Payment Resource, supported by Housing Finance Agencies across the country. From there, you can search for assistance programs in your city and state. (See link in the resources at the end of this chapter.)

Some programs have restrictions like maximum limits on household income. Some require borrowers to not have owned real estate within the last three years. Other programs require the property to be in designated geographical locations.

You can find more information on the types of down payment assistance programs and how they work in the book “Choosing the Best Mortgage –The Quickest Way to the Life You Want.”

Finding qualified income

Mr. Palmer-Business Owner Overcomes

![]()

This story illustrates some barriers that self-employed borrowers may smack into when applying for a mortgage loan.

Mr. Patrick Palmer had invested and worked long and hard in his own successful business for over 10 years. For the last several months, he struggled with fatigue and burnout. What Mr. Palmer needed was a change of scenery—like a nicer house with a view in the country.

On the day Mr. Palmer saw his dream home for sale, he made an offer to the seller. For the first time in months, he felt an exhilarating rush of hope that moving into this home with its serene outdoor space would provide the relief he needed from living so close to his business.

Mr. Palmer confidently marched into his bank to get his mortgage approved. He was shocked when the banker shook his head and handed him back his tax returns.

The next stop was to the realtor’s preferred lender. Again, the answer was no. Too little income showed on his tax returns.

A friend referred Mr. Palmer to me.

We scanned over his last two years’ tax returns, and in just a few minutes I had his preapproval letter ready to go. “How did you do that,” he happily demanded?

I explained to Mr. Palmer that instead of starting at the front of his tax returns, I started at the back. Then, I located expenses we could legally add back into his income as those tax write-offs were paper losses only.

These paper losses included depreciation on equipment, business use of the residence, and the depreciable part of business mileage. Other expenses that can sometimes work with the right documentation include once-in-a-life-time expenses. Calculating self-employment income from tax returns requires attention to detail. We found enough of these paper losses to boost his qualified income. Mr. Palmer was approved and bought his dream home!

REAL ESTATE TIP OF THE WEEK (Terri Murphy has about 1 to 1.5 minutes to share a real estate related money-saving or time-saving tip):

Jo offers tip about real estate historically being a hedge against inflation—especially enjoying a low, fixed rate mortgage rate. Inflation tends to cause the price on mortgage rates to go up. Fear of Infection from Omicron Variant has thrown markets into uncertainty. This caused prices on mortgage rates to go down over the last few days. Income/Jobs -income has been going up over the last year, counter balancing the increase in home prices. For now we are not in a housing bubble and not in an affordability crisis. Watch out for rising mortgage rates though.

ANNOUNCEMENTS:

Talk Shoppe offers free networking & education to anyone interested in real estate or in business. Talk Shoppe meets every Wednesday 9A-10A CT at Concorde Career College 5100 Poplar Ave 1st floor Memphis, TN (online go to www.Talkshoppe.com and click on Events tab to get the vitual meeting room) Business coach with Business Management Solutions will be presenting “Holi-daze-Finishing the Year Strong”

Talk Shoppe events are free thanks to advertisers like –Suzan David www.webandstorymedic.com Susan can help you develop your website using the power of stories to build brand loyalty with your customers.

2. Thank you to real estate closing attorneys Rob Draughon and Shelley Rothman of Griffin Clift Everton and Maschmeyer for sponsoring this episode of Real Estate Mortgage Shoppe. For your home purchase or refinance, contact Rob and Shelley to handle the title work and closing 901 752-1133

3.

4.

4. Subscribe at www.JoGarner.com and you can get our weekly blog posts with podcasts conveniently in your inbox.

5. Real Estate Mortgage Shoppe reminds you to MAKE YOUR PLAN. LET’S WORK YOUR PLAN. IF THE DEAL WORKS FOR YOU TODAY, DO IT TODAY.

SPECIAL NOTE: REAL ESTATE MORTGAGE SHOPPE RECOMMENDS THAT YOU CONSULT WITH A FINANCIAL, LEGAL OR OTHER CERTIFIED, LICENSED PROFESSIONAL BEFORE ACTING OR INVESTING ON ANYTHING YOU HEAR OR SEE FROM THE CONTENT ON THIS SHOW OR BLOG POSTS. THE INFORMATION WE SHARE ON REAL ESTATE MORTGAGE SHOPPE IS GENERAL IN NATURE MEANT FOR GENERAL EDUCATIONAL PURPOSES ONLY. ALL EXAMPLES GIVEN FOR ILLUSTRATION PURPOSES ON REAL ESTATE MORTGAGE SHOPPE AND ARE BASED ON TRUE STORIES BUT WE USE FICTIONAL CHARACTERS AND DO NOT DIRECTLY REFLECT REAL PEOPLE OR EXACT DETAILS IN ANY OF THE SITUATIONS.

QUOTE CORNER:

“You’ve heard that it’s wise to learn from experience, but it is wiser to learn from the experience of others.” Rick Warren

____________________________________________________________________________________

REJOINDERS:

-

Tim Flesner, business coach, consultant

-

Troy and Lynn McDonald of Erin McDonald Insurance Agency

-

Ed Hill of Masters Design Roofing

Transitional Music: “Home” by Phillip Phillips; “A Little Help From My Friends” by Joe Cocker; “Nothing’s Going to Stop Us Now” Starship; ”Memphis” by Johnny Rivers for Look Back Memphis Trivia Contest

PICK UP YOUR COPY OF “CHOOSING THE BEST MORTGAGE-THE QUICKEST WAY TO THE LIFE YOU WANT” by: JO GARNER

An essential guide for real estate professionals and their customers.

“Choosing the Best Mortgage-The Quickest Way to the Life You Want” is an essential guide for consumers and real estate professionals that will give them a good understanding of the loan products out there. They will have at a guide to the advantages the disadvantages of those loan products—when to use them and when not to use them.

The people stories give examples to help real estate professionals. Consumers that are looking now will benefit and I could easily see this book as a great resource for anybody in the future who want to buy real estate or restructure their finances using a mortgage.

Now on Amazon and Barnes and Noble

ABOUT TERRI MURPHY, NATIONAL SPEAKER, AUTHOR, TRAINER

www.TERRIMURPHY.com

About Terri Murphy

Terri Murphy understands the art of engagement through authentic communication. As a top producing sales entrepreneur in the Chicago area for over 28 years, Terri understands the unmatchable power of how to connect in a noisy and overcrowded marketplace to create powerful connections through powerful engagement in business today. Her expertise is consulting with companies, executives and associations on ways to create new relationships through cutting edge marketing and communication strategies. This includes developing innovative ways to add value and support systems that enhance networking opportunities between companies, their customers and ancillary services that build true clients for life.

As a professional presenter, Terri offers programs that include audience participation and interaction. Terri empowers her audience members and combines education with “edu-tainment” by providing practical sales and marketing strategies that build high level awareness and customer brand preference. She is a regular consultant to several major companies in the U.S and internationally and is a producer and host for television and radio programs. Terri has been featured on ABC, NBC and CNBC News as a sales expert. She is a regularly scheduled guest on WREGTV’s Live@9 for Women in Business and co-hosts Women’s Wisdom Wednesdays on KWAM990Talk Radio. and is the founder of www.SmartWomenSmarterChoices.com.

Terri is a pioneer in the development of online distance learning programs. She was the executive producer of the first online training networks, for IRTV/MUZAK and ISucceed/Entreport.com. Her expertise is in consulting and developing educational initiatives for companies, executives and associations on ways to advance skills sets and new relationships with high visibility engagement initiatives that combine both online and traditional communication and connection.

Terri is the president of Terri Murphy Communications, Inc. and CIO of U. S. Learning, a global interactive on-demand learning and training company based in Memphis TN.

Terri is the founder of SmartWomen/SmarterChoices, a coaching and consulting initiative for women in business. She is a nationally syndicated columnist, online media producer, radio and podcast personality, business coach & consultant and certified DISC and Motivators specialist. Terri is the author of 5 books on sales and leadership and is a certified DISC/Motivator specialist.

___________________________________________________________________

ABOUT JO GARNER-MORTGAGE LOAN OFFICER:

WHAT DO YOU WANT TO ACCOMPLISH WITH YOUR MORTGAGE?

www.JoGarner.com (901) 482 0354 jo@jogarner.com twitter @jogarner NMLS# 757308 (currently working with Sierra Pacific Mortgage, Inc Cordova, TN NMLS # 1788 An Equal Housing Lender)

“Whatever YOUR personal priorities are, my job is to help you get the mortgage terms that will give you bragging rights when you talk about it and help you score on hitting your goals .”

As a mortgage loan officer, my job is to help you get to the benefits you want from your financing terms. What is most important to you? I can help you find the financing terms that will help you get to what you want. What is your comfort level on a house payment? How much are you comfortable paying down,? What type of financing do you need to get the house you want to buy or refinance?

Different clients have different priorities in life—some are buying their first home with very little down payment funds. Some are recovering from medical challenges, divorces or preparing to send children to college and some are embarking on a long term goal of buying properties to build rental income.”

Jo Garner is a mortgage officer with extensive knowledge in tailoring mortgages to her customers who are refinancing or purchasing homes all over the country. She offers conventional, FHA, VA or other loan programs for refinancing and purchases.

Jo can help you look at rent vs buy, when it makes sense to refinance, how to get the best deal on your home purchase financing.

Jo Garner has been in the real estate/financing business for over 25 years. She got her start in Portland, Maine where she first began her real estate career. She received her real estate education from the University of Southern Maine and was personally mentored in San Diego, California by Robert G. Allen, author of Nothing Down, Creating Wealth and The Challenge.

On moving back to West Tennessee in 1987, she went into business buying and selling discounted owner-financed notes secured on real estate. In 1990 Jo went to work for a residential mortgage company and has been a mortgage loan officer for over 25 years. Her goal is to offer excellent, affordable service to her customers, tailoring the loan programs to the specific needs of her clients.

In addition to her work in the mortgage field, Jo Garner is the primary sponsor and founder of Talk Shoppe in Memphis. www.TalkShoppe.com Jo Garner also host the radio show Real Estate Mortgage Shoppe airing on News Radio AM 600 WREC and iHeart Radio with podcasts and show notes published on www.JoGarner.com